How will we pay for the coronavirus debt – and should we?

Eventually we will have to find the money to cover the government’s unprecedented spending and borrowing during the pandemic. But how? Tax expert John Cullinane explains

This year’s government budget deficit will exceed £300bn, more than twice the peak recorded after the 2008 financial crisis. It has already taken government debt to more than 100 per cent of GDP, a level portrayed as apocalyptic in the somewhat fevered debates that led to "austerity" in 2010.

How will we ever pay this back? What will have to happen to taxes? History suggests that there are many ways to skin this cat. At the end of the Napoleonic Wars, the UK’s national debt stood at about 200 per cent of GDP. It was paid off with Victorian conventionality. The government raised little in tax by modern standards, but spent even less. Income tax was low and flat rate, and customs duties remained a major, and regressive, source of revenue.

Other than giving themselves time, governments didn’t make things easy for themselves. Interest rates fluctuated, but were generally much higher than now, adding to the cost of the debt. Inflation was virtually non-existent, so the real value of the debt did not diminish by stealth. Wealthy bond-holders made good returns, while the government spent more on servicing debt than on education.

In the end, the debt was almost paid off: by the Edwardian period it was down to about 30 per cent of GDP. The achievement had taken about a century.

France, our financial as well as military opponent in the Napoleonic Wars, had a somewhat different political trajectory over the 19th century, but tells a similar story on debt reduction.

In the early 20th century, the rearmament ahead of the First World War, and the war itself, created a new debt problem for most European countries – by 1919 the UK’s stood again at more than 200 per cent of GDP. This time, responses were different. In some countries, money was printed to pay debt; and the resulting inflation (notably German hyperinflation in 1923) destroyed some of its value.

Default (especially in Russia after the revolution) and debt forgiveness played a part: the reparations debt that had been imposed on Germany had never been practically payable in any case. But there were also expenditure cuts in the immediate aftermath of the war: in Britain spending fell victim to "the Geddes axe", an exercise in austerity that disappointed those who had hoped for "homes fit for heroes" and the growth of the embryonic welfare state.

Tax played a part. In the run up to the war, political reaction against rising inequality had put progressive income tax and death duties on the political agenda in many countries. The war took much of the controversy out of these changes, and after it, financial necessity limited the scope for putting back the clock.

Debt at the end of the Second World War – at 310 per cent of GDP in the UK – produced different results again. France and Germany turned to wealth taxes (including confiscatory one-off rates, perhaps an easier sell when the wealthy were tainted with Nazism or collaboration). There was a great deal of debt forgiveness – Germany being a major beneficiary, reducing its debt from a large multiple to a small fraction of GDP – and the Marshall Plan took this largesse further.

The post-war international economic settlement, known as Bretton Woods, did prevent hyperinflation, but expansionary economic policies created growth, and led to modest inflation, both of which helped whittle away the real burden of the debt. The UK agonised about inflation in the seventies, but it sure helped pay off debt, for the government as well as mortgage-payers. The crisis leading to the 1976 IMF bail-out was a big political event, but barely caused a blip in the downward trajectory of public debt.

Once again, progressive taxation had been ramped up by the war and, at least until the late eighties, did not fully return to pre-war levels.

By the late nineties and early 2000s, UK public debt was once again at about 30 per cent of GDP – we had brought it down from more than 300 per cent of GDP in half the time it had taken the Victorians to bring it down from 200 per cent. Then came the 2008 financial crisis.

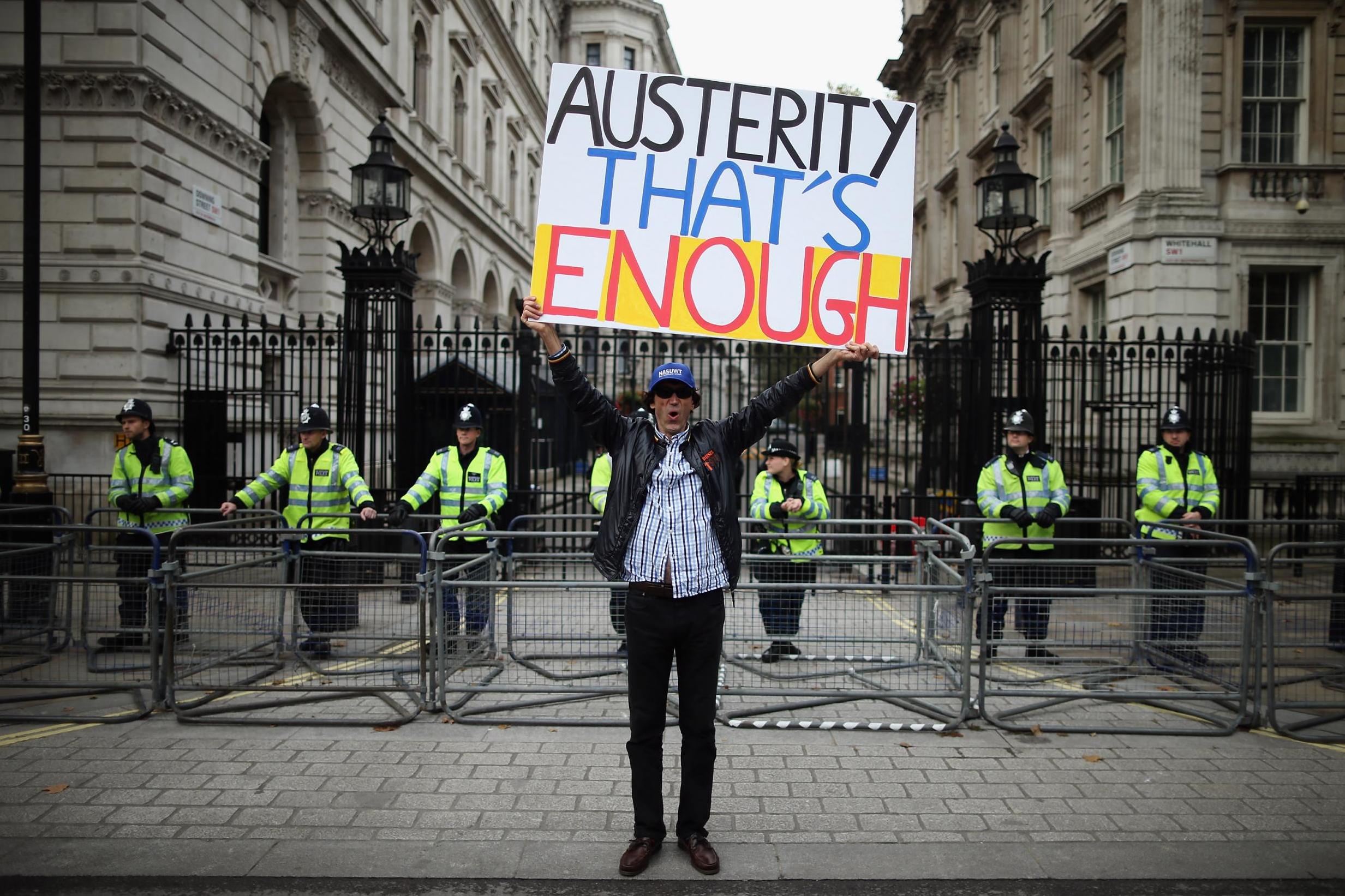

Initially there was a strong Keynesian response, which took public debt to nearly 70 per cent of GDP. Later, though money continued to be printed, governments increasingly refrained from spending it. Certainly in the UK, spending bore the brunt of austerity – some taxes were increased and others cut. The annual deficit came down markedly, but debt continued to rise – it was 85 per cent of GDP at the end of March, just before Covid-19 would take its fiscal toll. Inflation was low, and growth disappointing – so neither contributed much to the reduction of the effective debt burden.

What lessons can one draw?

First, for those interested in tax policy, that you cannot view tax in isolation: for good or ill, it’s part of a whole package. The size of the role that tax must play, and the nature of the taxes involved, are both part of a much wider set of variables. Secondly, can we say, who got it right? And who, wrong? Not entirely, as to some extent these are matters of political choice and subjective opinion (though one suspects that sometimes, some options are embarked on, and others ruled out, without even policy-makers being aware of the choice). Some facts stand out though. The burden of Napoleonic War debt did not prevent the Industrial Revolution. Average UK GDP growth exceeded 2 per cent, a record then in human history.

If people simply save the money that they would have spent on meals out, and everything else foregone during lockdown, then these excess savings would balance the government’s excess spending

This was also the case for the decades after the Second World War. Prosperity grew, more equally than in the 19th century, and without the Dickensian social conditions. At the time, average growth of just over 2 per cent per year was regarded as lacklustre in the UK, though it was very respectable by UK historical standards. Indeed, it is impressive by comparison with the period since 2008. British post-war disappointment may have reflected the fact that other European countries were doing much better, catching up with our previously higher standard of living – the French call the 30-year post-war period ‘Les Trentes Glorieuses’. (The US shared our modest growth levels, but with a much higher absolute standard of living, in those days seemingly out of our reach).

Probably both in that and the Victorian period there was stronger consensus about the policy mixes chosen on each occasion (notwithstanding the mixes were very different). One senses that after the First World War, there was less agreement. The growing demands of welfare conflicted with a yen to return to pre-war certainties.

Such nostalgia prompted one of the UK’s most disastrous economic decisions ever made: the 1925 return to the gold standard (a forced revaluation of the pound which burdened export industries and increased the burden of the National Debt, among many other downsides).The UK, as a consequence, missed out on the roaring twenties. One can learn from the past, but it’s important to assess policies against present conditions.

What of post-2008 policy? Growth was pitifully slow for a period of supposed recovery. Controversy persists about the roles of austerity, inequality, and other sources of the UK’s productivity problem. The Covid crisis has arisen before the full legacy of the crash, and policy reactions to it, have become clear, and looks set to dwarf its impact.

Finally, it is worth noting that massive public debt burdens have not ruled out bold policy decisions with huge financial implications. In the aftermath of the Second World War, the National Health Service was established, and the welfare state expanded. Early in the century of debt repayment after Waterloo, slavery was abolished in the British Empire and slave-owners compensated, creating a massive hike in the otherwise gradually declining level of debt. One can well ask, why the slave-owners were compensated and not the slaves? But one cannot dispute the scale, or fiscal confidence, of the decision. Perhaps one lesson is, that we should face the future with courage.

Is there anything special about the Covid crisis? Most historical precedents of high public debt came from wars. Tax goes up in wars, albeit not as fast as spending, so when the fighting stops, there is a higher tax base in place to help deal with the debt. When peace breaks out, a lot can be done by just not reducing taxes as fast as some would like. We won’t have that tactical advantage in the years to come.

On the other hand, a lot of consumption has been foregone, much of it by better-off people. Holidays, meals out, concerts, Wimbledon, Glyndebourne (OK, not Cheltenham…), all have been cancelled. This was the inevitable physical consequence of the shutdown – consumers have lost out, but if their incomes were secure, they are more in funds as a result.

By and large the things they would have enjoyed have gone unpaid for, and most money paid in advance has been returned (OK, not from the airlines). The economic counterpart of this is that incomes have been lost by all those who work in these sectors, except to the extent that the state has picked up the slack, largely through the furlough and similar schemes (which in turn are a major contributor to the fiscal problem).

Does this point to where the burden is likely, and maybe should fall? Public discussion has turned to wealth tax.

A slightly different question is, how important is it to repay the debt at all? If people simply save the money that they would have spent on meals out, and everything else foregone during lockdown, then these excess savings would balance the government’s excess spending – there is no sign of inflationary pressure, and it’s not as if the government has to pay much interest.

However, it is unlikely that there will be as much consensus about paying the bills as there was about the income support which has brought them about.

John Cullinane is the tax policy director at the Chartered Institute of Taxation

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments