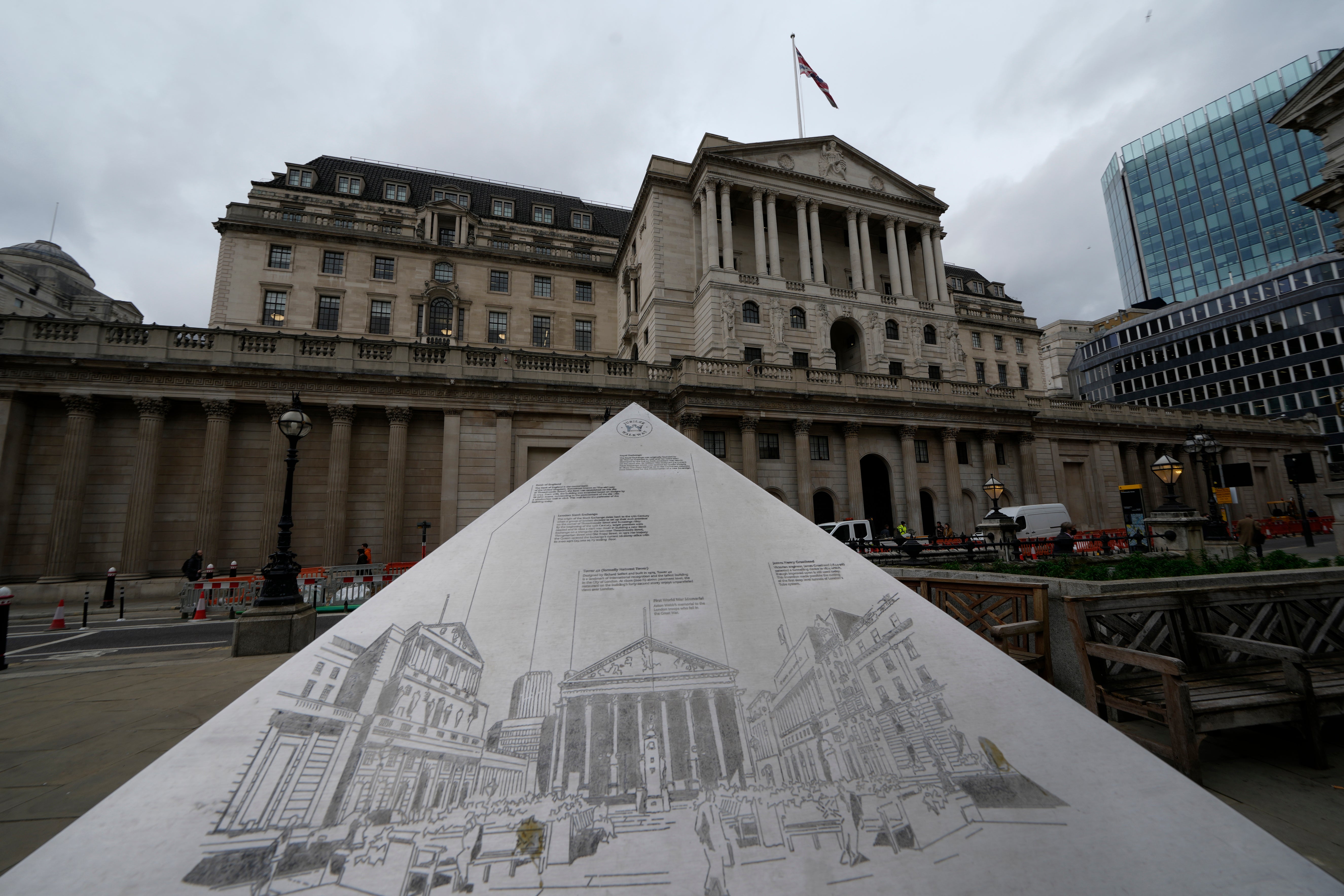

More bad news for borrowers as interest rates go up again – with worse to come

The economy is going to have to adjust to the end of the era of cheap money, which will probably prove to be quite painful, writes James Moore

It’s a good time to be a banker, at least for those towards the top of the hierarchy who qualify for fancy bonuses linked to revenues and profits.

First, the government is proposing to cut tax for banks by £1bn to promote the City’s competitiveness. Now the Bank of England has hiked interest rates to 0.5 per cent, in what is the first back-to-back rise since 2004. That’s just gravy.

The vote in favour of a 0.25 per cent increase was 5-4, when many forecasters had expected it to be unanimous. But it was, at least, in favour of a rise. The dissent arose over the size. There were four hawks on the Monetary Policy Committee (MPC) who voted in favour of boosting rates to 0.75 per cent.

That created quite the flutter in the City. In six weeks’ time we could easily be talking about three in a row. It depends on where inflation goes. Upwards, probably.

The Bank, at least for now, is sticking to its forecast of rates peaking at 1.5 per cent next year. Trouble is, those forecasts have become a moveable feast.

This is all, in theory, of benefit to the clearing banks. Higher rates mean higher margins mean higher profits. But there is a potential sting in the tail for them, too.

Bad debts seem certain to increase thanks to the impact of the cost-of-living crisis on borrowers, which this will add to in some cases.

Initially the numbers affected will probably be quite small. Only around a third of Britons have mortgages, and three-quarters of them are on fixed deals, of which around 1.5 million expire this year.

However, the deals they’ll be offered to replace them will be appreciably worse, while those currently on standard variable rates, or base rate trackers, will take an immediate hit. A typical mortgage of this type could increase by about £20 a month, or £240 a year. That is a little bit more than Rishi Sunak’s £200 energy price “rebate”, which is actually a loan because it has to be paid back.

The best of it is that the rate rise will have scant impact on the chief causes of the inflation it’s meant to keep a lid on – domestic energy prices, petrol prices and the like.

Combined with the fiscal tightening that’s coming courtesy of Boris Johnson’s national insurance rise, it will only serve to limit what economists refer to as second-order impacts. So, sustained higher prices. The room businesses have to increase them is going to be limited as a result of these measures.

Where things get interesting, and not necessarily in a good way, is that the Bank is at the same time unwinding its programme of quantitive easing (QE): the buying of government and corporate bonds to stimulate the economy.

A substantial chunk of the IOUs Rishi Sunak was forced to issue during the Covid-19 pandemic found a home in Threadneedle Street’s vaults. Now the Bank wants rid of them. The process will begin with the sale of its stock of corporate debt.

No one is quite sure what will happen when QE – in which numerous countries have engaged in one form or another – is put into reverse, which isn’t terribly surprising. It was an unprecedented move in the first place. But Stephen King-esque economists can readily cook up chillers to frighten the children at bedtime.

At the very least, the economy is going to have to adjust to the end of the era of cheap money, which will probably prove to be quite painful.

Rising margins are nice to have, but they could come at a price.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments