Clear carbon prices could boost private investment, says Blackstone

‘You can take that future liability and turn it into an asset by investing against it now’

A carbon tax would boost decarbonisation by improving the business case for rapid investment, a senior leader at global asset management giant Blackstone said on Thursday.

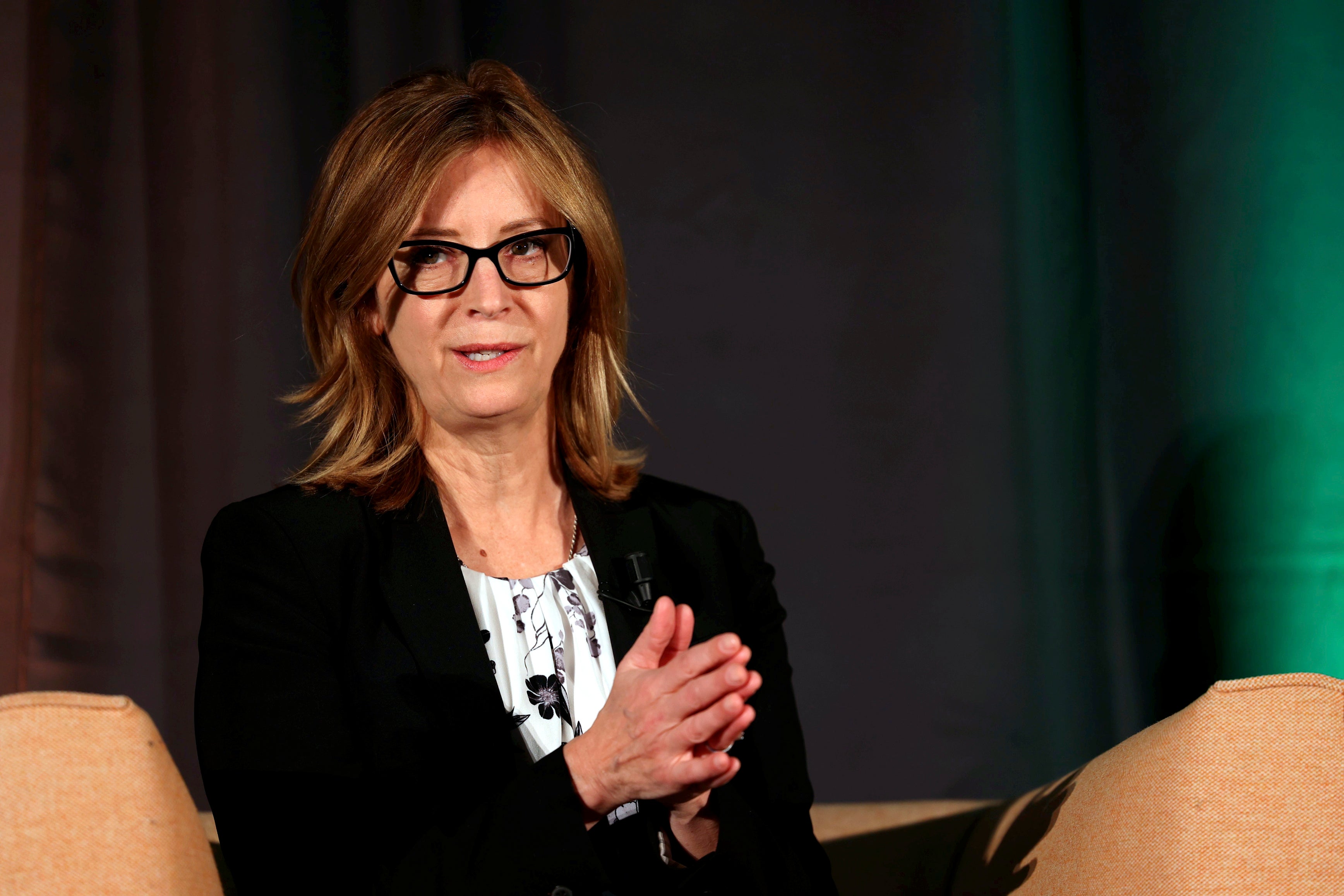

Jean Rogers, head of environmental, social, and corporate governance at the firm, said 90 per cent of the world’s GDP is now covered by a climate commitment but only 20 per cent of the world’s emissions are priced.

“That disparity makes it difficult for investors that have fiduciary duty,” she said, meaning those, like Blackstone, that act on behalf of investors rather than investing their own money.

“One thing that can really move the needle is actually pricing carbon and the reason for that is that it then becomes investable - you can take that future liability and turn it into an asset by investing against it now.”

Dr Rogers took a “net zero” copper mine in Canada, on which she is a board member, as an example. She said the current carbon tax is $50 a tonne and it’s going up to $170 per tonne of carbon by 2030 - that future liability incentivizes the business to decarbonize the copper mine, she said.

“We’d never want to pay a dime against that tax,” she added, speaking at the Dublin Climate Summit of which The Independent is a media partner. “And that is, I think, a really important mechanism.”

Dr Rogers said a carbon tax would give those working in the area of environmental, social, and corporate governance leverage with their boards and with their shareholders.

“We now need to be talking about long term capital strategies, and we need the tools, but we need the incentives to do that really well,” she said.

In the UK some there are levies on some emissions, but no economy-wide explicit carbon tax. There have been calls for that to change though.

The former Bank of England governor Mark Carney said last month that the case for a price on carbon “widely applied” is very strong, and that carbon tax breaks for poor households could aid the drive to net zero.

There is a strong case for financial firms to face levies on the carbon they generate in their activities, but policymakers should consider the impact on poorer households, the former central banker who is now the special envoy for climate action and finance at the United Nations, told the Lords Economic Affairs Committee.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments