Could Boris Johnson’s reference to Beveridge be the beginning of much-needed welfare reform?

The social reformer recognised that the Second World War had provided a transformative shock and seized his opportunity. The coronavirus pandemic could provide another, writes Ben Chu

In his virtual Conservative Party conference speech earlier this month Boris Johnson reached into the British politician’s big bag of wartime cliches and pulled out a civil servant called Beveridge.

“In the depths of the Second World War, in 1942 when just about everything had gone wrong, the government sketched out a vision of the post-war new Jerusalem that they wanted to build,” the prime minister recalled. “And that is what we are doing now – in the teeth of this pandemic.”

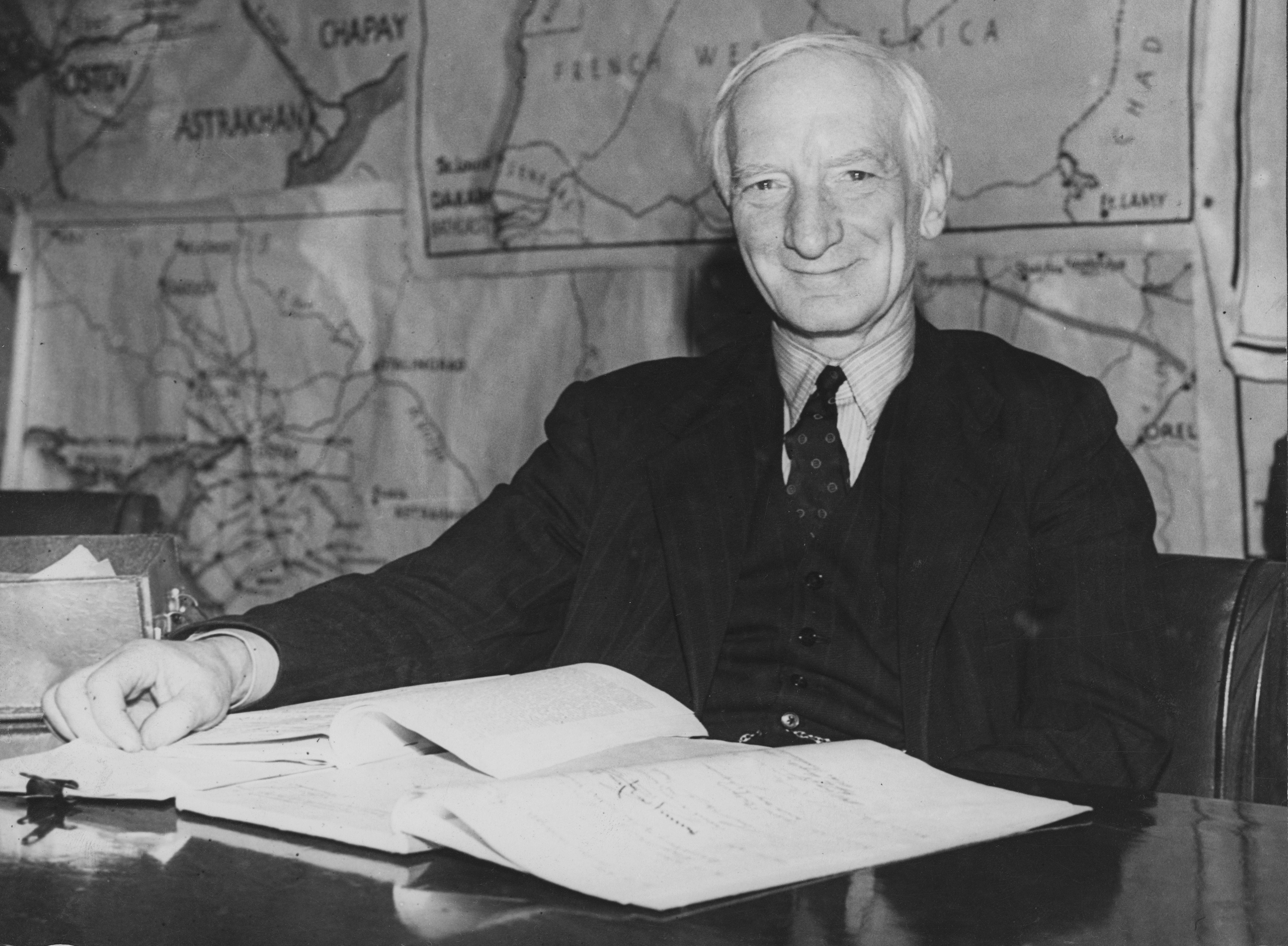

Johnson was referring to a report written in 1942 by an old Liberal called Sir William Beveridge.

The name of Beveridge’s report – “Social Insurance and Allied Services” – wasn’t particularly inspiring.

Yet his proposal of a new welfare state that would slay the “five giants” of want, disease, ignorance, squalor and idleness ignited the fires of the wartime public’s enthusiasm.

“A revolutionary moment in the world’s history is a time for revolutions, not for patching,” Beveridge declared.

There were queues outside the government’s official bookshop in London as people rushed to get hold of this visionary document. Some 600,000 copies were eventually sold, making Beveridge a bona fide bestseller.

The Ministry of Information even sent abridged versions to north Africa in the belief that Beveridge’s vision would give the troops something worth fighting for.

Boris Johnson stopped short of saying it explicitly in his conference speech, but others have argued that the coronavirus pandemic – and the deep social inequalities and fault lines it has exposed and emphasised – means we need a “New Beveridge” to slay the giant evils of our own day.

It’s a natural instinct at a time of deep social distress, even national crisis. The word “Beveridge” has come to be associated with progress, compassion and – a very contemporary resonance – “building back better”.

Yet before we start talking about a new Beveridge, we would do well to examine what the old Beveridge was.

One suspects that, like Stephen Hawking’s Brief History of Time, Beveridge’s report has been more bought than read.

Its reputation as a blueprint for the modern welfare state is overblown, given there’s little about health and almost nothing about housing or education in there.

This was a report about what that rather flat title specified: social insurance. It described (in a nutshell) a compulsory, nationalised and centralised system for workers to pool their resources to partially cover a worker’s income when he lost his job or retired.

The centralised element was key. There had, in fact, been a network of state social insurance schemes already in existence in the 1930s. Beveridge proposed to pull everything together and run the whole shooting match from Whitehall.

Beveridge’s vision was for flat financial contributions from all workers and flat payouts, with payouts strictly reserved for contributors. It was to be a fully funded system, with distributions from a ringfenced pot of money in Whitehall. That’s not, to put it mildly, what we have today.

In the depths of the Second World War, in 1942 when just about everything had gone wrong, the government sketched out a vision of the post-war new Jerusalem that they wanted to build. And that is what we are doing now – in the teeth of this pandemic

National insurance contributions from workers are not flat-rate, with those on higher incomes paying more. Payouts are flat but largely divorced from an individual’s contribution record. And those on low incomes receive top-ups from other state benefits, regardless of their past contributions.

The “National Insurance Fund” is nominally separate from the rest of the government’s coffers but in practice there’s no division. The system is pay as you go, which means what a person takes out of the system today is paid by what someone else pays in today.

For many reasons (by no means all of them bad) we do not live in a Beveridgean world when it comes to welfare. Moreover, the central feature of the system Beveridge proposed was that benefits would be paid “as of right” to all who had contributed, with no questions about the recipient’s income or savings.

This was the central reason Beveridge was such a popular hit. Memories of the means test during the mass unemployment after the First World War and even the Victorian Poor Law – which attached strict, humiliating and often savage conditions for relief – were still fresh in popular memory in 1942. Beveridge promised a deliverance from means testing.

Yet means testing survives, a condition of receiving those top-ups. Indeed, means testing now dominates the British working age welfare system.

Why?

The original sin of the new national insurance implemented by the Labour government of Attlee and Bevan after the Second World War was that payouts to the unemployed or retired were not set high enough to prevent poverty. That meant a separate means-tested system called National Assistance often kicked in.

Beveridge knew that some means-tested benefits would be necessary for those who fell out of the scope of employment-based social insurance, such as those too sick to work or abandoned wives and widows, but he assumed it would wither away over time thanks to full employment and decent wages.

Yet means testing has, instead, proliferated like buddleia in a post-war bombsite.

It’s partially due to social change. Beveridge had assumed that men would win the bread, women would bear the children and families would stay together. He did not anticipate rising divorce rates or the growth of part-time working and the informal economy, which have all strained his original conception.

But it also reflects political choices. Left-wing governments have tended to create new (income contingent) benefits for the poor while right-wing ones have tightened access to those benefits to reduce the system’s costs.

In the words of Uncle Monty in Withnail and I, one could say that the Beveridgean vision has been “shat on by Tories and shovelled up by Labour”.

Surveying this modern landscape of means testing the historian Noel Whiteside is left to conclude that “the 19th century poor law has made a deeper impact on British social policy than the Beveridge report ever did”.

So we are in a muddle. And not just about our history, but our present.

Many people think their national insurance contributions fund not unemployment benefits and the state pension but the health service.

And, in a sense, they’re not wrong. Because national insurance has become just another tax from the point of view of politicians of all stripes. Labour chancellors raise them to finance more public spending (including the NHS) while Conservative chancellors cut them to put more money in the pockets of the poor.

This has been slowly euthanising the social insurance conception of our welfare state. A spell of joblessness today is not a normal hazard of life against which one can feel financially covered courtesy of one’s past contributions, but rather an event to be feared, something that spells instant poverty for those forced to rely solely on benefits.

It leaves many people with a sense that they are paying into a scheme but not getting anything out of it when they most need it.

The paradox of our system has long been that it offers very meagre support to the unemployed by continental European standards (replacing 35 per cent of previous incomes on average versus 60 per cent in Germany and 64 per cent in France) and yet a large proportion of people have become convinced (encouraged, it should be stressed, by right-wing politicians and their media allies) that it’s excessively generous to the jobless.

The more that we get towards a welfare system whereby you take when you need, because you've paid in when you could, I think that sets the basis for the exercise of altruism

“It’s skivers against strivers,” laments the UK welfare expert John Hills of the London School of Economics. “Dishonest scroungers against honest taxpayers. It’s them against us”.

So given all that confusion and resentment, what might a “new Beveridge” look like?

For some the objective is simply to make the existing system more generous. That would certainly be in the spirit of Beveridge, who said very plainly that eliminating want would require “raising the rates of benefit”. Yet there are two broad proposals for major structural reform. The first is that it’s time for unconditional payments to everyone, or a universal basic income (UBI).

This is, the argument goes, the only way to get into all the cracks of the modern labour market with its zero-hours contracts and part-time working.

The left of the Labour Party has been moving in this direction for some time, though it was actually the Liberal Democrats who took it up as party policy this year.

Whatever its merits, such an approach plainly conflicts with Beveridge’s insistence that rights must flow from contributions. Those who think Beveridge was in favour of insurance payments to anyone on low incomes are under a significant, albeit common, misapprehension.

“The plan is not one for giving to everybody something for nothing and without trouble, or something that will free the recipients for ever thereafter from personal responsibilities,” stressed the 1942 report.

That doesn’t, in itself, mean UBI is a worthless idea. More problematic is the fact that to give everyone a UBI significant enough that it would not mean steep cuts in incomes for many existing claimants would necessitate levels of taxation above anything most modern economies, certainly the UK, have seen.

As the veteran public finance expert John Kay puts it: “Either the level of basic income is too low to meet its objectives or if its high enough to meet its objectives it becomes unaffordable.”

Other reformers want to go in a very different direction: back to Beveridgean principles.

Frank Field, the Labour MP who was famously asked to “think the unthinkable” on welfare by Tony Blair back in 1997 (and then ignored when he did), has produced a new pamphlet that argues the time has come for a resurrection of the “contributory principle”. Jonathan Reynolds, Labour’s shadow work and pensions secretary, hinted over the summer that he was thinking on similar lines.

So is this the way forward? Back to Beveridge?

Beveridge said that his scheme reflected the “sentiments of the British people”. But Noel Whiteside argues that Beveridge was more of a leader of public opinion than a follower of it, what today might be called a policy entrepreneur.

“I don't think that people faced with the conflict of World War Two were in any position to think, oh, well, we could rationalise all this and nationalise it and could do all the economic calculations to sustain it. This wasn't really at the forefront of political debate,” she says. “It was completely the opposite of a response to popular demand … He was very good at publicising his own material.”

60%

Of people support the proposition of moving to earnings-related benefits

Yet Beveridge clearly persuaded people that he was selling something that they wanted to buy, and he was clearly pushing on an open door in rejecting means testing. What, then, are those popular “sentiments” on welfare today?

To some extent one can identify, once again, an agreement that there should be more payments granted “as of right”. “I think we have got a system out of kilter and it needs to move back towards more focus on non-means-tested benefits,” says Fran Bennett of Oxford University’s Department of Social Policy and Intervention.

And the number of people who think welfare benefits are too generous has been falling in recent years, albeit from a peak of 55 per cent in the middle of the last decade.

It’s possible to envision an expansion of universal benefits (available to all), lower “conditionality” on recipients, an increase in the level of jobseekers’ allowance, wider access to statutory sick pay and so on. But will such reforms go far enough?

It’s worth thinking about what the contributory principle means. Does it mean that only contributors get payouts? Or does it mean contributors getting out more if they’ve put in more? Should benefits be earnings-related? This was not, it’s true, Beveridge’s conception, but it’s a central feature of most continental social insurance systems.

Reynolds’ remarks solicited a furious response from a disabled rights group, which read into them a covert agenda to cut the benefits of those unable to work. One can see why they think that after the welfare cuts implemented by the Conservatives over the past decade. As Joseph Heller observed, just because you're paranoid doesn't mean they aren't after you.

And the logic of variable benefits is indeed that some people will get less than others, at least from the main insurance system.

Yet some counter that a genuinely contributory insurance system, perhaps including earnings-related benefits, would restore broad public confidence in the system and an appreciation of its values, and so make most people more inclined to accept high support payments to carers, the disabled and the destitute.

“The more that we get towards a welfare system whereby you take when you need, because you've paid in when you could, I think that sets the basis for the exercise of altruism,” says Frank Field. “If most people feel that welfare is on the basis that you do have to pay in before you pay out people can be more generous to those such as refugees or people with incomplete [employment] records.”

The evidence from other countries such as Germany is that an earnings-based insurance system can consolidate public support for the broader welfare state, not least because the middle classes see what they personally get out of it. Benefits are not just for “them”.

“The truth is that a generous safety-net and good contribution-based entitlements often go hand in hand,” says Andrew Harrop of the Fabian Society.

“Countries with such robust social security were far better prepared than Britain to support people when the Covid-19 emergency arrived.”

Earnings-based and contributory insurance systems are also, arguably, less vulnerable to politicians seeking to make economies.

Either the level of basic income is too low to meet its objectives or if its high enough to meet its objectives it becomes unaffordable

“If you go to other countries and the government is trying to cut back [people say] ‘they cannot cut back that because that's a social insurance benefit and I'm entitled to it’”, explains Jochen Clasen of Edinburgh University, who studies welfare systems across Europe. “People make a distinction between getting money from the state [as to] whether it's insurance based or whether it's a means-tested, poverty alleviation type benefit. Because of the enduring relevance of social insurance, you have a stronger public support for social security in, say, France or Germany than in the UK.”

It’s certainly hard to point to our increasingly means-tested welfare infrastructure and argue that it enjoys stronger legitimacy among the public than continental-style insurance systems; nor, for that matter, that it’s any better at reducing poverty.

Earnings-related insurance, from the current UK perspective, seems regressive. What’s the moral justification for giving a barrister more than a barista when they’re out of work, or paying more to an unemployed accountant than an unemployed cleaner?

Yet try a thought experiment. What if when lockdown was imposed earlier this year millions of employees had been given flat payments of, say, £75 a week (the current rate of jobseekers’ allowance) by the state rather than 80 per cent of their existing salary (up to a cap of £625) under the Coronavirus Job Retention Scheme?

Rishi Sunak and the Treasury clearly thought flat rate payments would have been politically unacceptable, which is why they scrambled to replicate the earnings-related emergency income support mechanisms which were being rolled out across Europe.

And they were surely right in that calculation. There was no clamour for a flat rate furlough. Doesn’t that tell us something about the sentiments of the British people when it comes to the responsibility of the state to provide social insurance for its citizens?

It’s not hard to think of reasons why moving to earnings-related jobless benefits would be challenging.

European social security systems are different not only in how they calculate payouts, but in their overall institutional design. Trade unions and employers are deeply involved in the running of the German system and the central government is generally kept at arm’s length. This is partly what confers greater legitimacy – contributors have a direct sense of ownership of the scheme.

We could not move organically to that arrangement here. One way in which we do live in a Beveridgean world of welfare is that we have a centralised and statist system, which was precisely what Beveridge advocated.

The rise of self-employment and part-time work in the UK in recent years will heighten fears of the creation of a two-tier insurance system that favours privileged “insiders” in the labour market.

“[Germany’s system] is not seen as favouring those people who might be, for example, recent migrants or those people in the flexible labour market system that we have at the moment who might have zero-hours contracts or temporary employment. And often that will be women, of course,” notes Fran Bennett.

A precondition of strengthening the contributory principle might be reversing the casualisation of the labour market. Many will argue that the tide of history is running against this kind of reform. Attempts to introduce an element of earnings-related elements to national insurance in the 1970s failed. Does anyone lament the demise or the State Earnings Related Pension Scheme? Did anyone really understand it?

“If you look back, there were always periods when the contributory system was looked at in public debates and political debates in the UK,” says Clasen, pointing to serious discussions in policymaking circles in the late 1990s and as recently as 2012. “These ideas come up now and then, but they haven't really gone anywhere.”

And while surveys point to dissatisfaction with the UK welfare system, they have also tended to point to a hostility to earnings-related benefits as well.

Yet could attitudes be on the move? Could this time be different? Many thousands of people made unemployed since March have already been shocked at the meagre benefits on offer. Others have been angered by the fact that if they have £16,000 of savings they can’t access universal credit.

“I have paid taxes all my working life … I feel the state has completely broken its social contract with me,” a freelance TV producer who was refused universal credit told The Guardian last month.

The British middle classes are meeting the means test and they don’t like what they find. The UK media is increasingly noticing and highlighting the difference between the UK’s flat-rate benefits system and the earnings-related schemes in places like Sweden and Germany.

A nationally representative survey by the Find Out Now research group carried out for The Independent earlier this month found that almost 60 per cent support the proposition of moving to earnings-related benefits, with 32 per cent in agreement and 27 per cent in strong agreement.

And this may be only the beginning. We could be facing a record 4 million unemployed by the end of the year as the furlough scheme ends. How will mass unemployment shape opinions on the adequacy of our welfare system?

Paradigm shifts, social scientists tell us, tend to result from major social, economic and political shocks. Beveridge recognised that the Second World War had provided one such transformative shock and seized his opportunity. Could the coronavirus pandemic provide another? Could the hour of earnings-related unemployment benefits finally be at hand?

Ben Chu’s analysis on “The Future of Welfare” will be broadcast on BBC Radio 4 on Monday 26 October at 8.30pm

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments