Home repossession hotspots revealed

Two new reports reveal England's worst-hit regions

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

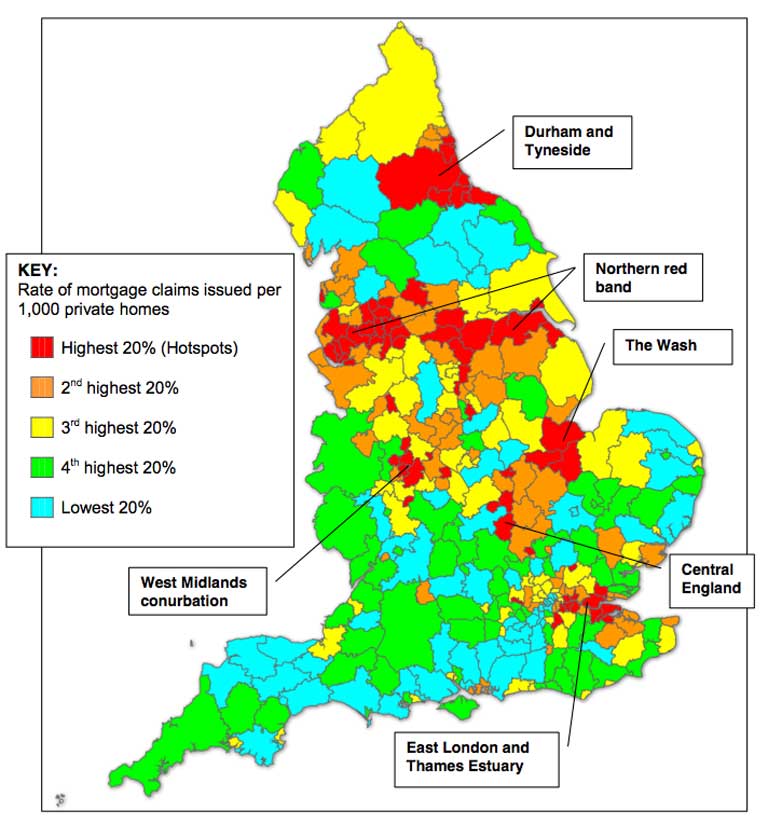

Your support makes all the difference.The results of housing charity Shelter's analysis reveal clusters of hotspots including a band stretching over the north of England from Merseyside to Humberside in the east, with a spike extending south into Derbyshire.

Barking and Dagenham emerged as England's top hotspot, closely followed by Knowsley in the north west, and Thurrock in the east. Lewisham in south London and Rossendale, also in the north west, were fourth and fifth.

The map also shows hotspots in the north east around Durham and Tyneside, a group around Birmingham in the West Midlands, and in central England combining Northampton, Wellingborough and Milton Keynes. East London and the Thames Estuary also had hotspot clusters including Croydon and Newham, reaching east into Basildon.

Repossession risk also varied widely across the country, with Barking and Dagenham more than twice as high as the national average, and almost eight times as high as that in West Dorset. The divide is also noted in a second report by Quickmovenow.com which shows that around 70% of repossession enquiries come from the north.

"Just six towns and cities supplied a quarter of all purchase requests due to repossession, all of which are situated in the north," said the organisation's market analyst Donna Houguez. "There is a clear cluster of a high proportion of repossessions in a band of the northern counties of Durham, Lancashire, Cheshire, Cumbria and Yorkshire. Perhaps more surprisingly though, there are two pockets with a very high concentration in the south – in the south-west, Devon and Cornwall and in the south-east, Cambridge, Essex and Kent."

Shelter's research also uncovered a strong link between rising unemployment and repossession, with unemployment in hotspot areas rising at a much greater rate than areas with the lowest risk.

Most people think that repossession will never happen to them, but rising unemployment, rising living costs and high house prices mean that many people are living close to the edge already, and risk falling into a spiral of debt and repossession," said Chief Executive of Shelter, Campbell Robb. "The journey from being a homeowner to becoming homeless is frighteningly swift, with just one small thing like a wage cut, a health problem or a job loss meaning that a family can no longer meet their mortgage payments.

“When repossession happens, the impact on families is devastating – research shows people think repossession is worse than having to fight a child custody battle.”

Top repossession risk hotspots:

1. Barking and Dagenham

2. Knowsley

3. Thurrock

4. Lewisham

5. Rossendale

6. Rochdale

7. Blackpool and Darwen UA

8. Burnley

9. Newham

10. Luton

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments