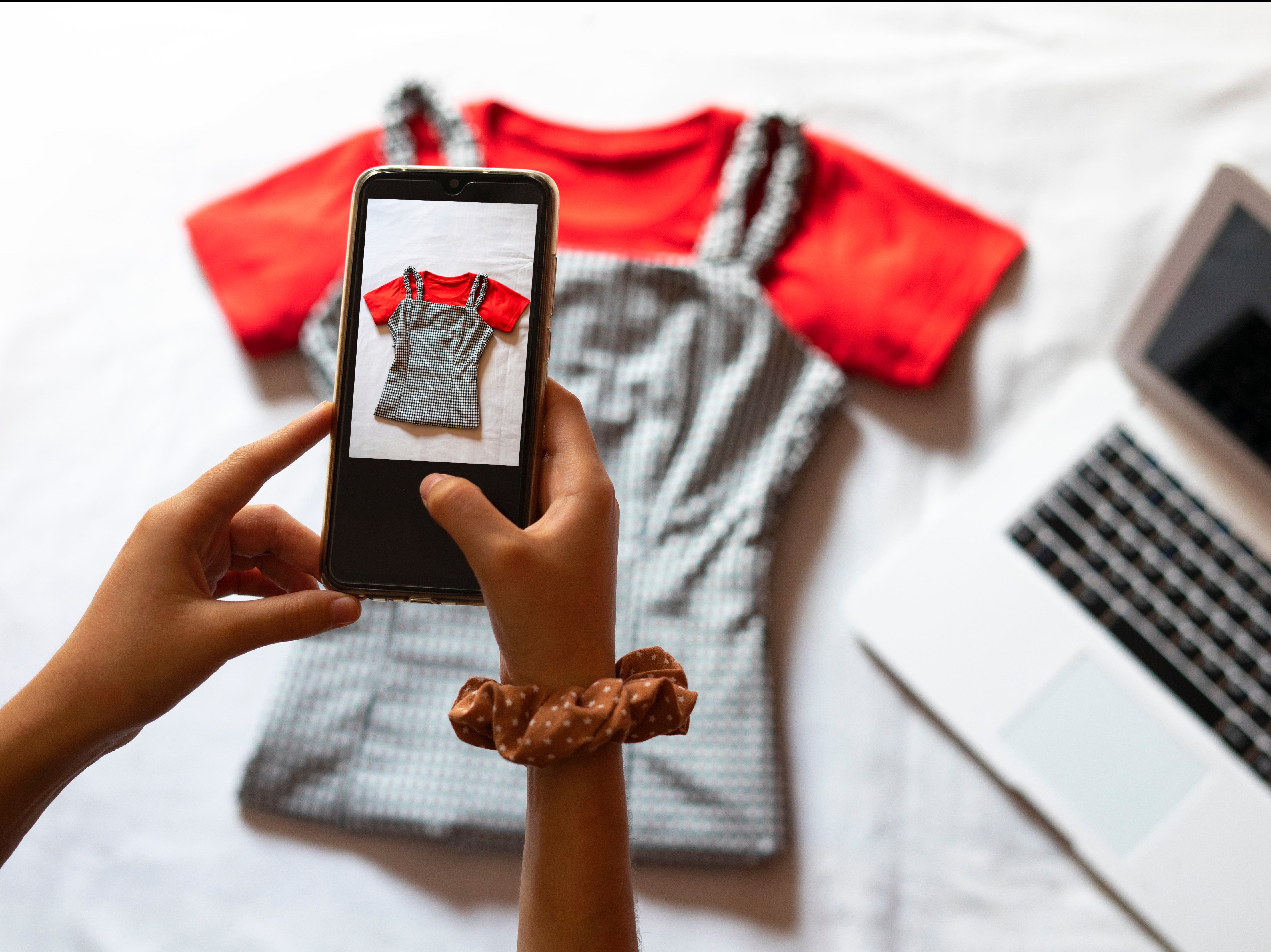

Fast fashion in the slow lane: Secondhand market set to dominate by 2030

With more consumers prioritising sustainable clothing and reducing waste, Kate Ng takes a closer look at how secondhand marketplaces saw demand soar during lockdown

With more people turning to secondhand apparel in an effort to cut fast fashion out of their lives, the US pre-loved clothing market is expected to grow to twice the size of the fast fashion industry by 2030, a new report estimates.

American resale marketplace ThredUP said in its latest annual resale report that 33 million consumers bought secondhand clothing for the first time in 2020, 76 per cent of whom plan to increase their spending on pre-owned items in the next five years.

The boom in sustainable fashion has been coming over the hill for some time; between Boris Johnson’s new wife Carrie Symonds jumping on the wedding dress rental bandwagon and fast fashion brands feeling the pinch as Generation Z customers gravitate towards more sustainable options, the pre-loved fashion industry has found itself speeding ahead of its throwaway rivals.

Secondhand clothing platforms have seen sales soar over the past year as economic uncertainty and greater awareness of the environmental crisis pushed consumers to make more sustainable shopping choices, particularly during the pandemic.

Last year, data from eBay revealed that two secondhand fashion items were sold every three seconds between January and July in the UK, with 30 per cent more items being sold in June 2020 compared to March.

Britons were identified as the biggest consumers of secondhand clothing on eBay, spending 117 per cent more in 2020 than US shoppers.

This year’s study by ThredUP found that the average thrift shopper bought around seven secondhand items in the past year that they would normally have bought new, displacing more than 542 million new clothing items.

The report also found that consumers’ values have changed during the pandemic, with one in three caring more about wearing sustainable clothing compared to before Covid.

More consumers are also turning the tide against waste, with 51 per cent being more opposed to environmental waste and 60 per cent more opposed to wasting money.

Other online platforms focusing on secondhand clothing, such as Depop and Thrift Plus, have also experienced huge growth in 2020. Last October, Depop announced it was planning to expand its UK workforce by almost a quarter by the end of the year after seeing a surge in sales during lockdown.

The company said it saw “tremendous growth” over the year, with demand doubling during lockdown. This growth was largely driven by the app’s Generation Z users, who often act as ambassadors for secondhand retail.

Thrift Plus, which described itself as an “on-demand clothing donation service” and fills the gap between consumers and 150,000 UK charities that do not operate high street shops, also saw a surge in demand during the Covid crisis.

In June this year, Thrift Plus announced its online community had raised £1 million since it launched in 2017.

Consumers are refreshing their closets and turning to resale as a way to sustainably discard garments and acquire new ones

Joe Metcalfe, founder of Thrift Plus, told The Independent that the resale market in the UK is also seeing “huge growth”, adding that his platform grew eight times bigger over the course of 2020.

This growth was “fuelled by wardrobe clear-outs, rising concern about the environmental impact of fashion, and a continuing desire to support charities through clothing resale”.

He added: “90 per cent of our customers tell us they have made lifestyle changes to help protect the environment, and we aim to provide a service that makes shopping and re-selling secondhand clothes effortless.

“While 70 per cent of our customers say that less than half of their ‘new’ clothes are second-hand, 60 per cent would like this figure to be more than half.”

This showed “clear intent” among consumers to shop more secondhand apparel rather than new, said Metcalfe, whose platform aims to accelerate the adoption of circular fashion and be “the engine of the resale economy in the UK”.

Neil Saunders, managing director of retail analytics firm GlobalData, which conducted the study for ThredUP, said: “As we emerge from the pandemic, the resale market is stronger than ever. Consumers are refreshing their closets and turning to resale as a way to sustainably discard garments and acquire new ones.

“Retailers recognise this shift, which is why so many of them are now looking to get into resale. These trends will make resale the most dynamic and fast-paced part of the apparel market over the next decade.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments