Billionaire’s shortbread: Jeff Bezos and the farcical philanthropy of the super-rich

Charity has always been a loophole for those at the top of the pile to look generous as they exploit tax breaks, writes Ahmed Twaij

Jeff Bezos, CEO and founder of Amazon, recently pledged to donate $98.5m (£74.8m) to support homeless people across the United States. Such a move is geared more towards a PR stunt than a charitable contribution by the richest (or second richest) man in the world. Philanthropy, in general, is better invested in democratically elected, socially representative and publicly accountable taxes than the rich elite. “Charity is a cold grey loveless thing. If a rich man wants to help the poor, he should pay his taxes gladly, not dole out money at a whim,” wrote Francis Beckett when summarising former British prime minister Clement Attlee’s views on charity.

Labour Party leader Jeremy Corbyn was quick to point out that Bezos’s donation equates to less than 0.09 per cent of the multibillionaire’s net worth and that he should instead “Just pay [his] taxes,” which would be a significantly higher figure. If we take the average net worth of a US citizen to be $97,300, the equivalent charitable donation made would be less than $90 – that’s less than the average weekly grocery spend in the US.

You just have to check your friend’s charity run sponsorship page to see how the regular American generously spends proportionally much more on charity. In fact, those who have an adjusted gross income of under $15,000 make, on average, $1,471 of charitable donations annually.

If you paid the $119 annual fee to become an Amazon Prime member, you paid more to Amazon than it paid in taxes

A recent study showed that Americans in the top 20 per cent of earners contributed an average 1.3 per cent of their income to charity, compared with the bottom 20 per cent who donated 3.2 per cent, more than double the wealthy. Since the study, the rich have been giving even less to charity. With three Americans – Bill Gates, Jeff Bezos and Warren Buffett – owning more wealth than the bottom 50 per cent of all Americans, such statistics are a damning indictment of the current state of social inequality in the US and globally.

The Gini coefficient, the most widely used measure of income inequality, reveals that the United States has sustained the most unequal society of the developed world. The most recent Gini coefficient figures, despite Trump’s celebrations of a seemingly growing American economy, place the US on par with some wartorn countries for inequality. Tax breaks for the wealthy have shifted this inequality from a wealth gap to a full-on abyss.

With the federal minimum wage remaining at $7.25, it is understandable that earnings are the same today as they were in the 1970s for average Americans. To successfully redistribute the wealth, a progressive taxation system must be implemented. Supporting education, infrastructure and healthcare are not “handouts”, as recently explained by congresswoman Alexandria Ocasio-Cortez, but are “public goods” that essentially bridge the gap between the growing elite and the average citizen.

Amazon, owned by Jeff Bezos, possesses the global monopoly on same-day delivery of almost anything you care to imagine. Despite doubling its profits last year from $5.2bn to $11.2bn, the multinational company paid 0 per cent in federal tax. The 0.09 per cent donation made by Bezos is far smaller than the federal tax figures Amazon and other companies have been evading. The average American, on the other hand, pays 11.4 per cent in federal income tax.

Bernie Sanders pointed out: “If you paid the $119 annual fee to become an Amazon Prime member, you paid more to Amazon than it paid in taxes.” Remarkably, Amazon in 2018 actually received a federal tax refund of $129m, meaning its federal tax rate was at negative one per cent. In contrast, trying to avoid paying taxes on a low income, without expensive and creative accountants, is near impossible, confounded by the fact that IRS audit rates for the wealthy have been dropping the most steeply since 2011. The reason why Amazon has had a non-existent federal tax bill is thanks to Donald Trump’s 2017 Tax Cuts and Jobs Act, which effectively increased the tax for lower income earners. Both President Trump and former speaker of the House of Representatives, Paul Ryan, promised the tax break would see workers benefiting from “around a $4,000 pay raise”.

Two years since the bill passing and the average employee has seen little development compared with their employers. Only 6 per cent of the money saved from the tax cuts have been invested in the workers, compared with 56 per cent benefiting the handful of shareholders like Jeff Bezos.

A report by the bipartisan Congressional Research Service indicated that the tax cuts cost the American citizens more than it improved the economy. For-profit companies, accountable to their shareholders only, will inevitably focus on pleasing the boardroom and making the bottom line more appealing, especially in an environment where poor worker rights exist in an unregulated labour market.

Should a government see a rise in per capita gross domestic product, the equivalent of a company reporting a growth in profits, it is accountable to the electorate, the government’s shareholders, and would have a duty to invest in public services such as infrastructure, healthcare, education and housing, especially as it seeks re-election. Such solutions provide a sustainable approach towards tackling a growing homelessness crisis.

Amazon is a global company, its tax evasion is similarly global. The philanthropic work purported by Bezos targets homelessness only in the US, leaving some of the world’s most poverty stricken population to continue to suffer.

The tax havens used by Bezos and his billionaire counterparts store over 11 per cent of all the global wealth which entrenches poverty in developing countries. For example, between 2010 and 2012, five deals for mining rights in the Democratic Republic of Congo (DRC), involving two British companies, were carried out through Panama, Gibraltar and the British Virgin Islands, saving the multinational companies billions in taxation but depriving the DRC of an estimated $1.36bn – double the combined annual budget for education and health in the country in 2012.

There seems to be a flagrant irony in Bezos choosing to donate funds to the homeless crisis. Cities across the US, such as San Francisco and Seattle, have witnessed a spiralling homelessness emergency, largely due to the tech boom which has caused housing prices to skyrocket. Such a crisis has even been dubbed the “Amazon Effect” due to a large influx of highly paid individuals into big-tech hubs.

The Seattle crisis shows that in the hands of billionaires, the wellbeing of the civilian population is undermined for the sake of rising profits

According to the United States Census Bureau, after Amazon’s expansion into Seattle, rent prices in the Seattle metro area rose by 17 per cent between 2011 and 2015, driving many of the city’s residents on to the streets and becoming the city with the highest homeless population in the country. To counter this effect, the city of Seattle proposed a $275 per employee tax on large employers, such as Amazon, to alleviate the growing homeless crisis.

The initiative, which would have a raised a viable annual income of $50m for the city to tackle the homelessness crisis (compared with Bezos’s impetuous, one-off donation for the whole country) was shut down after pressure from Bezos’s Amazon through a quid pro quo (which Trump is now learning constitutes a bribe). In effect, the Seattle crisis shows that in the hands of billionaires, the wellbeing of the civilian population is undermined for the sake of rising profits.

At least a quarter of all homeless people in the US, 140,000 individuals, suffer with severe mental health illness and 45 per cent suffer with some form of mental health condition which resulted in their being forced to live on the streets.

Imagine if corporations such as Amazon paid a fair share of their taxes so that a social healthcare system, much like the proposed Medicare For All, could effectively be implemented: many of those living homeless due to mental health would be treated. Similarly, the 57.1 per cent of personal bankruptcies in the US which are directly due to medical bills (and therefore contribute to the homeless crisis) would successfully be avoided.

The farcical philanthropy presented by the King of Retail will inevitably do little to assist the homeless community. Amazon itself has directly contributed to homelessness, especially to employees who have suffered major workplace injuries and have been left without any income, support or compensation.

The cost of housing for homeless people in the US is approximately $10,000, meaning with Bezos’s contribution, only 9,850 homeless people can be supported, a slither of the 553,000 homeless people across the US.

Understanding its low employee wages were not enough to cover rent, medical and utility bills, Amazon launched CamperForce. The temporary workforce paid at minimum wage is made up of those living in tents or cars, to fulfil the needs of Amazon’s warehouses, especially during festive periods. Such insecure jobs help President Trump in claiming unemployment rates have fallen to a 50-year low.

Forcing employees into living nomadically in order survive reveals the underlying inequality of the current workforce, especially now that the top one per cent of Americans earn 81 times more than the bottom 50 per cent, and therefore the need to support the American population through public services.

The decision on how philanthropic money is spent is solely reliant on the impulses and personal interests of the elite. In 2018, only 12 per cent of all major philanthropic donations went to humanitarian services, with the remainder going to religious or arts-based charities. Those in decision-making positions, especially in the unelected nonprofit sector, rarely represent the population at need.

Nearly 85 per cent of all charitable board members are white, making it difficult for charities to comprehend the requirements of all demographics. Those who are most in need of charitable contributions are less likely to be white – for example, only 40 per cent of all homeless people are white. “Three-quarters of foundations have no written policy on board diversity”, said Gara LaMarche, president of the Democracy Alliance, showing just how out of touch some charities are. When compared with money spent by taxation, democratically accountable governments are more likely to reflect social needs of the general public than the priorities of an unaccountable charitable board.

If you worked every single day, making $5000/day, from the time Columbus sailed to America, to the time you are reading this tweet, you would still not be a billionaire, and you would still have less money than Jeff Bezos makes in a week

Jeff Bezos’s net worth has now reached $110bn. Amassing such unfathomable sums of money begs the question: why do billionaires even need to exist? Once you’ve burnt through your first 20, 30, 40 million dollars, what need do you have for the rest of your 900 million (and if you are Bezos, the rest of your $108.9bn)? After you’ve built a few $42m clocks, how much more wealth could an individual need?

In a now viral tweet, as one Twitter user pointed out, “If you worked every single day, making $5000/day, from the time Columbus sailed to America, to the time you are reading this tweet, you would still not be a billionaire, and you would still have less money than Jeff Bezos makes in a week.” The reason why the world’s wealthiest turn to philanthropy, usually in their old age, or in their death, is because they eventually come to the realisation that such an enormous sum of wealth is not natural for one individual.

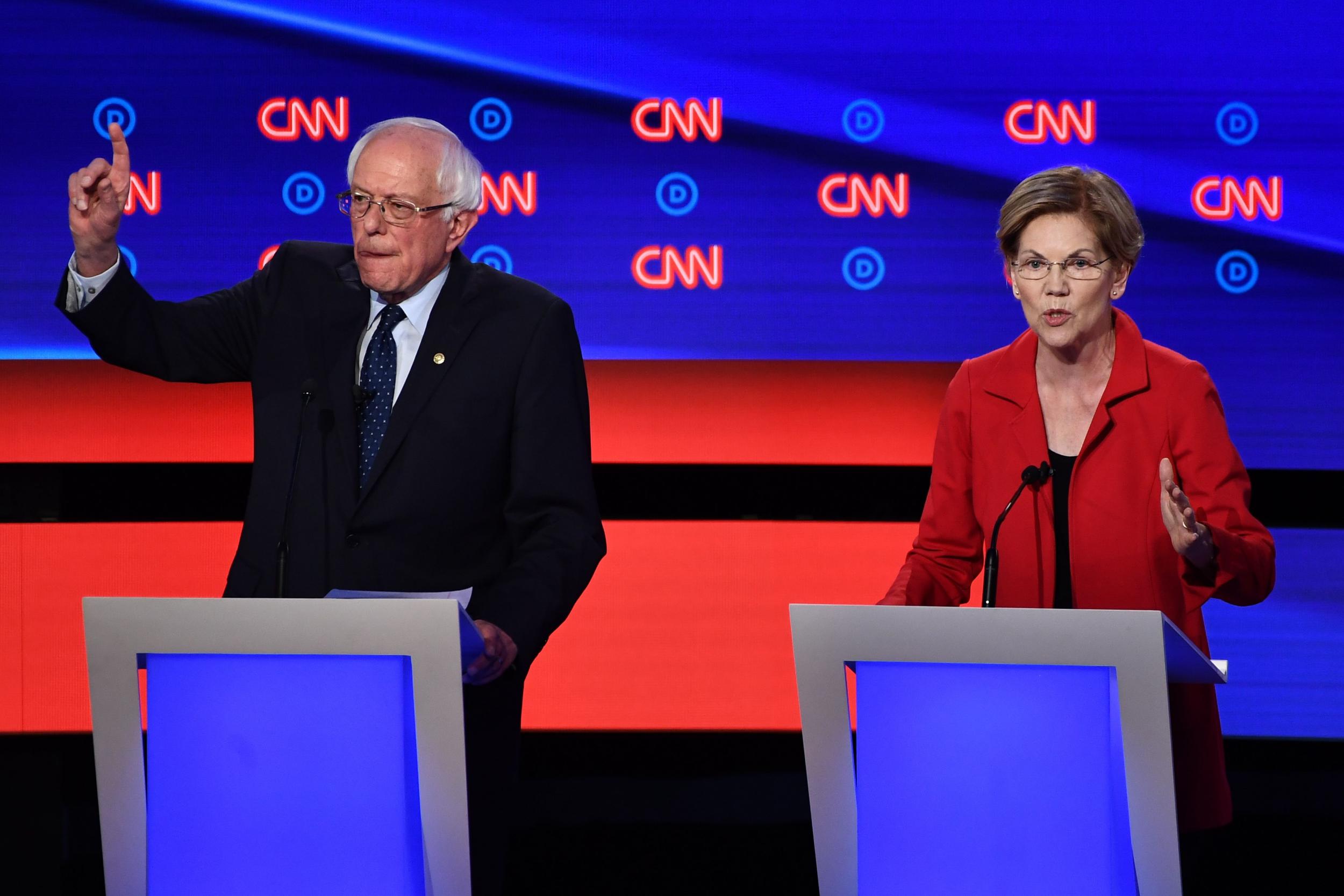

For these reasons, the wealth tax proposals of Bernie Sanders and Elizabeth Warren are needed in order to redistribute the wealth which has been increasingly widening the share of wealth in the US. Both Sanders and Warren have been attacked by Democrats from the right for such policies. Senator Cory Booker, responding to Warren’s taxation plans in a recent Democratic debate, stated that “we Democrats also have to talk about how to grow wealth, as well”, suggesting that going after wealth and job creators like Bezos will prevent any money from “trickling down” to average Americans.

In reality, many who work for companies such as Amazon often work in below living wage conditions, work multiple jobs and sometimes operate at a loss, showing that tax breaks for the rich rarely translates into better living standards for the poor. Unsurprisingly, Warren’s wealth tax was inevitably criticised by the super-rich Bill Gates of Microsoft.

Despite reporting record profits in 2018, Amazon has become one of the top employers of those that receive Supplemental Nutrition Assistance Program (Snap) – more commonly known as food stamps – in at least five US states. In Arizona, for example, one in three Amazon employees – that’s 1,800 people – are dependent on food stamps. Although Bezos has become a multibillionaire thanks to underpaying hardworking labour, it unavoidably becomes the burden of the taxpayer to supplement Amazon’s low wages; taxes which Amazon barely contributes to.

The longstanding Republican (in the US) and Conservative (in the UK) argument has been that companies such as Amazon cannot be taxed as they are job creators; the reality is that taxation is required to supplement the poor living standards fostered by Amazon as shareholders’ pockets are lined. Regardless, Amazon is working hard at automation, which has inevitably resulted in job cuts as well as contributing to the closure of 30 per cent of America’s stores and malls. Amazon is even working on self-flying drones, Amazon Prime Air, alongside publicly funded Nasa, to remove the need for delivery drivers.

To claim that Jeff Bezos is self-made is fantastical. Without public funding and support from taxation, many large companies would never reach the success they have reached. Amazon, for example, relies on public infrastructure such as transportation links for its deliveries.

Without US government funding, the internet as we know it today would never exist – Amazon would never exist. Similarly, much of the revolutionary high-tech equipment found in Apple devices exists thanks to US government grants. Jeff Bezos, and others, owe their success directly to US taxpayers and have a responsibility to give back.

It’s easy to look at Bezos’s contribution to charity as a positive contribution and something that we should celebrate. After all, giving something is better than nothing, right? When such donations, however, serve as a replacement for taxation is when such initiatives set a dangerous precedent. Charity has always been a loophole for the super-rich to look generous as they exploit tax breaks, partially explaining why so many of the rich elite refuse to share their tax returns. Donald Trump even illegally used funds from his charity, the Trump Foundation, to finance his 2016 election campaign.

Billionaires are able to continue using their rising profits to lobby governments into implementing laws for the benefit of a few select individuals

It is the privilege and arrogance of billionaires that allows them to feel they know better how to spend money on the public than a democratically elected government, and their own narcissism which leads them to name their foundations after themselves. Billionaires are able to continue using their rising profits to lobby governments into implementing laws for the benefit of a few select individuals. Amazon, for example, has increased its spend on lobbying fivefold over the last five years. Now, billionaires have direct access to the presidency, with Donald Trump being the prime example, having self-funded his own election campaign.

For the 2020 Democratic race, Bezos has been mulling over sponsoring Michael Bloomberg’s run for presidency in what can only be described as an act of “class solidarity”, as pointed out by Alexandria Ocasio-Cortez (not that the ninth richest man in America needs any extra cash). This class solidarity extends into office too: through the tax cuts he himself implemented, Trump will personally save up to $15m, along with similar savings for his billionaire counterparts.

The US has long been a heavily capitalistic society, championing stories such as that of Bezos as the “American Dream”. The celebrated notion of “pulling yourself up by your bootstraps” as if in a beloved John Wayne movie, valiantly riding through the Wild West and achieving success without any external help, is held dear by many Americans.

The heroic idea that it is achievable to go from rags to riches as self-made billionaires is one of capitalism’s most pliable myths. Growing structural inequalities have been in place providing for the fortune of a select few. Longstanding institutional racism has meant that one in seven white families in the US are now millionaires, compared with only one in 50 black families.

Success stories such as that of Bezos, regurgitated in the media, provide hope for Americans working three jobs in pursuit of their dream and are often treated as the example rather than the exception. Regarding the role of media in maintaining such public consent, Noam Chomsky writes: “The mass media serve as a system for communicating messages and symbols to the general populace. It is their function to amuse, entertain, and inform, and to inculcate individuals with the values, beliefs, and codes of behaviour that will integrate them into the institutional structures of the larger society. In a world of concentrated wealth and major conflicts of class interest, to fulfil this role requires systematic propaganda.” It is not surprising, therefore, that Bezos and other billionaires have invested in mainstream media outlets, which propagate their taxation practices.

Single, one-off donations to charitable causes act merely to bandage a problem which only fair redistribution of wealth, through taxation, can repair. A systematic problem needs to be mended and haphazard donations by philanthropists only provide a band-aid to deep-running ailments. This is not to say that charitable donations must be stopped, rather that they should not be used as a replacement for taxation. It is time a just global taxation system is put in place, with the funds used to address the direct needs of the general public, implemented by those elected to represent them.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments