Bitcoin price: Cryptocurrency value surges amid Brexit chaos

Crypto markets buoyant as pound plummets against US dollar

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The price of bitcoin has shot up over the last 24 hours amid global economic and geopolitical uncertainty.

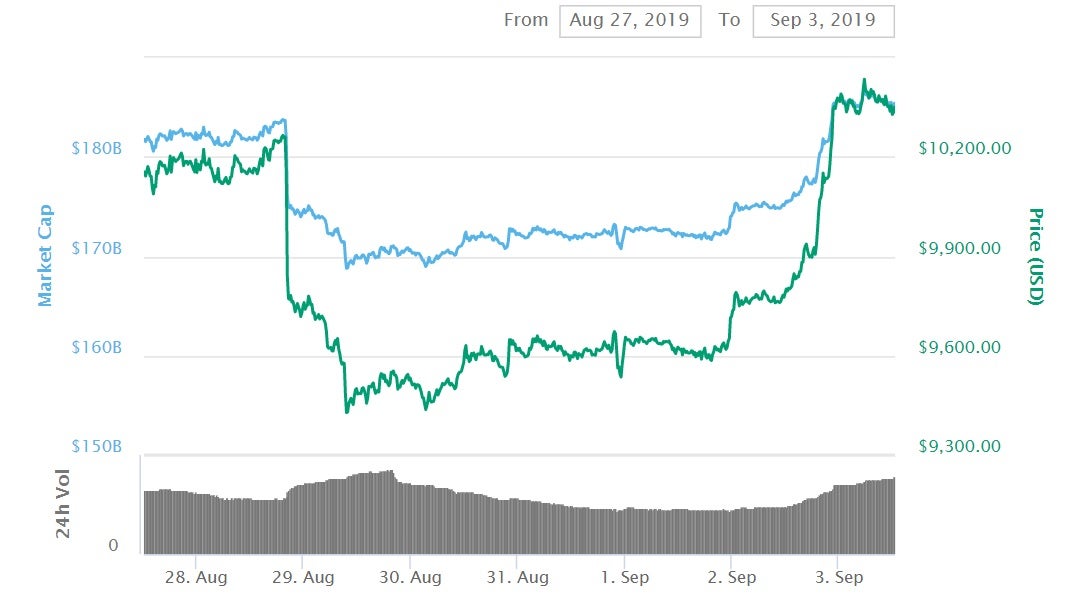

Bitcoin rose above $10,000 overnight, taking it back above the milestone it fell below after a mini flash crash at the end of August. Other major cryptocurrencies also experienced a price boost, including ethereum, ripple and bitcoin cash.

A 6 per cent rise against the US dollar amounted to nearly 10 per cent of gains against the pound after turmoil surrounding Brexit sent the UK currency into free-fall. Market analysts have previously predicted that bitcoin will reach record highs if the UK leaves the European Union without a deal.

Economic turmoil in Argentina, combined with an escalating trade war between the US and China, also helped to bolster bitcoin’s price, according to Marcus Swanepoel, CEO of cryptocurrency firm Luno.

“After lacklustre trading over the weekend, bitcoin went against the market trend yesterday, quickly breaking through the $10,000 level and reaching $10,500,” Swanepoel told The Independent.

“Today the focus will be on Europe and the Brexit developments in the UK, as well as the deepening crisis in Argentina. After the Labor Day holiday in the US, all markets are open, and we can expect to see volumes rising in what is normally the busiest trading month of the year.”

The UK is set to leave Europe on 31 October, 2019, though this date could be delayed if parliament votes to block the possibility of a no-deal exit.

Prime Minister Boris Johnson has said he plans to take the UK out of Europe in time for the Brexit deadline, with or without a deal. If plans to block a no deal are passed then Johnson will likely call for a general election before the Brexit deadline.

Such uncertainty has seen the pound fall to its lowest level against the US dollar since January 2017. Neil Wilson, chief market analyst at Markets.com, said: “The outlook for sterling may well worsen if there is an election and will certainly deteriorate if it’s a no deal.”

The price of bitcoin is notoriously volatile but has seen a steady increase in its price throughout 2019. It has nearly trebled in price since the start of the year but still remains a long way of its record price of close to $20,000, which it hit in late 2017.

The prospect of an economically damaging Brexit, together with increased trade tariffs between the world’s two largest economies, has helped contribute to bitcoin’s resurgent price.

Some investors are even beginning to see the cryptocurrency as a safe-haven asset, similar to gold.

This is thanks to its finite supply – only 21 million bitcoins will ever exist – and the fact it relies on a borderless and decentralised infrastructure that is less prone to the effects of a single country or market.

Nicholas Gregory, CEO of blockchain firm CommerceBlock, recently told The Independent that bitcoin had “rediscovered its mojo” in 2019 thanks to an increasingly unstable global economy.

“A no-deal Brexit could see a massive and unprecedented breakout,” he said.

“Not only will a no-deal departure from the EU create turmoil and volatility across two major fiat currencies, it will also trigger an identity crisis for the global system as the contingency and vulnerability of major global fiat currencies is laid bare.”

We’ve teamed up with cryptocurrency trading platform eToro. Click here to get the latest Bitcoin rates and start trading. Cryptocurrencies are a highly volatile unregulated investment product. No EU investor protection. 75% of retail investor accounts lose money when trading CFDs.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments