Bitcoin’s record price surge of 2017 was caused by a single person, study claims

Cryptocurrency 'whale' could have been behind record high value of $20,000

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Bitcoin's dramatic price surge in 2017 that saw it reach record highs was caused by a single cryptocurrency trader, according to a new study.

University of Texas Professor John Griffin and Ohio State Assistant Professor Amin Shams claim their latest research of bitcoin transactions between March 2017 and March 2018 shows that bitcoin was manipulated through large-volume trades that drove the price up.

"This one large player or entity either exhibited clairvoyant market timing or exerted an extremely large price impact on bitcoin that is not observed in aggregate flows from other smaller traders," the academics wrote in a paper, which was shared with Bloomberg ahead of its publication in the Journal of Finance.

The price of bitcoin is notoriously volatile, susceptible to reacting strongly to geopolitical events and regulatory rulings concerning cryptocurrency.

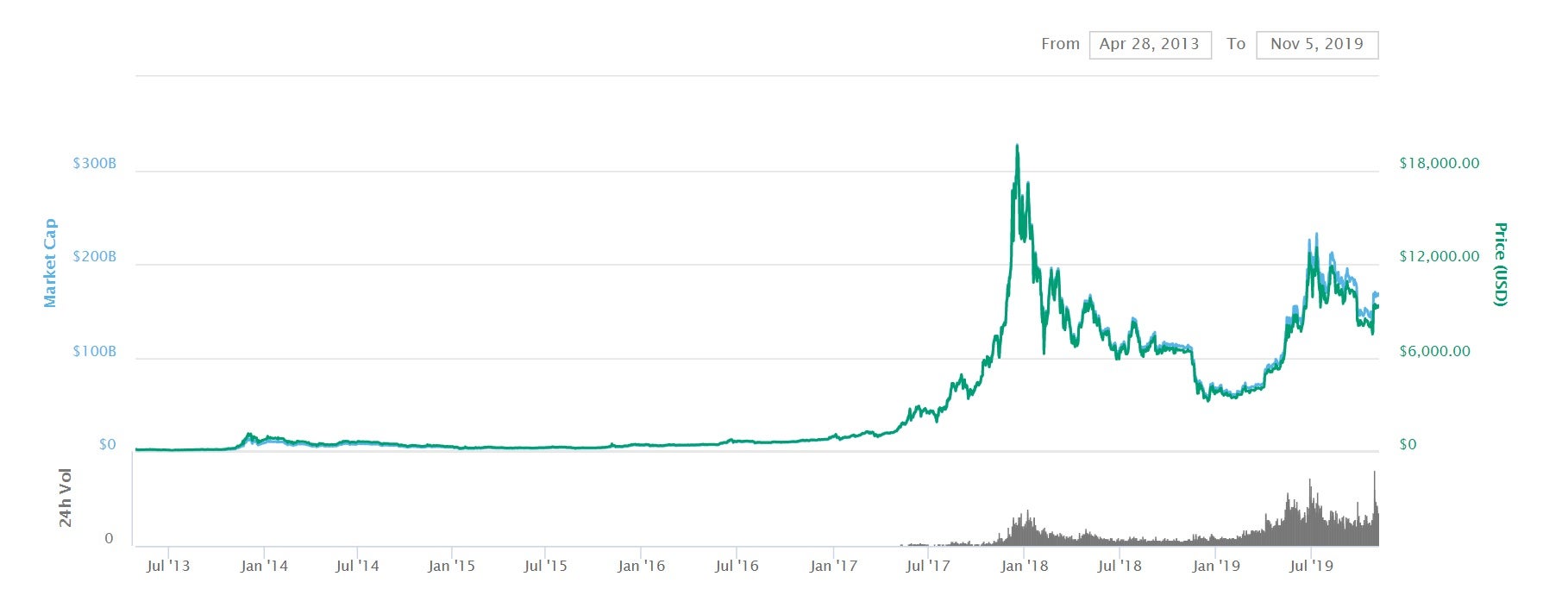

In the wake of its record price high in 2017, which saw it reach close to $20,000, bitcoin experienced a series of crashes throughout 2018 that saw its value eventually drop below $4,000.

This year bitcoin's price has risen steadily and it is currently trading at around $9,300, having briefly reached above $12,000 in June. It remains prone to sudden swings in price, which some attribute to market manipulation by so-called bitcoin whales that are able to influence the price through a single trade.

A flash crash that wiped $1,000 from bitcoin's value in less than an hour was triggered by the sale of 5,000 bitcoins - worth around $40 million at the time of the trade.

It remains a long way off its 2017 highs, though some market analysts believe its upward trajectory will likely continue in the long term.

Changpeng Zhao, CEO of the world's largest cryptocurrency exchange Binance, recently predicted bitcoin will reach $16,000 "soon-ish".

Other cryptocurrency experts claim that despite the historical turmoil, bitcoin will continue to rise in price and could eventually recover to 2017 levels.

Some advocates even believe bitcoin is still a long way from reaching its full price potential, with figures like John McAfee and Tim Draper arguing that its scarcity means it could grow more than 25-fold in value over the next few years.

“$250,000 means that bitcoin would then have about a 5 per cent market share of the currency world and I think that may be understating the power of bitcoin,” Mr Draper said in September.

Mr McAfee, who founded the eponymous antivirus firm, is even more bullish in his forecast, having recently stood by his notorious prediction that bitcoin would hit $1 million by the end of 2020.

A website set up to track his prediction shows that it is currently more than 90 per cent behind being on track.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments