We’re at a crossroads with Amazon and its kind – and something needs to change

With the world fighting a deadly second wave of the coronavirus, many of us have little choice other than to use Amazon, but this is a big problem when you consider how little tax they pay, writes Chris Blackhurst

Did Jeff Bezos lace the world with the coronavirus?

Before the Amazon founder reaches for his lawyers: Jeff, I’m just joking.

But it would certainly make for the plot of some fantastical conspiracy movie. Consider that in March, before the pandemic took hold, shares in Bezos’s online behemoth stood at $1,689 (£1,287). As I write this, they’re $3,322.

This has happened as the world grapples to contain the spread of Covid-19 and many countries embark on further lockdowns. Non-essential stores are closed for at least a month in the UK, just at the moment when people begin their seasonal shopping – shut during the “golden” final quarter, the one that makes or breaks their year.

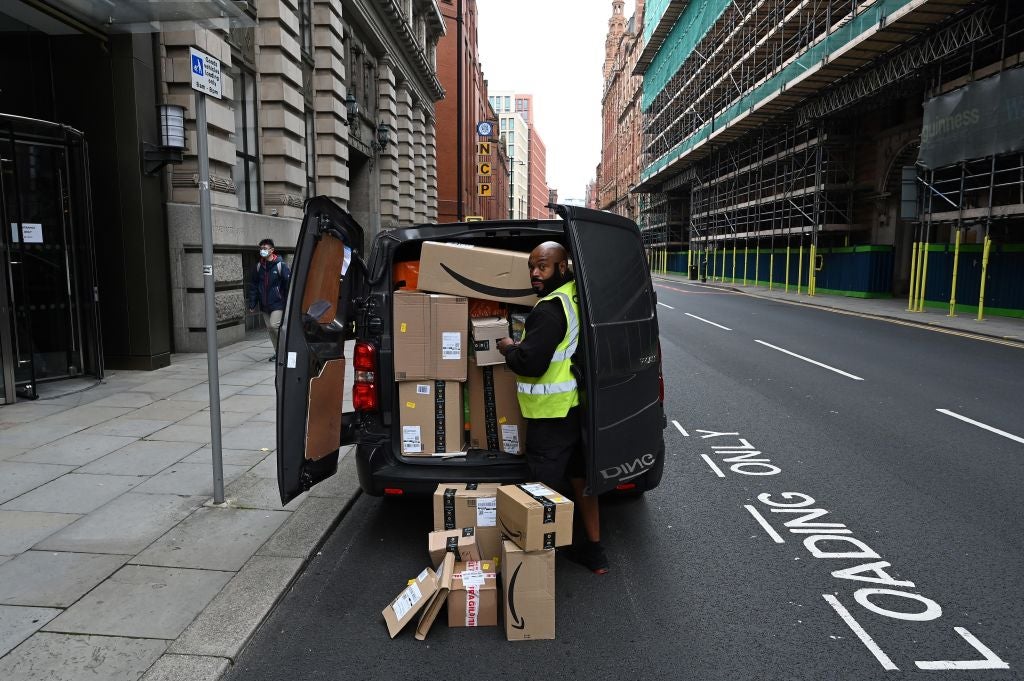

On our local high street, most of the premises are locked, some are empty and boarded up, their owners having given up for good. Meanwhile, delivery vans block the residential roads, many of them handing over those now-ubiquitous brown boxes with the familiar Amazon arrow on the side.

It’s a battle that was unequal before, and is even more so now because of the insistence that the digital giant’s bricks-and-mortar rivals – basically those that do not sell food, groceries or medicine – must stop trading. Every day that goes by, Amazon and its tech rivals, but especially Amazon, are racking up staggering sums. Make that every minute, or every second in which Amazon’s customers are spending $11,000 on its wares and services.

Bezos, who was the world’s richest person before the onset of the coronavirus, is now lapping the field. His fortune is $191bn and rising. The company he founded in 1994 in his garage is worth more than $1.6 trillion, up 75 per cent this year, and he still owns 10 per cent of the stock.

So far in 2020, Bezos’s wealth has climbed $76.1bn. Last Wednesday, while we were bracing ourselves for lockdown 2.0, Bezos’s fortune jumped by another $10.5bn.

With the coronavirus restrictions, our attitude to Amazon has changed. It was shifting before, but now it has accelerated.

The platform is no longer a place where you browse and buy, clicking on a book or a piece of sports equipment. It’s become an essential provider, a utility – relied upon to supply pretty much everything, and quickly. With our virtual inability to go elsewhere, psychologically we would be be lost without Bezos’s titan of logistics and distribution.

There must be an estimate within the Treasury as to how many businesses will disappear, and how many jobs will be lost, because of the surge in online sales led by Bezos’s colossus

Thanks to its complex offshore billing structure, Amazon paid 2.1 per cent in tax last year on UK sales of £13.7bn. The response from Amazon is that the company pays all the UK tax it is required to pay.

It’s a claim I’ve heard many times before – usually from individuals who, having built successful businesses in the UK, choose to base themselves in Monaco or some such tax haven to minimise their dues. It does not wash – from them, or from an Amazon that is flooding our land and which we effectively have little choice other than to use.

Tax exiles and Amazon like to point to the taxes their employees pay – as if the staff have a choice – and how their organisations meet any other levies they’re required to pay, like business rates. What they never reveal is the calculation they’ve made, the bill they would otherwise face but for the fact they’ve gone to convoluted lengths to avoid it. They fulfil all their obligations, they say, so where is the problem?

Just as successive governments have failed shamefully to do anything meaningful about tax avoidance by individuals, so too have they allowed Amazon to sweep all before it and put so little back. The problem with the tech sales giants – and Amazon is not alone, it just happens to be the most egregious – is that they’re destroying other businesses, other employers, other full payers of taxes.

When Amazon is finished, what will be left? As with the sum for how much tax Amazon would otherwise pay, so there must be an estimate within the Treasury as to how many businesses will disappear, and how many jobs will be lost, because of the surge in online sales led by Bezos’s colossus. If there isn’t, then there urgently should be.

We’re at a crossroads with Amazon and its kind. The new UK digital services tax of 2 per cent is not going to solve anything. Not only is it paltry but Amazon will not even pay the charge on goods it sells directly to consumers, while those small traders who sell products via Amazon will be hit. That’s because it’s not a sales tax but a services tax – Amazon will pass the 2 per cent on to the third-party sellers for using its site. Amazon, meanwhile, will not have to pay the tax on items it sells itself.

Bezos is laughing for another reason: where Amazon and the smaller retailers sell the same goods using Amazon, his company is enjoying a 2 per cent price advantage over them. Brilliant. The government, far from hurting Amazon, is actually assisting it.

Something needs to change. We have to decide what we want: some semblance of a non-essential retail sector or one that is consigned to memory, and if it’s the latter, how we’re going to replace all those jobs.

In the meantime, there’s someone at the front door. Another parcel has arrived.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments