What does the Autumn Budget mean for house prices?

The OBR predict that house prices will fall by 9 per cent between end of 2022 and third quarter of 2024

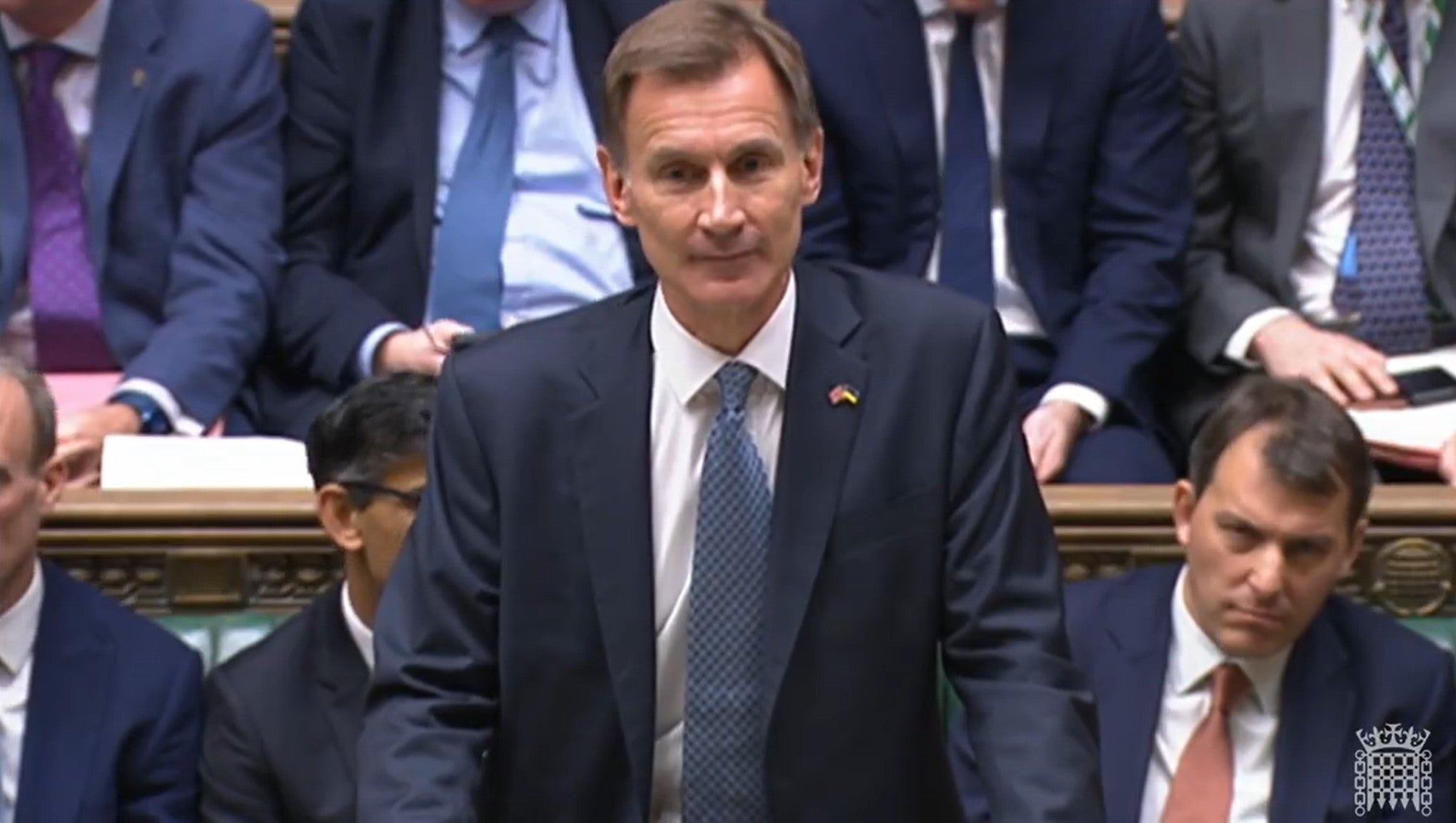

Jeremy Hunt announced that stamp duty cuts will only last until 21 March 2025 in his Autumn Budget on Thursday.

The new time limit will now add “urgency for people trying to get on the ladder or trade up in the next few years”, estate agents have said.

Speaking in the House of Commons, Mr Hunt said: “The OBR expects housing activity to slow over the next two years, so the stamp duty cuts announced in the mini-Budget will remain in place but only until the 21 March 2025.”

Rightmove’s property expert Tim Bannister said that this could prompt a jump in sellers “towards the end of next year and into 2024 to ensure they can move in time”.

It’s not likely to have a big effect in 2023 however, Mr Bannister added.

“It’s likely to be most challenging for first-time buyers with smaller deposits, as we know it’s currently taking them an average of five years to save up enough for a deposit,” he said.

House prices look like they are slowing, with the average property costing £295,000 in September this year.

The OBR are also predicting that prices will fall by 9 per cent between the fourth quarter of 2022 and the third quarter of 2024. This will be “largely driven by significantly higher mortgage rates as well as the wider economic downturn”, they forecasted.

According to ONS data, house prices grew by 9.5 per cent in the 12 months to September. This is down from 13.1 per cent in August and 15.2 per cent in July.

With people struggling to afford the higher mortgage rates caused by Liz Truss’s disastrous mini-Budget, the number of houses sold is likely to decrease over the rest of the year, estate agents have warned.

Jeremy Hunt’s Autumn statement tried to fix the damage caused by Ms Truss’s economic plan. However, with the rising cost-of-living, many of the factors contributing to a drop in house prices are likely to be unaffected by Mr Hunt’s statement.

Edward Heaton, founder of buying agents Heaton and Partners, said that there was nothing within Mr Hunt’s announcements that changed the “fundamentals of the property market as we head into a recession”.

“We must anticipate some pain in the coming year,” he added.

“For anyone buying or re-mortgaging, the message is that mortgage rates should continue to edge downwards in coming months and the stability of recent weeks will continue,” Tom Bill, head of UK residential research at Knight Frank, said.

He continued: “However, the spike in borrowing costs that followed the mini-Budget in September was a reminder that a 13-year period of low rates is over, which we expect to put downwards pressure on prices as they fall back to the level they were at last summer.”

There is some indication that high mortgage rates will ease over the coming months, however they are still causing problems for the current market.

Lawrence Bowles, Savills residential research director, said: “Data from the Bank of England shows the average quoted rate for a 2-year fix at 75 per cent loan-to-value rose from 1.29 per cent in October 2021 to 6.01 per cent in October this year.

“For someone repaying their mortgage over a 25 year team, that translates to a rise in monthly payments of 66 per cent, but we’ve begun to see rates easing, a trend that will be very keenly watched over coming months.”

Mr Bowles is predicting a fall in house prices, saying: “With mortgage affordability so stretched, we are likely to see sales volumes in the mainstream housing market slow over the rest of the year. We’ve forecast average price falls of -10 per cent in 2023, with values recovering through 2024 and beyond as mortgage rates fall back to more affordable levels.”

He added that the most expensive houses on the market were likely to be less affected by price drops as many of their buyers do not need mortages.

Bloomberg economists have predicted that house prices in the UK could fall by as much as 20 per cent. “Valuation gaps can persist for years, but history is punctuated by episodes of acute stress in which prices plunge. The latest evidence suggests some form of correction is likely,” they said in a recent report.

Martin Beck, the chief economic adviser to forecaster EY Item Club, said that although mortgage rates have “retreated from the highs seen just after the mini-Budget, they’re still elevated compared with early to mid-September.”

He added: “Cost of living pressures remain challenging, and face being exacerbated by tax rises and public spending restraint in November’s autumn statement, and consumer confidence is notably depressed.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments