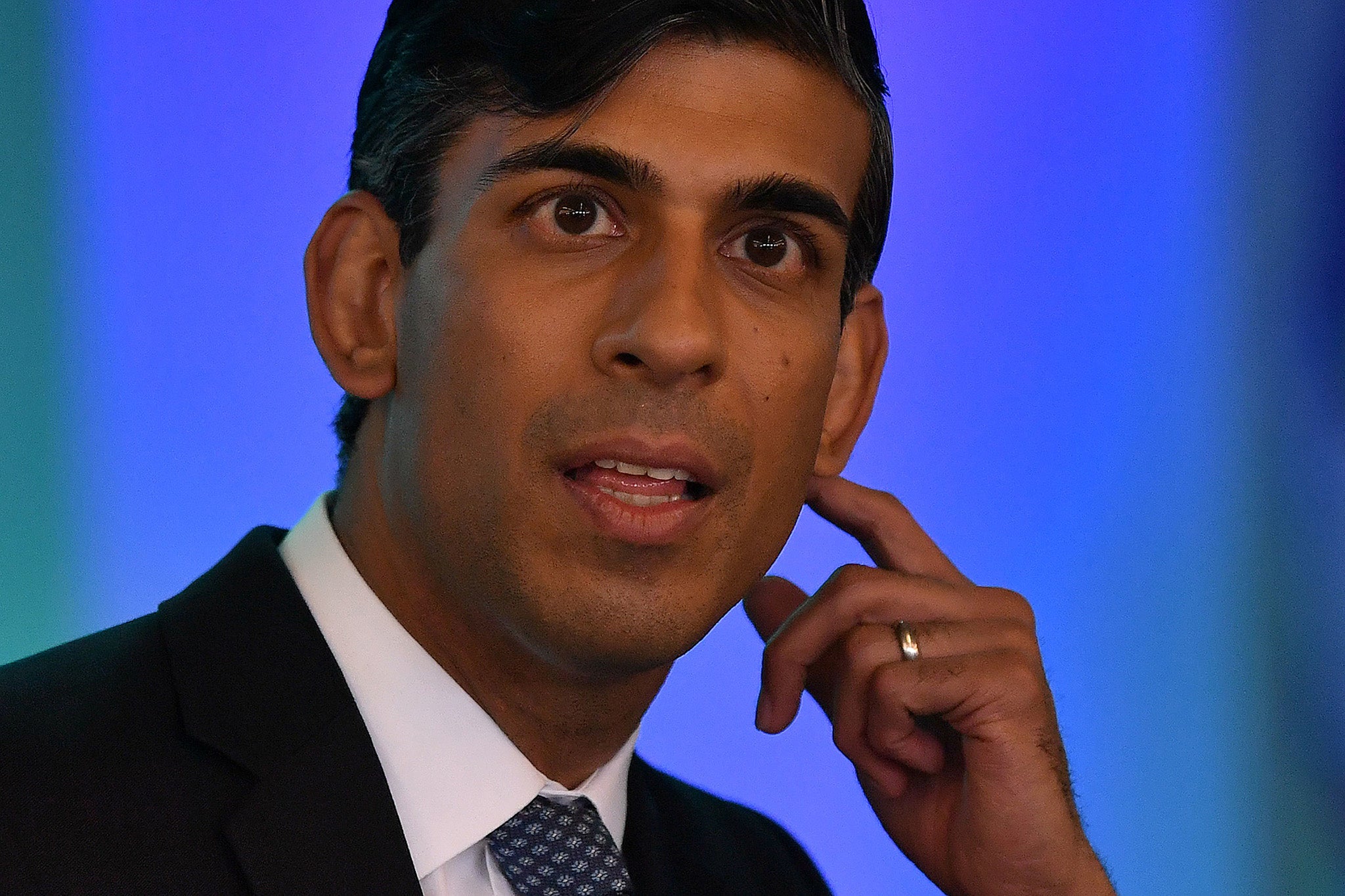

Why the news headlines are full of speculation about what Rishi Sunak will do next

The chancellor is reported to be considering tax rises – though most economists agree that’s a bad idea at this time, writes John Rentoul

One thing on which most economists are agreed is that now is not the time to be raising taxes. After the shock caused by the response to the coronavirus pandemic, people need to be encouraged to spend; money needs to be pumped into the economy, not taken out of it. So why are the news headlines full of speculation about new taxes?

Part of the explanation is that the Treasury is doing its job. It always has to be working on possible new sources of tax revenue, and especially in the run-up to a Budget, so that it can give the chancellor a range of options. Rishi Sunak presented a series of fiscal statements in the early stages of the coronavirus crisis that were far bigger than most budgets, but now he is preparing for the actual Budget, in November or early December, in which he wants to set out a credible path for a return to sustainable government finances.

In the medium term, that will mean higher taxes. So even if he doesn’t intend to raise taxes in this Budget, he may want to prepare the ground for doing so later. However, any work done in the Treasury – and especially any options that are shared with No 10 – is likely to find its way into the public domain. Sometimes, this is deliberate briefing in order to try to kill a particular idea, or to discredit the person who advocated it. More usually, it is seepage: gossip and showing off by people in the know that finds its way to journalists.

That is why ideas such as capital gains tax on homes, higher national insurance contributions (NICs) for the self-employed, and cutting pension contribution relief for the higher paid have all been reported as being under consideration. These are the zombie tax rises that ministers always shy away from but to which officials keep returning, because they are ways of dealing with unfairness or anomalies in the system that could raise significant sums of money.

Philip Hammond, when he was chancellor, tried to raise NICs on the self-employed in his first Budget but was forced into an embarrassing U-turn within days. Cutting the tax relief on higher-rate taxpayers’ pensions has been floated as an option for squeezing the rich before every Budget that I can remember, but it hasn’t happened. All the other ideas have been proposed and rejected before, but many of them will continue to be proposed – not least because the obvious sources of additional revenue have been ruled out by the Conservative manifesto. At the 2019 election, Boris Johnson promised: “We will not raise the rate of income tax, VAT or national insurance.”

In the end, something will have to give: if not in this Budget then in subsequent ones. Sunak told Conservative MPs last week that the government could not maintain high public spending and high borrowing indefinitely: “If that’s what the British people believe in – that none of this stuff matters, sound finances don’t matter – then they would have voted Labour at the last election.”

This happens to coincide with the view that is strong in the Treasury that, although borrowing is justified now, the markets need to be reassured that it is sustainable by setting out a path towards something resembling a balance between revenue and spending.

That does not mean taxes will rise in this Budget, but it does mean options for tax rises are being discussed intensively behind the scenes – and some of that discussion is bound to make its way into the headlines.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments