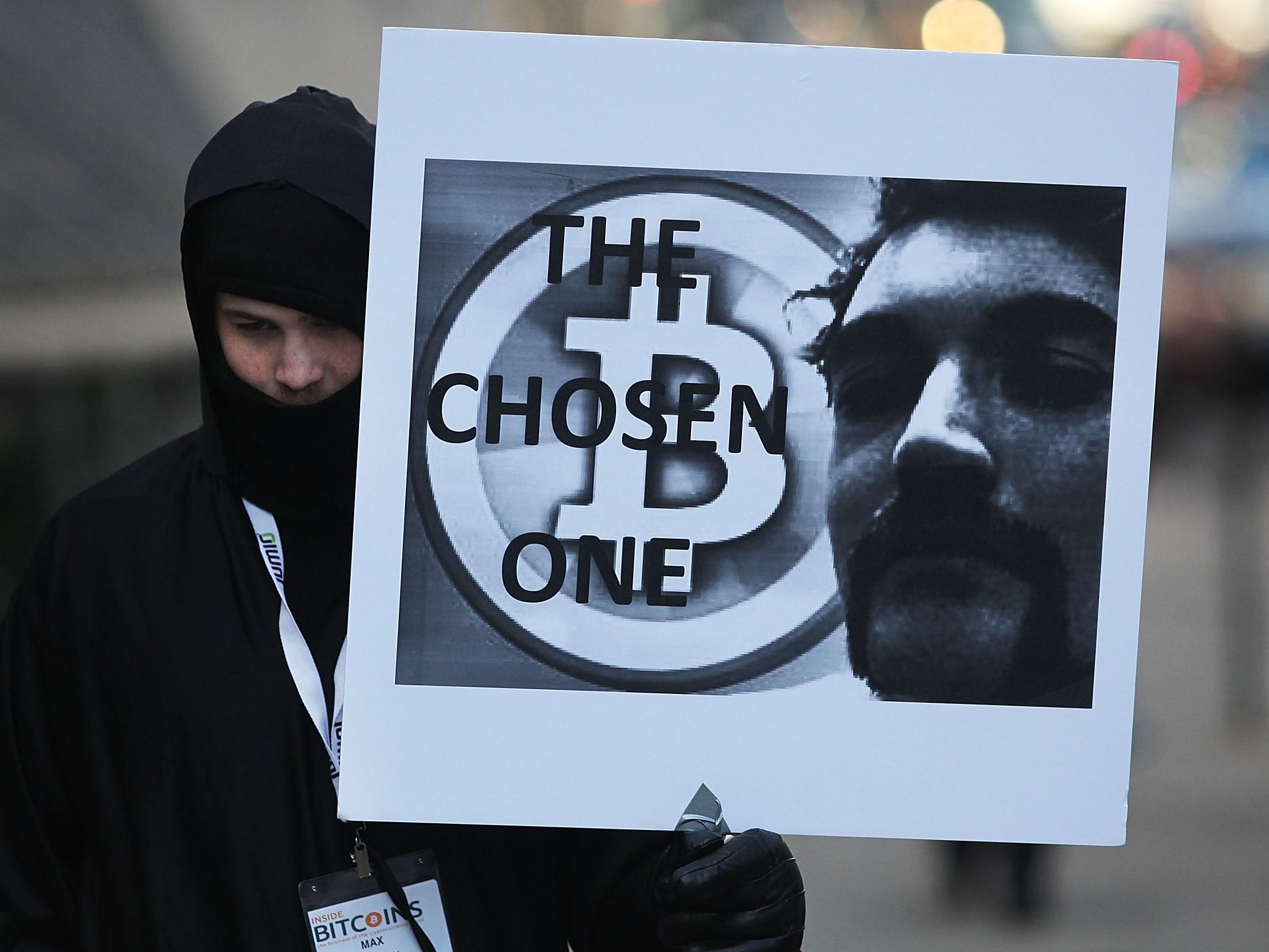

Notorious dark web criminal makes $100k bitcoin price prediction from prison

Silk Road founder Ross Ulbricht is spending his time in prison studying economic theory and cryptocurrency

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Bitcoin is on the brink of another massive price surge that will take its value up to $100,000 (£75,000) in 2020, according to the founder of the world’s most famous dark web marketplace.

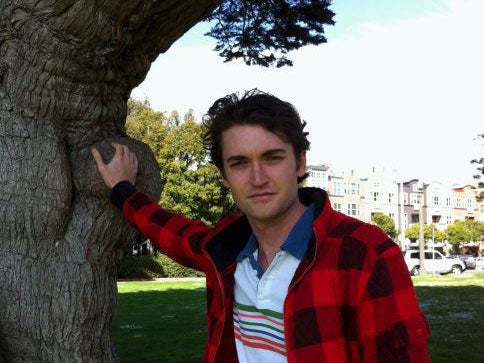

Ross Ulbricht is currently serving a double life sentence in a US prison for creating the now defunct Silk Road, which was the first place bitcoin was used as a currency on a significant scale.

Following his arrest in October 2013, bitcoin experienced its first major price spike that saw it shoot from $100 to over $1,000 in a matter of months. After crashing back down to $175, it then went on another positive run in 2017 that took it close to $20,000 by the end of that year.

Since then, bitcoin has tumbled once more, reaching below $4,000 at the start of 2019 before recovering to today’s price of around $7,000. (At the time of his arrest six years ago, the FBI seized 144,000 bitcoins from Silk Road and Ulbricht - worth just over $1 billion at current prices.)

Ulbricht claims he predicted both of these waves from his prison cell and believes another one is already building – a prediction he says he is able to make without being swayed by day-to-day price movements and general market hubris his imprisonment shelters him from.

In a six-part blog published from letters he wrote in prison, Ulbricht applied a form of market analysis known as Elliott Wave Theory to predict new all-time highs for bitcoin.

The theory forecasts the highs and lows in financial market cycles by identifying extremes in investor psychology, which in the case of bitcoin appear to be far more tempormental compared to traditional markets due to the nacency of the cryptocurrency.

The principle posits that price movements in speculative markets are driven by investor expectation, which when combined with mass psychology can force prices artificially higher through a positive feedback loop of buyer optimism.

Looking at the previous price waves of bitcoin, Ulbricht puts the next big wave reaching between $93,000 and $109,000 before the 17 February, 2021. He notes that his speculation should be considered with appropriate scepticism.

“We have a price target... of ~$100,000 some time in or near 2020,” he wrote. “However, there is no rule that market moves have to be proportional. This is just a patter we see unfolding that may or may not continue.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments