Cost of living: UK households more worried about money than at any time in past 10 years, study suggests

Pollsters say Treasury’s ‘limited measures’ have ‘evidently failed to reassure most consumers’, Lamiat Sabin reports

Households in the UK are more pessimistic about their finances now than at any other time in the last decade, according to a new study.

Many factors are contributing to the current cost of living crisis. Experts have attributed the high prices of energy, food, and bills to higher post-pandemic tax rates, inflation hitting 30-year highs, and Russia’s ongoing invasion of Ukraine.

More people are worried about meeting everyday costs now than a year ago, results of a monthly survey by YouGov and the Centre for Economics and Business Research (Cebr) show.

Households were asked how they think their financial situation will change in the next year. The pollsters scored the responses – with anything above 100 deemed as positive, while a number below 100 indicates a more negative outlook.

The score exceeded 100 a year ago, but – over recent months while the cost-of-living crisis has worsened – it fell from 59.7 to 49.1, with the worst decline over the past month.

“The ongoing cost-of-living crisis and uncertainty caused by continued conflict in Ukraine has, once again, seriously impacted on both consumer confidence and the public’s household finances,” said Emma McInnes, global head of financial services at YouGov.

“For the second month running, tumbling household finance measures – both retrospective and forward-looking – find themselves at their lowest ever level since tracking began almost 10 years ago.”

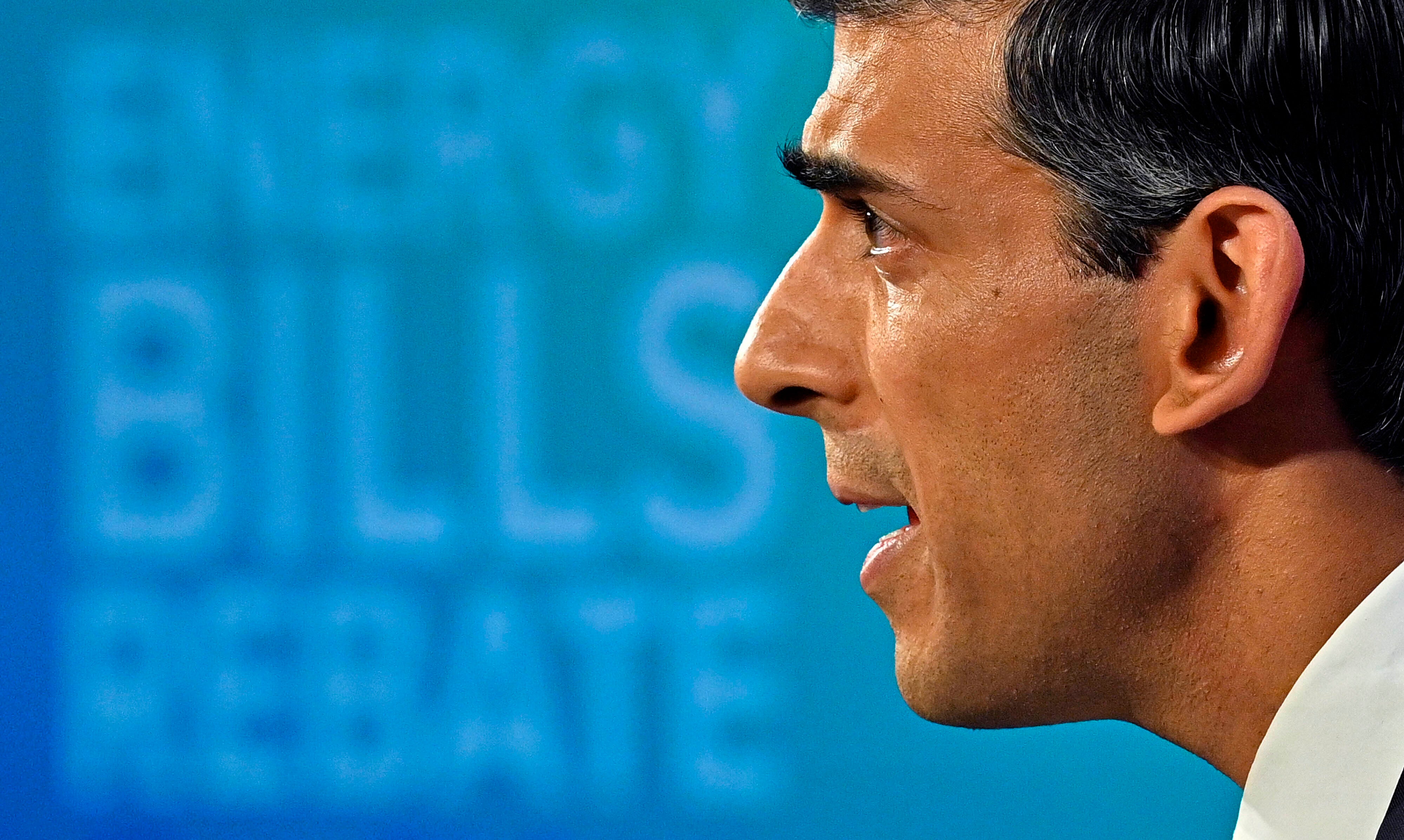

In his spring statement last month, chancellor Rishi Sunak responded to calls for him to soften the blow of the cost-of-living crisis by promising to raise the National Insurance threshold by £3,000 to £12,750 from July, and to lower basic tax rates from 2024.

Earlier, in February, he announced an energy bills rebate via council tax of between £150 and £350.

But critics said that the government’s measures do not go far enough, as the Bank of England has predicted that inflation will “reach around 8 per cent this spring” and climb “even higher later this year” before falling “considerably over the next couple of years.”

Kay Neufeld, at Cebr, said: “With inflation hitting 6.2 per cent in February on the CPI (consumer prices index) measure, the cost-of-living crisis has well and truly arrived in the UK, which goes some way to explaining the dismay expressed by households looking at their financial situation.

“The limited measures announced by Chancellor Rishi Sunak in the spring statement have evidently failed to reassure the majority of consumers.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments