Is Wall Street finally learning its lesson on tech firms?

Co-working company WeWork raised multiple red flags before suspending its flotation — but so did Uber and Lyft, says James Moore

A corporate visionary for a new way of working, or an accident waiting to happen? Fears that WeWork may be in the latter category clearly played a role in the suspension of parent WeCompany’s much hyped, but increasingly troubled, New York flotation.

The co-working company takes out long leases on property, pretties up the space, then sublets it to firms and individuals. Tech start-ups, freelancers, fast growing young companies and so on.

The aim is to foster a sense of community in the midst of an atomised and insecure working culture, with a bright, colourful and informal image designed to appeal to millennials.

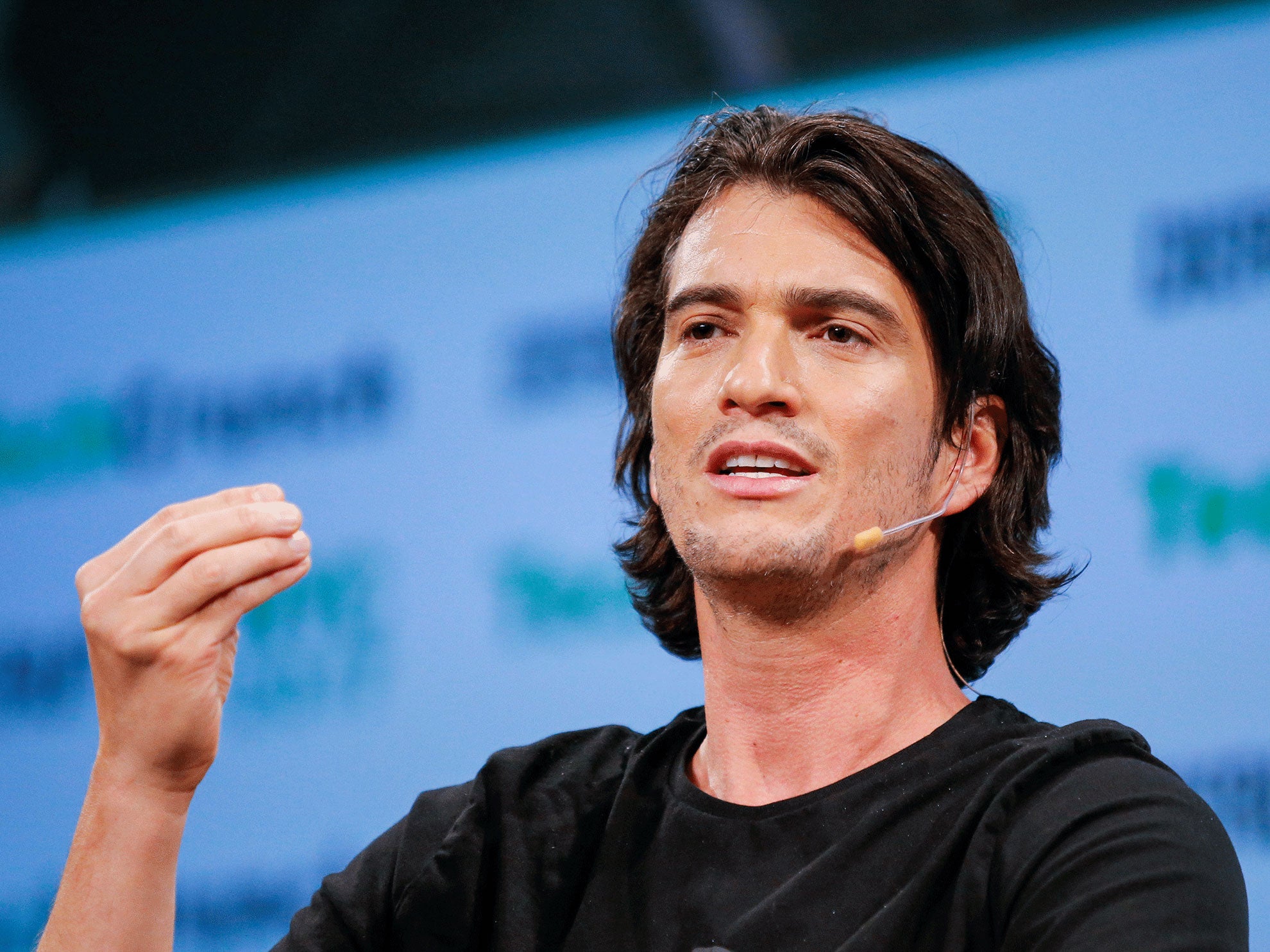

WeWork has a tech company aesthetic and a rockstar founder in the form of Adam Neumann, who boasts a mane of wavy brown hair and has a fondness for donning T-shirts and trainers for his public appearances, which attract large crowds.

His business has also enjoyed tech company style growth, having started out less than a decade ago in New York’s fashionable SoHo district, picking up big money backers such as Japan’s famed SoftBank along the way to going global. Fascinating fact: WeWork is the largest corporate office occupier in Central London, eclipsing the City’s big banks and tech kingpins such as Amazon and Google. Only the government has more space. So naturally its plans for a New York floatation generated more hype than a fleet of celebrity-carrying Uber cars.

The company was initially reported to be seeking a $47bn (£37.6bn) valuation. Trouble is, the hype train didn’t get the float out of the station. It soon fell to $20bn (£16bn). Then it fell to as low as $15bn (£12bn). Some reports said it dipped as low as $10bn (£8bn) in an attempt to get investors to bite. Now the thing has been taken off the table. At least for the moment. What’s gone wrong? Quite a lot. Let’s start with governance.

Neumann has taken hundreds of millions of dollars out of the company, with which he has a complex contractual relationship, including owning four buildings he rents back to the firm. His voting control, and a warning in the prospectus that effectively tells outside investors that they’ll have to lump it if he takes decisions they don’t like, cooled their ardour. Even reducing his voting rights to 10 votes a share from 20 didn’t cut it.

Wall Street has begun to fight shy of tech firms with ultra powerful founders. Memories linger of the open warfare at the top of Uber that ultimately led to the departure of its controversial founder Travis Kalanick. Perhaps more serious still are the financials: WeWork lost around two dollars for every one it generated in revenue in the first half of 2019, burning through a little under $2.5bn (£2bn) according to US regulatory filings. That’s a tech company style fire.

But is this really a tech company? Or is it, in reality, a snazzy serviced office provider, which is the sort of company that can suffer badly in the event of a global downturn. When you have long leases, but your clients have short ones, you’re in trouble if their businesses start folding or they look for cheaper premises in which to ride out an economic chill.

Having got its fingers well and truly burned on Uber and Lyft, both of which struggled badly in the market after their flotations, a little caution on the part of Wall Street was overdue. Investors have been paying over the odds to pile into fancy companies with shaky business models, as much out of fear that they’ll miss the next Amazon or Google as anything else. That’s not a sensible way to carry on.

Perhaps the real killer for WeWork’s stock market listing is its timing. The company will now have to go back to the drawing board, and probably to its banks. A big financing package was contingent on the float which will probably need renegotiating.

If it can navigate the next few months successfully, it could yet make a second attempt. Maybe a successful one. Wall Street might have taken this one carefully this time around. But it’s very much a case of once bitten, once shy, and not always for very long in America’s financial hub.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments