Bitcoin price crash: Cryptocurrency loses 10 per cent of its value in sudden sell-off

This latest dip may not be the last of 2018, a prediction from one crypto analysts suggests

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

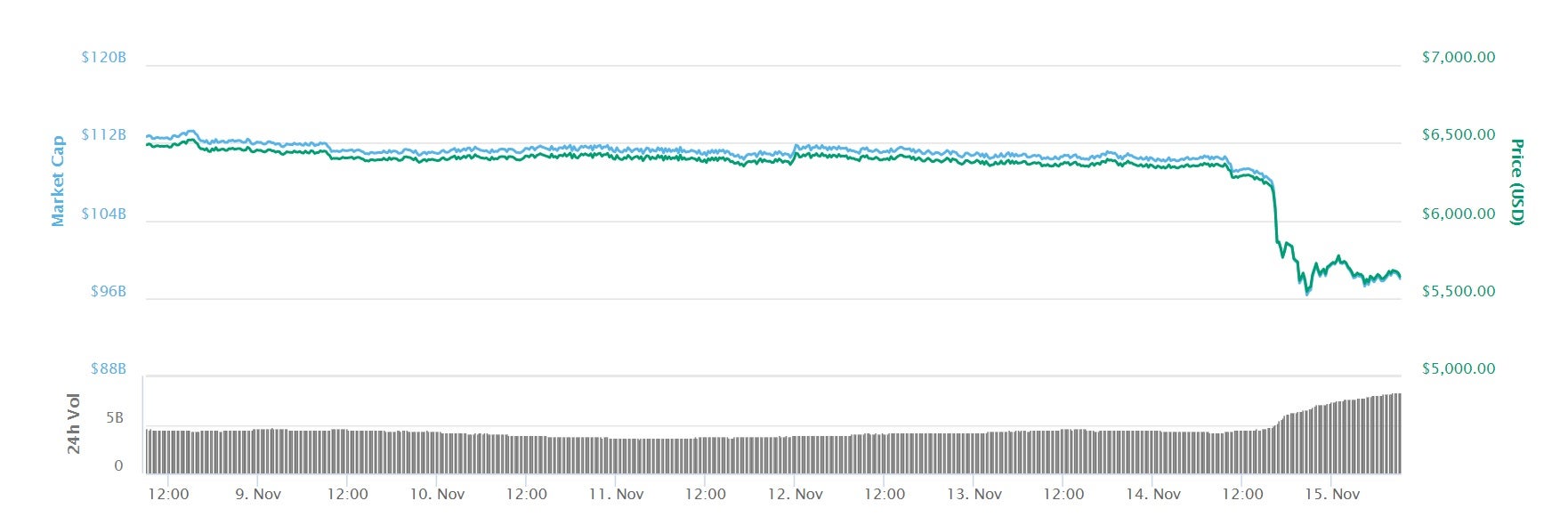

Your support makes all the difference.The price of bitcoin has plummeted to its lowest value in more than a year, as the cryptocurrency market took an abrupt downturn following the most sustained period of stability in its history.

More than 10 per cent of bitcoin's value was wiped away in the space of just a few hours, with other major cryptocurrencies like ethereum and bitcoin cash experiencing similar losses.

Cryptocurrency analysts have been quick to point to certain forces that may be driving the current dip.

Many have pointed to the imminent 'hard fork' of bitcoin cash, whereby the cryptocurrency will effectively split in two on Thursday to create a brand new cryptocurrency.

"It's safe to say that bitcoin cash's upcoming hard fork stirring uncertainty among crypto investors, and forecasters across crypto and traditional markets alike have predicted a prolonged bear market heading into 2019," Donald Bullers, North American representative for the blockchain firm Elastos, said in an email to The Independent.

"Crypto investors have proven to be highly reactive to changes across the landscape, and this dip could be the most recent case study of that phenomenon."

This uncertainty meant bitcoin cash experienced some of the biggest losses, having been one of the only significant cryptocurrencies to experience price gains over the last few weeks.

"In the first week of November, wile the markets for the main large cryptos were flat, bitcoin cash was the only major cryptocurrency shooting up," said Angel Versetti, CEO of Ambrosus, an internet-connected sensor firm that utlises blockchain technology.

"It created strong expectations and pulled the price up, resulting in outflow of money from other cryptocurrencies. However, now that [Thursday's] split is looming and the outcome is yet undefined, this has impacted the outflow of money from bitcoin cash... As people are moving into fiat, cryptocurrencies are taking a fall."

The market-wide crash, which saw the price of bitcoin fall below $5,600 (£4,300) for the first time since October 2017, follows a remarkable period of stability for the notoriously volatile cryptocurrency.

Since early September, bitcoin had traded in a narrow range between $6,000 and $7,000, following months of steady losses that had seen it fall from a high close to $20,000 in late 2017.

Earlier this week, cryptocurrency experts said the lack of major market movements is likely just the "calm before the storm."

This prediction was not necessarily for a price crash, however, with some analysts anticipating a surge in value over the final weeks of 2018.

Despite the crash, some crypto experts still believe there could be an upswing in the market in the coming months, under certain conditions.

"We believe that there are three likely catalysts that could result in a crypto market turnaround in the next six months," Rohit Kulkarni, managing director of private investment research at SharePost, told The Independent.

"These are: A greater clarity from regulators which could embolden the market; A select group of blockchain startups that have completed token offerings in the past year finally announcing innovative commercial products; And the piling up of institutional capital triggering investors to call the bottom of the market."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments