Bitcoin price headed for record losses on anniversary of dramatic all-time high

'The sliding price does not seem to currently show much sign of abating'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

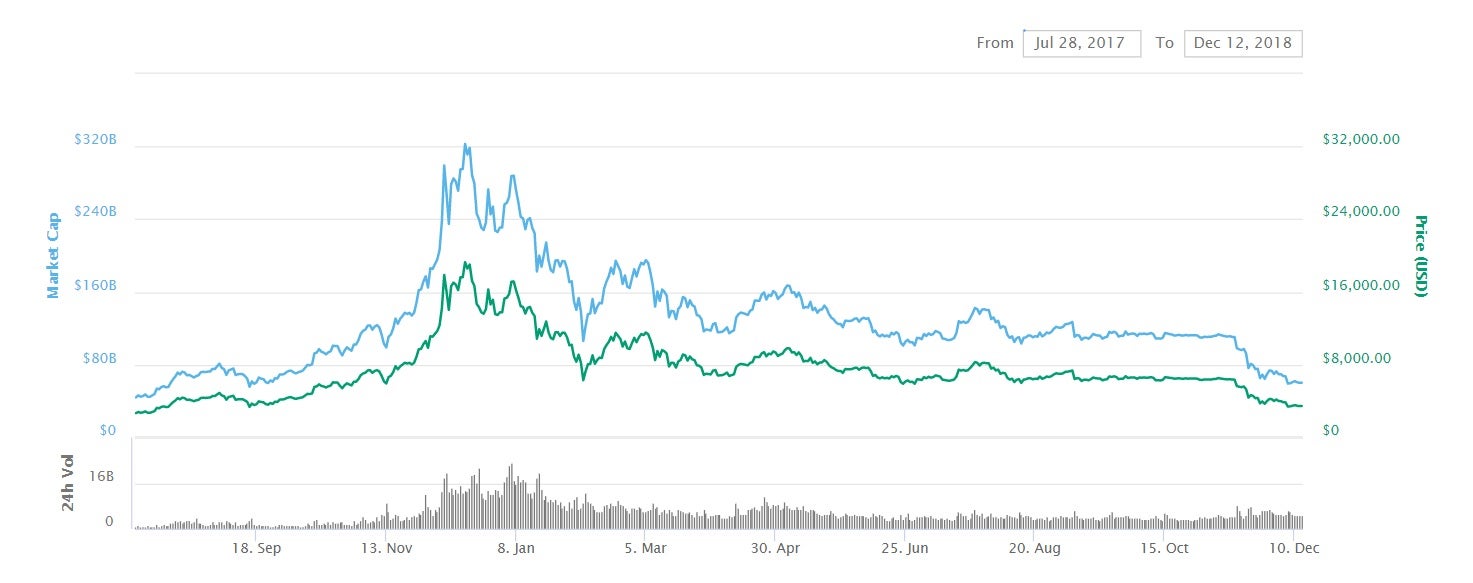

Your support makes all the difference.One year on from bitcoin's record-breaking high of almost $20,000, the world's most valuable cryptocurrency may be about to break a new record as it approaches a new 2018 low.

On 17 December, 2017, the price of one bitcoin hit $19,783, having started the year trading at around $1,000. The remarkable surge in value was followed by a series of price crashes that saw bitcoin tumble by thousands of dollars in the space of just a few days, before a steady decline took hold of the market and forced the cryptocurrency down to today's price of just $3,400.

If losses continue, the price collapse could be worse than any previously experienced by bitcoin.

"Today is an opportunity to look back at all the people who told you that this was going to be a new world, that you were missing out, or that you didn't understand the new paradigm taking place, and cut them out of your life," said Clement Thibault, a senior analyst at online financial platform Investing.com.

"Bitcoin holds a big promise of sovereign and sound money – the bubble we experienced a year ago was an unfortunate consequence of human greed and short term thinking. Bitcoin hasn't changed in the past year and it remains the same asset, whether it's worth $20,000 or $3,000. It's potential and usefulness haven't diminished with the price."

Other analysts say it is difficult to predict whether bitcoin will continue to fall, as the nascency of the cryptocurrency industry means it is still adjusting to many different price factors.

"One year on from bitcoin’s all-time high, many are questioning how cryptoassets are valued, and whether they are a sensible investment," said Mati Greenspan, a market analyst at online trading firm eToro.

"As a relatively new concept, cryptoassets are still finding their feet in terms of value. It’s important to remember that all assets, in every market, experience a process of price discovery, and that cryptos are no different. Given the rapid growth of the crypto industry in the past years, this process has been accelerated, but long-term investors should not be deterred.

Like many other analysts, Mr Greenspan is quick to note that this is not the first "cycle" that bitcoin has experienced in its 10 year history.

Five previous cycles saw bitcoin fall by an average of 85 per cent from its high before eventually recovering to a level above that high.

The latest price fall may seem dramatic due to the numbers involved but it still only represents an 83 per cent fall in value from its December 2017 price. But bitcoin only needs to fall by another $1,000 before the latest losses become record losses.

"As for a short 2019 outlook, I don't see Bitcoin reaching new highs in 2019," Mr Thibault said.

"I believe too many would-be early adopters got burnt badly last year, and once an asset has been labelled a bubble, a gamble, or a speculative investment, it takes time to rebuild the trust and appeal needed to push the asset forward."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments