Bitcoin price prediction model remains ‘amazingly accurate’ with less than 1% error – and forecasts record end to 2021

PlanB’s crypto forecasts for August and September were off by less than a third of a per cent

The price of bitcoin is less than a few hundred dollars away from a prediction model made more than three months ago.

The forecast was made by the pseudonymous Dutch analyst PlanB, who predicted in June that the cryptocurrency would be $43,000 at the end of September. Bitcoin is trading just above $43,150 at the time of writing.

Follow all the latest crypto market updates with The Independent’s live blog

PlanB has gained a devoted following on social media, gaining more than half a million followers on Twitter in 2021 alone, with one follower recently describing his Stock-to-Flow (S2F) model as “amazingly accurate”.

This model posits that bitcoin’s inbuilt scarcity — only 21 million coins will ever exist — combined with its diminishing supply, will see its value continue to increase over the longterm.

S2F divides bitcoin’s supply (stock) with its production (flow) — bitcoin’s annual production halves roughly every four years — to determine when price rallies and peaks can be expected.

Bitcoin hit a new all-time-high of $64,000 in mid April, however according to PlanB’s calculations this was not the peak of the current bull run.

There are various versions of his S2F model, with all of them putting the top of this market cycle well into six figures.

Following bitcoin’s crash between April and July, which saw it briefly fall below $30,000, PlanB posted his “worst case scenario” for the cryptocurrency.

Bitcoin was below $34,000 at the time the prediction was made, though PlanB claimed it would hit $47,000 by the end of August before dipping to $43,000 at the end of September. Both predictions were off by less than a third of a per cent.

According to his forecast, bitcoin will return to its all-time high of $64,000 by the end of next month, before hitting $98,000 in November. December will see it finally reach above $100,000, according to the analyst, who predicts it will finish 2021 at $135,000 — more than three-times today’s price.

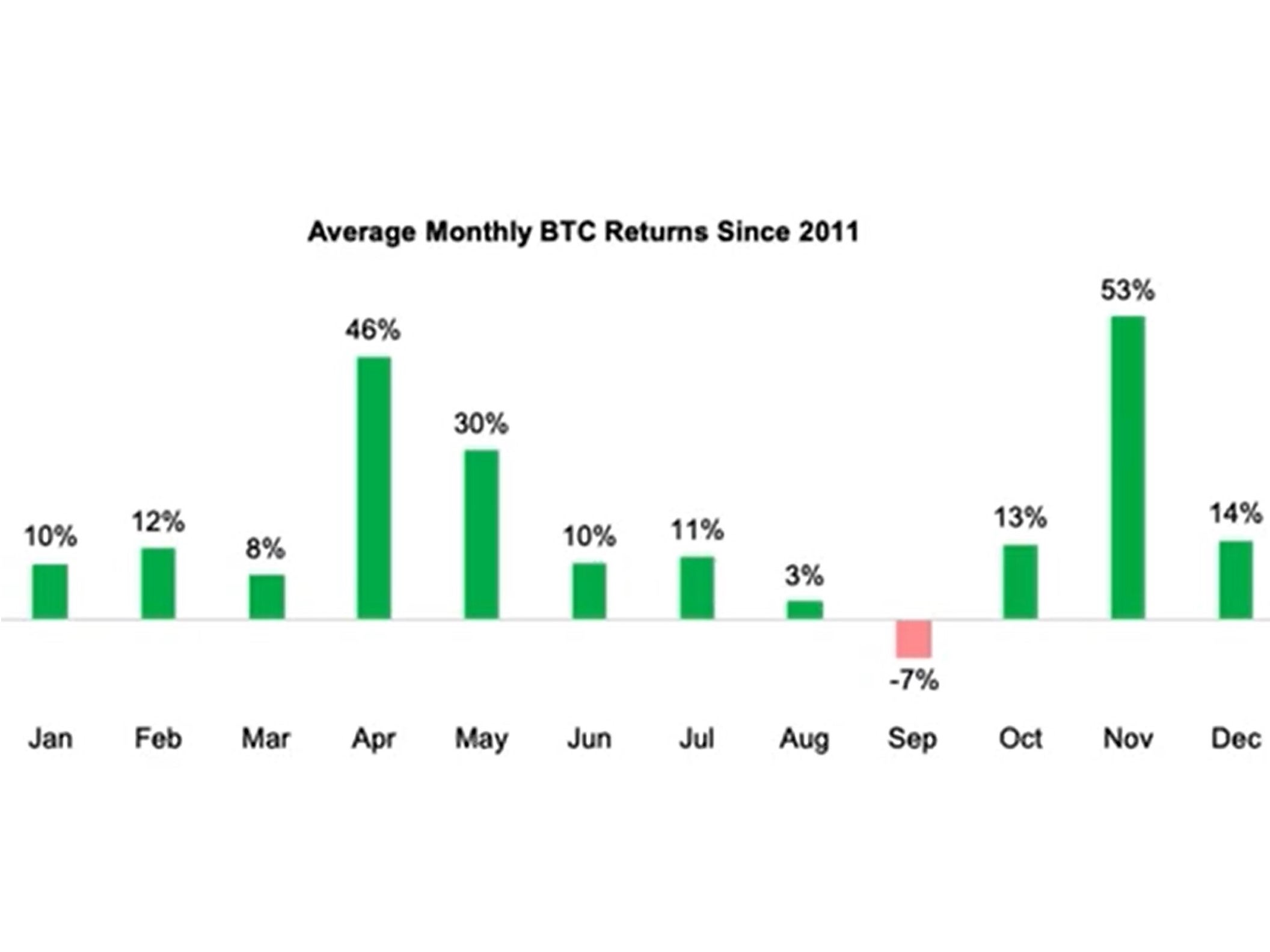

September has traditionally been a bad month for bitcoin, with price movements since 2011 averaging out at a 7 per cent loss. The latest dip can be attributed to various factors, including China’s crypto crackdown and El Salvador’s shaky roll out of its pioneering Bitcoin Law.

Any number of external factors are able to throw carefully calculated prediction models off course, as positive and negative news can cause chaos in such a nascent market.

“All of these forecasts can be destroyed by a black swan event, like a bitcoin ban, Covid escalation, war with China, etc,” PlanB told The Independent earlier this month.

“ETF approval or El Salvador success spreading or favourable legislation could be the trigger event for the next leg up. And of course, the complete lack of sellers at one point – in my opinion we are approaching that point in a few months.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks