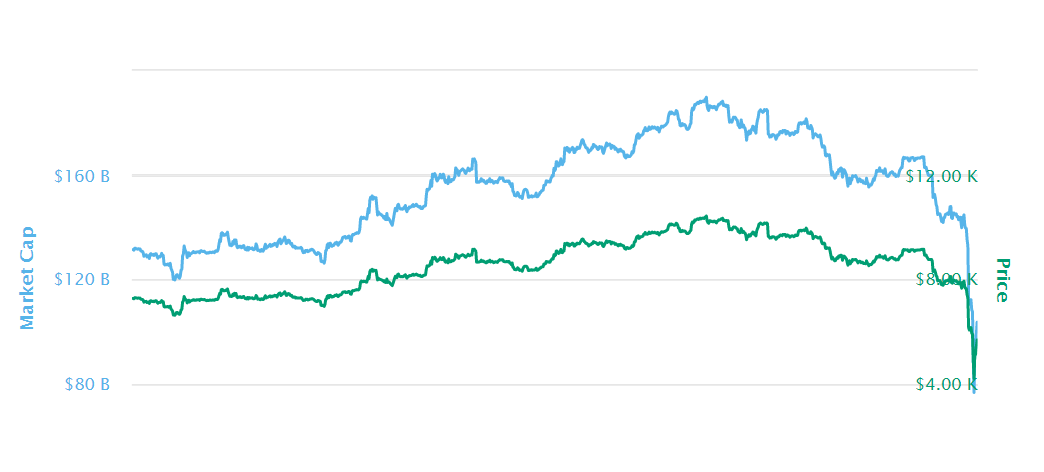

Coronavirus: Bitcoin meltdown as panic selling sees cryptocurrency's price halve

Market collapse calls into question theory that it has become a safe-haven investment

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The price of bitcoin has fallen to its lowest level in nearly a year, losing more than half of its value amid a major cryptocurrency sell-off sparked by the spread of coronavirus.

Bitcoin was trading above $9,000 (£7,100) over the weekend but dropped to nearly $4,000 on Friday morning following a series of flash crashes that began on Thursday.

Other major cryptocurrencies experienced similar losses, including ethereum, XRP and bitcoin cash.

“This is obviously a knock-on effect from the sell off we’ve seen on the traditional stock markets, while even so-called safe haven assets like gold have seen their values drop,” Simon Peters, a market analyst at online trading platform eToro, told The Independent.

“As governments across the world impose drastic public restrictions to halt the spread of the virus and financial authorities struggle to implement measures to limit the economic impact of Covid-19, investors are clearly overwhelmed with bad news.”

The dramatic price fall calls into question the theory from some analysts that bitcoin had become a safe-haven asset in times of geopolitical instability.

According to the theory, investors look to non-sovereign assets and currencies in order to safeguard their wealth during moments of global crises.

Global unrest at the start of the year appeared to support this idea, with bitcoin increasing in price by nearly a third in the first month of 2020.

The latest cryptocurrency price crash, however, has mirrored the fortunes of traditional markets.

“Bitcoin is a very young currency and does not have the volumes to act as a safe haven asset,” said Marcus Swanepoel, CEO of London-based cryptocurrency firm Luno.

“However, as we head into a bear market we think investors will see the benefit of holding uncorrelated cryptocurrencies.”

Whistleblower Edward Snowden was one of several prominent figures on social media suggesting that they might buy during the dip, with others dubbing it "the greatest sale of the decade".

Bitcoin has seen a strong rebound since reaching a low of $4,100, suggesting that some investors have sought to capitalise on the low price.

It is currently trading at around $5,650, with an overall market cap of just over $100 billion.

“The next few days will be crucial for cryptocurrencies to see if the sell off has bottomed out,” Mr Peters said. “Sentiment seems to be turning, perhaps off the back of investors tempted by the low prices of the likes of bitcoin.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments