Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

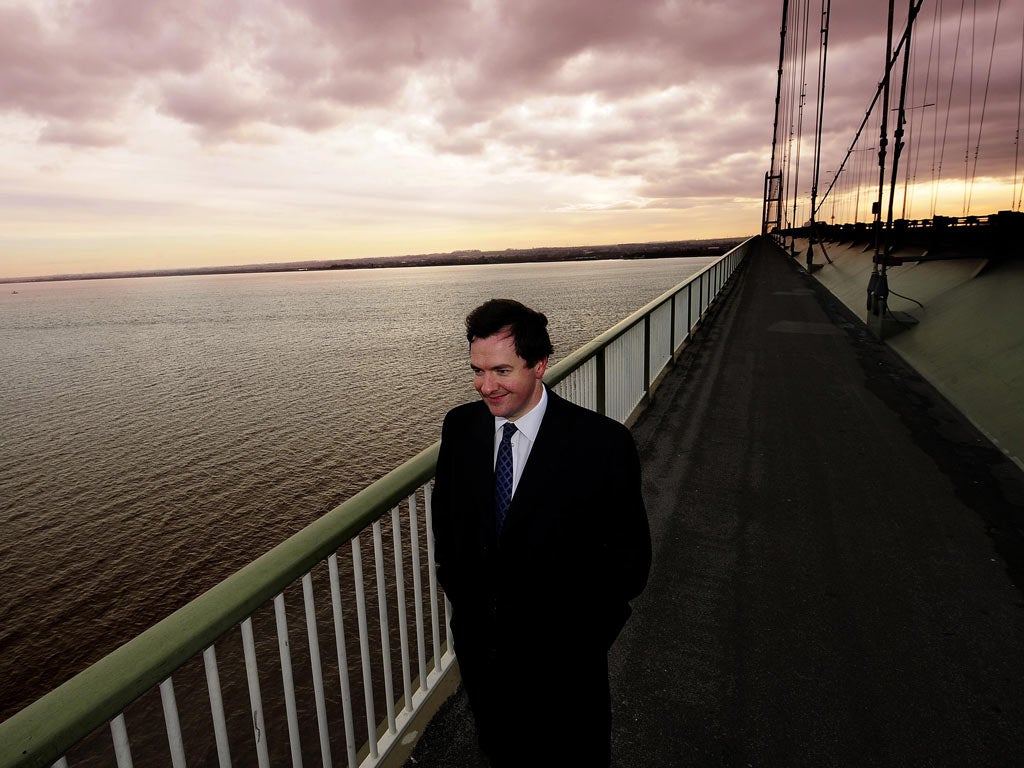

Your support makes all the difference.The full scale of big banks' lobbying of the Chancellor George Osborne to get him to water down banking reforms can be revealed today: senior bank executives met or called Treasury ministers nine times in the weeks after Sir John Vickers published his landmark proposals on how to prevent another banking crisis.

In addition, Mr Osborne personally met with the Barclays boss Bob Diamond, the Royal Bank of Scotland's Stephen Hester and Lloyds' Antonio Horta-Osorio on separate occasions.

Bank bosses are fighting furiously behind the scenes to limit any changes to the way they handle money. Fears are growing – articulated by Sir John himself – that the banks are successfully nobbling the Government's plans to overhaul the British banking system, and that the Treasury is weakening some of the key reforms as a result of the lobbying.

The Chancellor will announce his official response to the Vickers Independent Commission on Banking proposals on Monday – certain to be scrutinised for any sign that the Government's resolve to tackle the hostile sector has been weakened.

The Commission recommended that banks should be required to "ring fence" their high-street banking operations away from their "casino" investment operations; and to increase their capital buffers in order to reduce the chances of British taxpayers being forced to rescue them in future.

There have been reports that the Treasury is preparing to water down key elements.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments