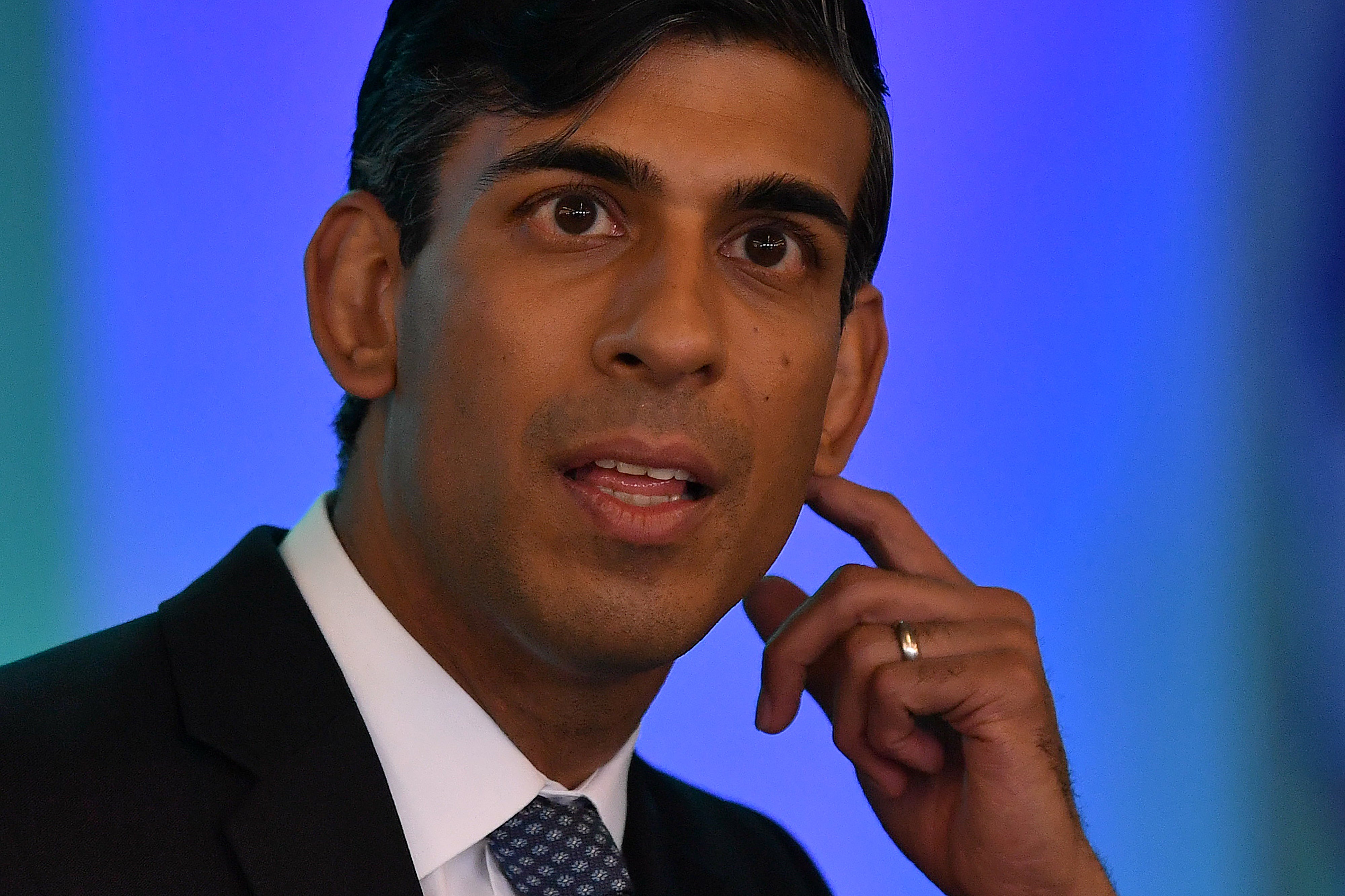

Rishi Sunak must decide how to protect jobs now – or risk losing his superstar status

Propping up workers on less hours as a result of economic disruption rather than furloughing them is now on the agenda, writes James Moore

It looks like we’re heading for the job retention scheme (JRS) 2.0 as part of a “massive package” to support jobs.

But whatever emerges from No 11 Downing Street will be a successor and absolutely not an extension, given that the chancellor, Rishi Sunak, has repeatedly ruled that out.

The problem he faces is that his job retention bonus payment for firms that keep furloughed staff on the payroll through the end of January looks woefully inadequate as a successor to the JRS, especially in the wake of the new restrictions announced to contain the second wave of Covid-19.

Sunak was reportedly part of a faction arguing against making them tougher still because of the economy. His penance is finding more cash to support it.

The smart money is now on the emergence of a scheme similar to the ones favoured by some European countries.

On the plus side, the reports I’ve been getting is that Sunak has been in listening mode, which is a welcome sign from a government that likes to give the impression it has all the answers, and they’re to be found within the giant brain of Dominic Cummings with a dash of Michael Gove.

To that end, both the TUC and the CBI have put forward variations on the preferred theme, and they both have points in their favour.

The TUC’s proposal is the more generous of the two. To qualify, workers would have to put in a minimum of just 10 per cent of their hours, for which they would be paid 100 per cent of their wages by their employer. The government would pay 70 per cent for those not worked, but a worker would be guaranteed no less than 80 per cent of their salary in total. Those on short time would also be given the opportunity to undertake training.

Its scheme would be conditional: beneficiaries would have to commit to fair wages, to suspend their dividends and to pay UK tax. The government has twitched about conditionality putting firms off from applying in the past. But there’s a good case to be made for it.

The sort of conditions suggested by the TUC would be popular with the public and would concentrate support on firms that do things the right way. There is, for example, something deeply wrong with a business utilising offshore tax havens getting support from people who pay tax here.

The CBI’s proposals are less generous, but with less conditionality too.

They call for employers to pay 100 per cent of an employee’s wages for the time they are working. For non-working, perhaps we should say furloughed, hours there would be a 1/3, 1/3, 1/3 split between employer, employee and government.

An individual would have to work a minimum of 50 per cent of their normal hours for their employer to qualify for government support, and there would be a clawback available if a subsidised role was made redundant before a certain date.

The CBI also wants employers to be able to opt to take the job retention bonus as an alternative, although they wouldn’t be allowed to make use of both.

The direction of travel at the Treasury, and the thinking that informs these proposals, is simple. They are aimed at protecting jobs that would be viable were it not for the renewed public health measures that have been announced, rather than propping up jobs set to go.

They do not, to use an unfortunate expression of Sunak’s, offer “false hope”.

I wouldn’t be surprised if whatever is announced, likely as part of a package including an extension of the various government-backed loan schemes to support firms through the pandemic, looks more like the CBI’s proposal than the TUC’s but perhaps Sunak is a secret red Tory who’ll surprise us and wow the nation like he did with the furlough scheme.

The downside with the suggestions outlined here is obviously the potential for fraud; for employers having their staff work, say, 80 per cent of their hours while still claiming for, say, half their wages.

Several billion pounds are already estimated to have been fraudulently claimed via the JRS. The Treasury really needs to ensure that HM Revenue & Customs has the resources to aggressively pursue cheats.

But while that is an understandable worry, what’s important is that Sunak comes up with something. The economy might otherwise career into a brick wall.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments