Carmakers and utility firms are failing on net zero, finds post-Cop26 report

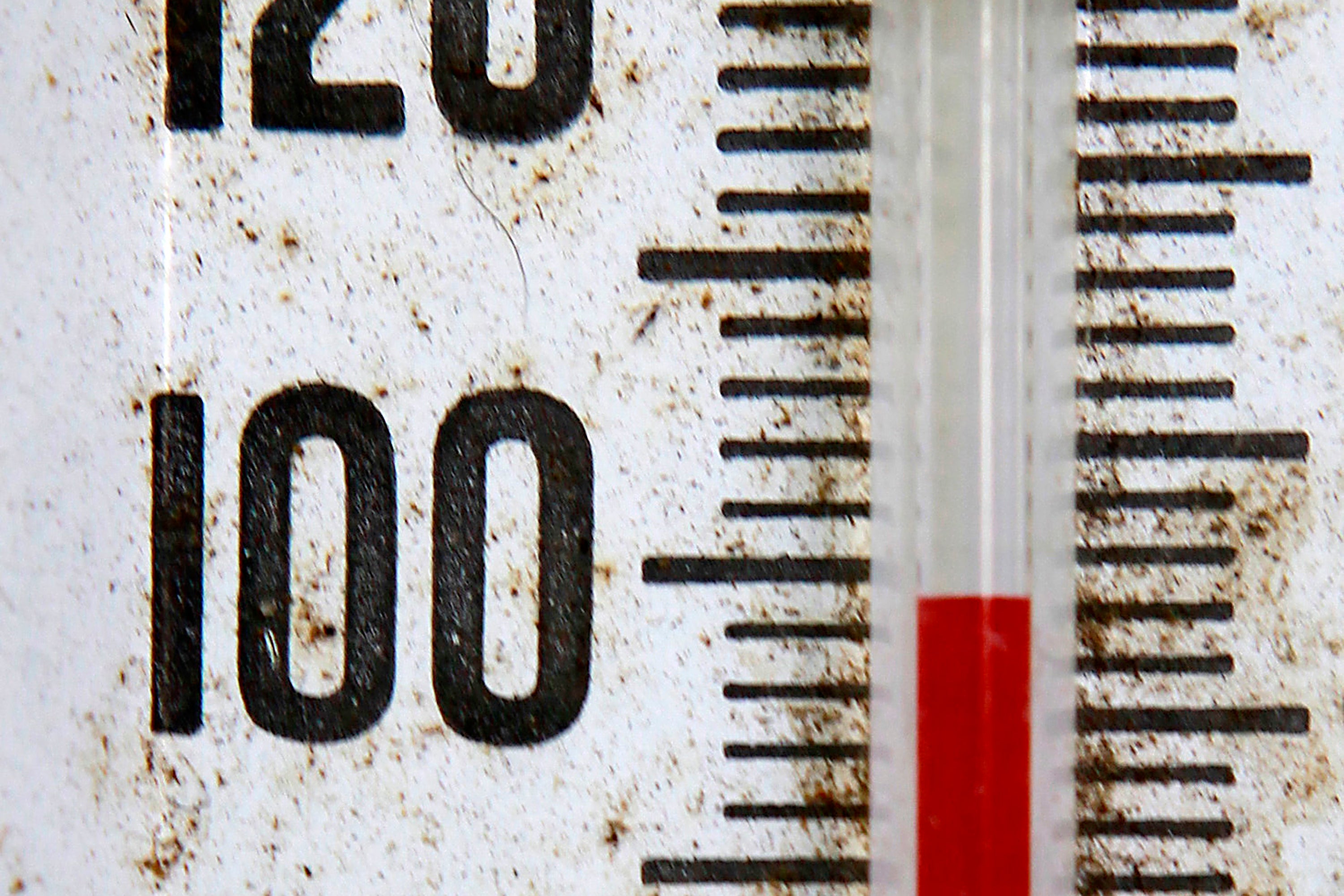

Paris aim of limiting warming to 1.5C will fail in the absence of rapid action from these companies, which have yet to wake up to the cost of inaction, writes James Moore

The obvious post-Cop26 terrace chant for world leaders? “You’re not very good, you’re not very good, you’re not very, you’re not very, you’re not very good.”

It won’t surprise you to learn that it could easily be directed at the corporate sector, with its expensively produced ESG reports that are basically a mixture of greenwashing and window dressing.

Enter the World Benchmarking Alliance, the CDP, formerly the Carbon Disclosure Project, and ADEME, the French agency for ecological transition, which have been publishing reports on how companies have been living up to all the gaudy promises about net zero and the commitments to green up that they’ve made. Or that they’ve not made.

The latest, and the first post-Cop26, covers the automotive and electric utility sectors, assessing the top 30 global companies in the former, and the top 50 in the latter. It won’t surprise you to learn that its conclusions aren’t pretty.

Both sectors continue to rely heavily on fossil fuels, with nearly all (98 per cent) of those in the utility sector and 93 per cent of those automotive sector set to exceed their notional carbon budgets.

In order to be aligned with the Paris Agreement’s target of 1.5C warming, 64 per cent or more of the vehicles sold in the automotive sector need to be low carbon by 2030. They’re currently at 7 per cent, which is, it’s true, an increase on the 2 per cent in 2015. But, really, that’s the rate of progress of a clapped out Trabant on its final journey when what’s needed is something more akin to a fancy Porsche on a German autobahn.

The report is particularly scathing when it comes to the likes of Ford, Honda, Mahindra & Mahindra, Mazda, Subaru, Suzuki and Toyota, which it says still draw less than 1 per cent of their sales from low-carbon vehicles. However, performance hasn’t been up to scratch across most of the sector.

There’s one crumb of comfort. The study does find transition plans “are becoming more detailed and ambitious”. In some cases governments are clearly helping to drive change, with promises to ban new petrol-fuelled cars being one example. The UK is targeting 2030 for that. But more work is clearly required.

The utilities are, if anything, worse. Just three out of 50 companies assessed had emissions targets that align with the 1.5C warming scenario of the International Energy Agency. Only Denmark’s Orsted was projected to stay within its carbon budget between now and 2035.

The performance of 35 of the 50 is actually expected to decline in the near term, given the sector’s reliance on fossil fuel. And coal – the most villainous of the fossil fuel industry’s parade of grotesques – was found to account for 10 per cent or more of the capacity of at least 34.

“These updated benchmarks prove once again that the world can’t only rely on private sector’s commitments to reach planetary carbon neutrality,” said Romain Poivet, from ADEME, in response.

Having spent far too much time wading through companies’ ESG reports, looking at their “net zero” plans, and assessing their claims, I can testify that that is a statement of the bleedin’ obvious.

Greater pressure from governments and civil society, as the authors advocate, is clearly required. But perhaps it requires more than that. Carbon taxes have often been discussed, but with little action. A more aggressive application of the principle of “polluter pays” would be welcome. It might encourage a more sustained effort from the companies covered.

Their investors need to play a role too. Institutional fund managers are increasingly cognisant of the economic damage global heating will inflict, and of the (severely) negative impact it will have on returns.

You can pick and choose your estimate for the cost of carbon transition, as climate deniers do when they want to argue that it’s too expensive. Trouble is, the cost of inaction will be far higher. The costly extreme weather events of recent years suggest they are just a small part of the down payment.

This explains why money managers have proved increasingly willing to exert pressure on investee companies behind the scenes, and to deploy their votes when that doesn’t work.

However, the numbers, the dismal set of grades handed out to many of the companies in these sectors, indicates a still more assertive stance from them is also required if that damage is to be averted.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments