There is a way to get our economy back on track – better taxes

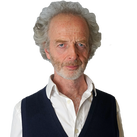

British business won’t just bounce back. If the government does nothing, debt will spiral out of control and it will be tempting to let inflation rip. Neither would be good for the country, warns Hugo Dixon

The coronavirus pandemic will blow an almighty hole in the public finances, which will eventually have to be paid for, one way or another. The good news is that we can repair the damage in a way that creates a fairer and greener society.

The extra borrowing is likely to be even higher than in a leaked Treasury analysis, which forecasts a £337bn deficit this year followed by a £83bn one next year. This is because the government will need a “new deal” to get the economy moving once the current life support operation is over.

To stop mass long-term unemployment – especially a lost generation of young people – the government will have to create jobs. This will be expensive.

The government might be able to handle an extra half a trillion pounds of debt, if that was its only problem. Although borrowing would rise to more than 100 per cent of gross domestic product, interest rates are currently extremely low.

But Boris Johnson has another problem because the economy won’t just bounce back to where it was, the yearly deficit will also be higher. If the government does nothing, the debt will spiral out of control – and it may then be tempted to let inflation rip. Neither would be good for the country.

There won’t be much scope to cut spending. Indeed, after the pandemic, there will be pressure to spend more on the NHS and care of the elderly.

So most of the effort to cut the deficit should come from taxes – and these should support a long-term vision for our country, which is green and fair. It would be a mistake to hike taxes now as that would stifle the economy, but here are four that could eventually do the trick.

Carbon taxes

The government has frozen fuel duty for almost a decade. The pandemic-induced plunge in the oil price is a good opportunity to push duty up again. Motorists wouldn’t notice the difference that much. Johnson should also increase taxes on carbon emissions by industry and energy producers, while compensating the poorest people for the extra cost of their electricity.

As well as raising money, such a move would incentivise the country to switch to cleaner forms of energy and travel. If Johnson wants to maximise the environmental benefits, he should put the money into creating green jobs like retrofitting people’s homes so they are energy efficient.

Fairer council tax

Council tax is monstrously unfair. For example, a super-rich oligarch in Kensington pays only £2,474 a year, whereas the borough’s poorest household pays £824.

Council tax should go up as a proportion of the value of a house, not go down. Since councils would be raising more money themselves, their grant could then be cut. Such a move wouldn’t just raise cash and be fair, it would empower local government and local people, since councils would be less dependent on drip feeds from the centre.

A leverage tax

One reason the government is borrowing so much is because it is bailing out over-indebted companies. Astonishingly, the credit crunch did nothing to curtail firms’ borrowings. What’s more, the government actually encourages companies to splurge on debt by making interest payments tax deductible.

Johnson should phase out the tax-deductibility of interest payments for large companies. This would kill two birds with one stone: government would claw back some of the bailout costs; and firms would have an incentive to fund themselves more with equity than debt and so would be in better shape when the next crisis hits.

Higher digital tax

The government has just introduced a 2 per cent “digital services” tax on the UK revenues of large internet groups such as Facebook and Google. This is to make them pay their fair share for public services, since they make a lot of money from operating here but book their profits elsewhere.

Digital companies are already big beneficiaries from the crisis as people work, shop and socialise online. They’ll do even better if the government rolls out fast broadband as part of a new deal to revitalise the economy, as it should. If so, it would only be fair that the likes of Facebook pay more.

Johnson seems to want to be a one-nation green prime minister. His exit strategy from the lockdown mentions “fairness” as its second overarching principle. And he brandished his green credentials at this week’s Prime Minister’s Questions, saying his determination to cut carbon emissions to zero by 2050 was undiminished.

A package of fair, green taxes as we exit from the pandemic would show he means business.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments