Bitcoin price in bizarre free fall as cryptocurrency hits new 2018 low

Analysts predict there may be 'still more pain to come'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

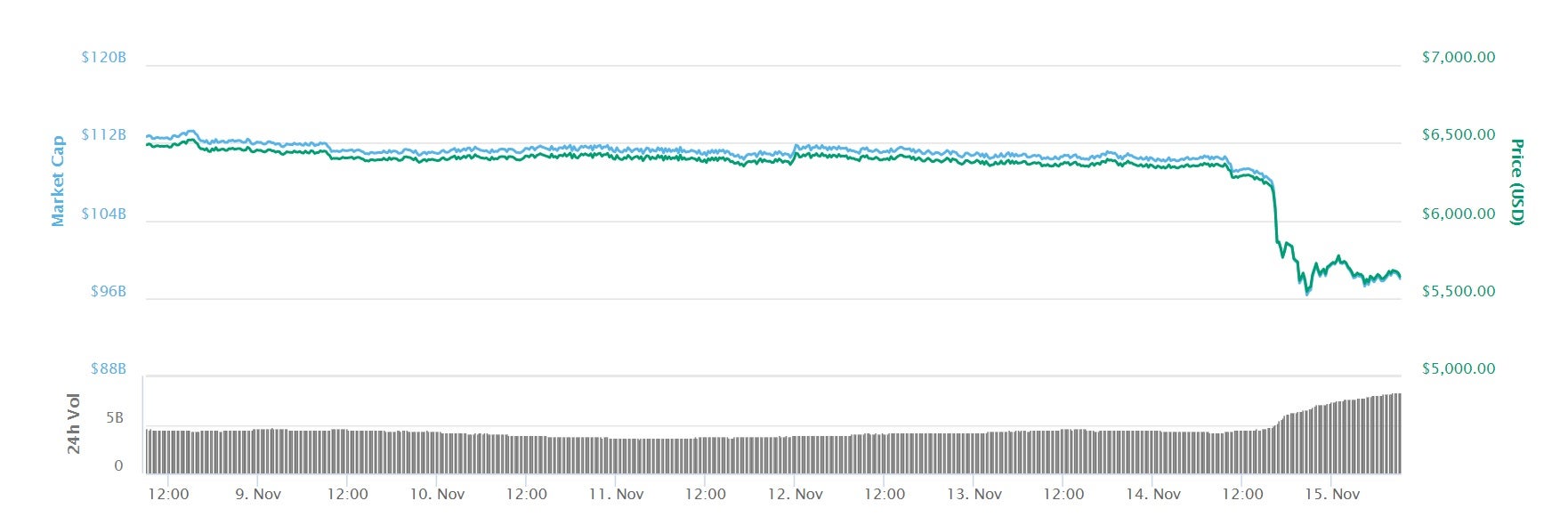

Your support makes all the difference.The price of bitcoin has continued to fall following last week's market-wide crash, losing more than a fifth of its value in the space of just a few days. The cryptocurrency is currently trading at its lowest level since October 2017, though analysts are struggling to explain why.

Billions of dollars have been wiped off the value of bitcoin since last Wednesday, with no sign of the market turning around. Other major cryptocurrencies to experience significant losses include ethereum, ripple and bitcoin cash.

Over the last 24 hours bitcoin has lost a further 10 per cent of its value, according to the CoinMarketCap price index, and threatens to fall below $5,000.

Speculation surrounding why the cryptocurrency market has been hit with such heavy losses in recent days has focussed on the 'hard fork' of bitcoin cash that took place on Thursday, whereby the cryptocurrency effectively split in two to create a brand new cryptocurrency.

This move led to uncertainty among cryptocurrency investors, in a market that is already experiencing reduced interest due to the steady losses that have been happening throughout 2018.

Until the cryptocurrency price crash on 14 November, bitcoin had actually been experiencing one of the most prolonged periods of stability in its history, trading between $6,000 and $7,000 since early September. This had led some analysts to predict that the lack of market movement was the "calm before the storm," though many anticipated the price shift to go in the other direction.

"The next week is going to be important for crypto and more specifically bitcoin as some analysts feel that there is still more pain to come," London-based cryptocurrency broker GlobalBlock wrote in its weekly cryptocurrency update.

"However, many already in the space are still looking to [hold onto their assets] and feel that an upswing will be imminent and that sellers will exhaust themselves."

The huge losses experienced by bitcoin and other cryptocurrencies in 2018 have led many advocates to revise their bullish predictions for the year ahead, however many remain hopeful of a market turnaround before the end of the year.

"The wild benchmark levels that were called by crypto-evangelists may well have been reigned in somewhat," GlobalBlock stated. "However some are still calling levels in excess of $10,000 before year end, which from these levels would be a very strong recovery,"

Bitcoin's remarkable fall in value since the highs of 2017 has led to a sharp decrease in the number of people looking for blockchain and cryptocurrency-related jobs, according to new figures from the job site Indeed, suggesting confidence in the industry is low.

"The spectacular rise in the value of bitcoin wasn't only good news for investors and speculators, it also led to a boom in the blockchain industry with vacancies and jobseeker interest soaring to record highs," Bill Richards, UK managing director of Indeed, said in an emailed statement to The Independent.

"However, our data suggests employers and jobseekers alike are keeping a close eye on the value of bitcoin as a bellwether for confidence in cryptocurrencies and careers in the all-important technology that underpins it."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments