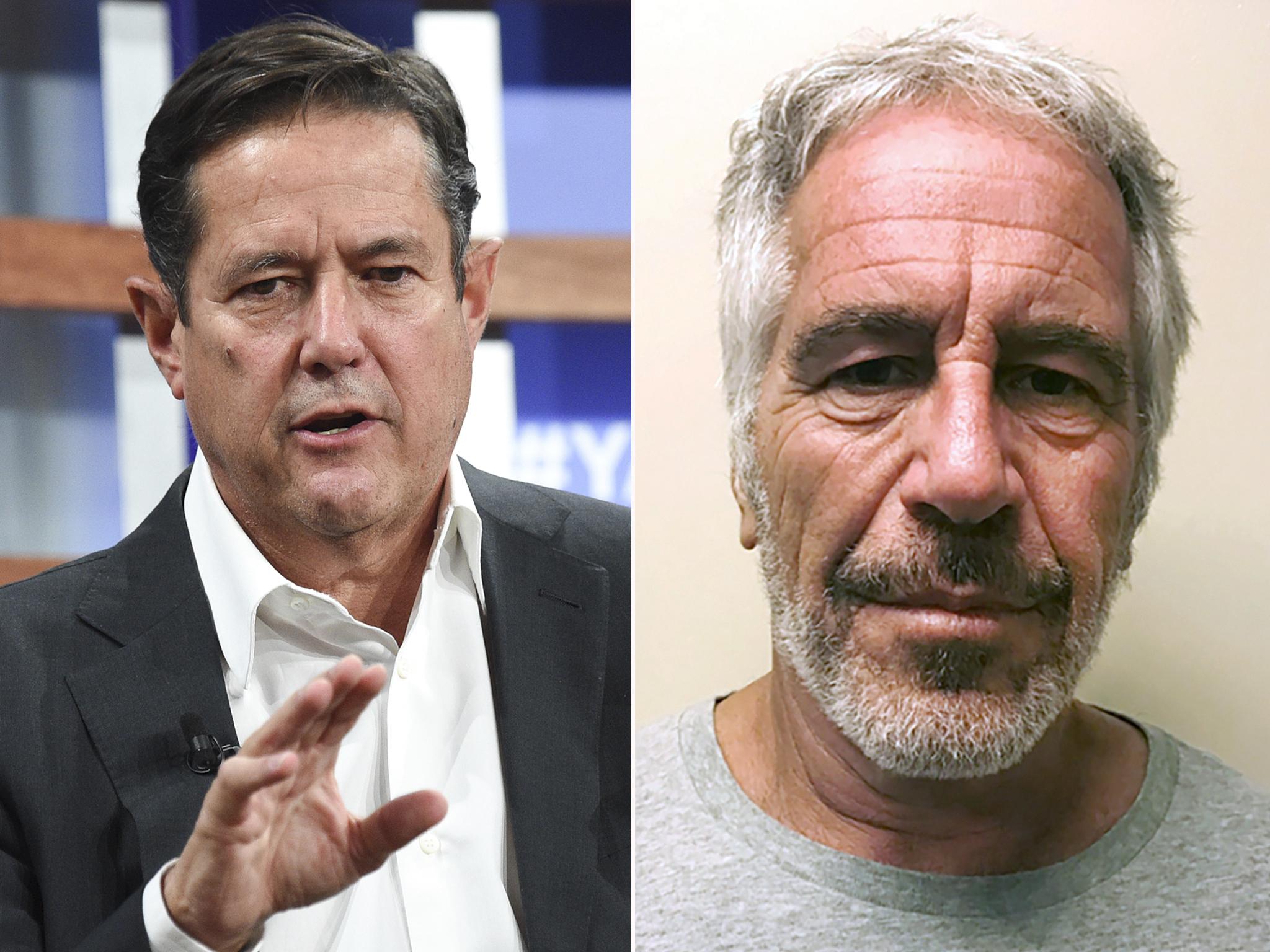

Hard questions for Barclays over Jeffrey Epstein investigation

The bank’s board decided to back CEO Jes Staley – which means their decisions are also under scrutiny, writes James Moore

Once again, Barclays CEO Jes Staley is in the crosshairs of Britain’s financial regulators, under investigation and under a dark cloud as a result of his past relationship with Jeffrey Epstein, financier, friend of Prince Andrew and Donald Trump, convicted sex offender.

News of the probe emerged alongside the bank’s generally solid set of financial results, thus ensuring no one outside of the City of London was at all interested in the numbers. It promises to stay that way potentially for months to come.

It shouldn’t surprise anyone that a former Wall Street heavy hitter like Staley knew, and had a relationship with Epstein, who had a powerful network which included some very big names. Staley used to run JP Morgan’s wealth division, handling the finances of wealthy Americans of which Epstein knew a lot of. He ended up sending dozens of high net worth clients Staley’s way. But Eptstein, as we now know, was a highly unsavoury character.

Where it gets complicated for Staley is that, per the New York Times, he visited Epstein when the former financier was serving time in Florida for soliciting prostitution as part of what today looks like the plea bargain of all plea bargains (a portion of his 13 month sentence was served at his Palm Beach office).

The issue for UK regulators – both the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are involved – is what Staley told Barclays about the relationship and what Barclays told them

The bank says that in the summer of 2019, “in light of the renewed media interest in the relationship”, Staley “volunteered and gave to certain executives and the chairman (Nigel Higgins) an explanation of his relationship with Mr Epstein”.

He also confirmed to the board that he had “no contact whatsoever with Mr Epstein at any time since taking up his role as Barclays Group CEO in December 2015”.

Having seen the media reports, the FCA, understandably enough, made an inquiry into Barclays about its chief executive and his connection with the financier. The response it got is what is the investigation is all about.

The use of the word “investigation” is important as it has a special status with the FCA. When the latter launches one, it means the case has been handed over to its enforcement division – the people who also do the fining and the banning – which has the legal power to compel interviews, and to search records and emails, and the like.

Now, it may not find anything. But this has nonetheless become a very serious issue for Barclays. Staley already has form with the regulator having been fined over an attempt to out a whistle blower who he accused to trying to smear a friend and former colleague. He paid out £1.1m in fines and lost bonuses as a result.

Purely in business terms, Staley has proven to be a reasonably effective CEO of Barclays. The shares are down since he joined, and by quite a bit, but there is a school of thought that Barclays has outperformed against what were admittedly fairly low expectations on his watch. Earnings are on the rise, so is the dividend (the shares now yield about 5 per cent).

Staley has also (to date) effectively fended off a controversial attempt by activist investor Ed Bramson to break up the bank. The direction of travel is clearer than it ever was under his predecessor Antony Jenkins, who took over after the turbulence of the Bob Diamond era.

The relative stability Staley has ushered in, given the challenges that Barclays faces, might explain the board’s willingness to back him come what may. But the word accident prone springs to mind, and that may be underestimating it. That board’s backing also means that it isn’t just Staley who will be facing hard questions if the regulators bring the hammer down again.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments