Bitcoin performed 10 times better than gold in 2020

Cryptocurrency could be in the midst of the third great price rally in its history, market analysts predict

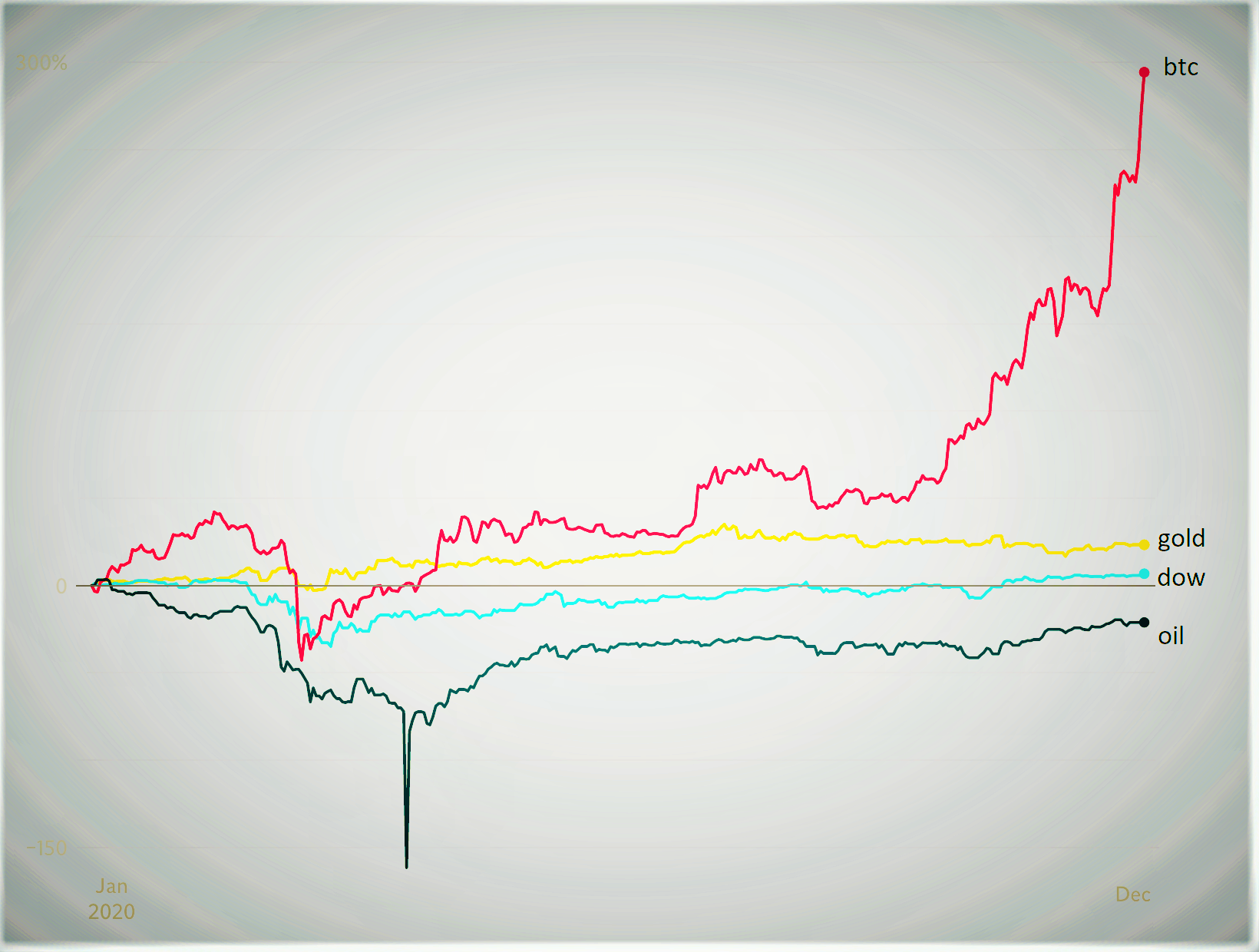

Bitcoin has risen in price by nearly 300 per cent in 2020, outperforming the combined gains of gold and the Dow Jones stock market by a factor of 10.

Recent gains have propelled the cryptocurrency to new record highs of close to $30,000 (£22,000), having traded below $5,000 as recently as March.

Bitcoin’s performance have led some analysts to speculate that we are in the midst of the third great price rally in its 11-year history, as investors increasingly view it as a form of “digital gold” rather than a speculative investment or cash alternative.

How bitcoin performed compared to gold, oil and Dow Jones

Since peaking in late 2017 at around $20,000, bitcoin spent the best part of two years in steady freefall before its resurgence in March this year.

Its bounce back coincided with the enforcement of lockdowns around the world, as the full extent of the Covid-19 pandemic began to be realised. With economies stalling, funds flooded out of stock markets and into gold and cryptocurrency.

The Dow Jones Industrial Average, which tracks the performance of 30 large companies listed on US stock exchanges, has since recovered and hit record highs on 29 December following an end-of-year rally spurred on by the signing of a $900 billion Covid relief package.

The stimulus package means the Dow is now up by 6.8 per cent since the start of the year, while oil is yet to recover from a major crash in April and is down by more than 20 per cent since January.

What caused the huge price surge?

Bitcoin was born out of the 2008 Financial Crisis as an innovative form of “peer-to-peer electronic cash” that was no longer reliant on governments or financial institutions to operate. It has another economic crisis – the worst since the Second World War – for its role as a store of financial value to be properly realised.

Mainstream adoption remains a long way off but investors increasingly refer to the notoriously volatile cryptocurrency as a safe-haven asset, with some analysts going as far as to call it “digital gold”.

The geopolitical uncertainty brought about by the coronavirus pandemic, which saw stock markets crash around the world, would typically see investors look towards stable assets like cash or gold.

While gold’s upward trajectory since March would attest to this, bitcoin’s bull-run has largely been the result of massive institutional investment moving into cryptocurrency.

Part of the reason for this is bitcoin’s finite supply – only 21 million units will ever exist – meaning it is not susceptible to artificial inflation techniques like quantitative easing.

Joining institutional investors have been other major players entering the market and buying up the limited number of bitcoins in circulation. Among them is PayPal, which announced in October that it would open up cryptocurrencies to its roughly 350 million users worldwide in early 2021.

“Demand continues to outstrip supply and institutional investors continue to seek exposure to bitcoin hedge against inflation, both of which have helped to keep the price above $20,000,” Simon Peters, an analyst at the online investment platform eToro, told The Independent.

“Investors are recognising that, despite the rapid price rise grabbing headlines recently, bitcoin’s real potential remains as a long-term investment to be held for months if not years.”

Will bitcoin continue to rise in 2021?

Looking at past trends, some market analysts are hopeful it will continue to see massive growth before potentially crashing back down.

A leaked report from senior Wall Street analyst Tom Fitzpatrick in November predicted that bitcoin could hit $318,000 in 2021, followed by a “painful correction”.

The Citibank report, titled ‘Bitcoin: 21st Century Gold’, stated: “Improbable though that seems it would only be a low to high rally of 102 times (the weakest rally so far in percentage terms) at a point where the arguments in favour of bitcoin could well be at their most persuasive ever.”

Others believe that economic and geopolitical stability caused by the global roll-out of Covid-19 vaccination may see a shift away from cryptocurrency investment and back towards traditional markets.

The incoming Biden administration on 20 January could also bring with it a number of regulatory challenges that could restrict bitcoin’s growth in the short-term.

“While many expect the bitcoin rally to continue in 2021, I’m more concerned with what the Biden administration could mean for crypto,” Jesse Cohen, a senior analyst at Investing.com, told The Independent.

“Incoming Treasury Secretary Janet Yellen has previously warned investors about bitcoin during her time as Fed Chair, calling it a highly speculative asset and not a stable store of value.

“I expect bitcoin to remain highly volatile to the downside in the new year, given the potential for more scrutiny and tighter regulation. That should see prices fall back from their record highs."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks