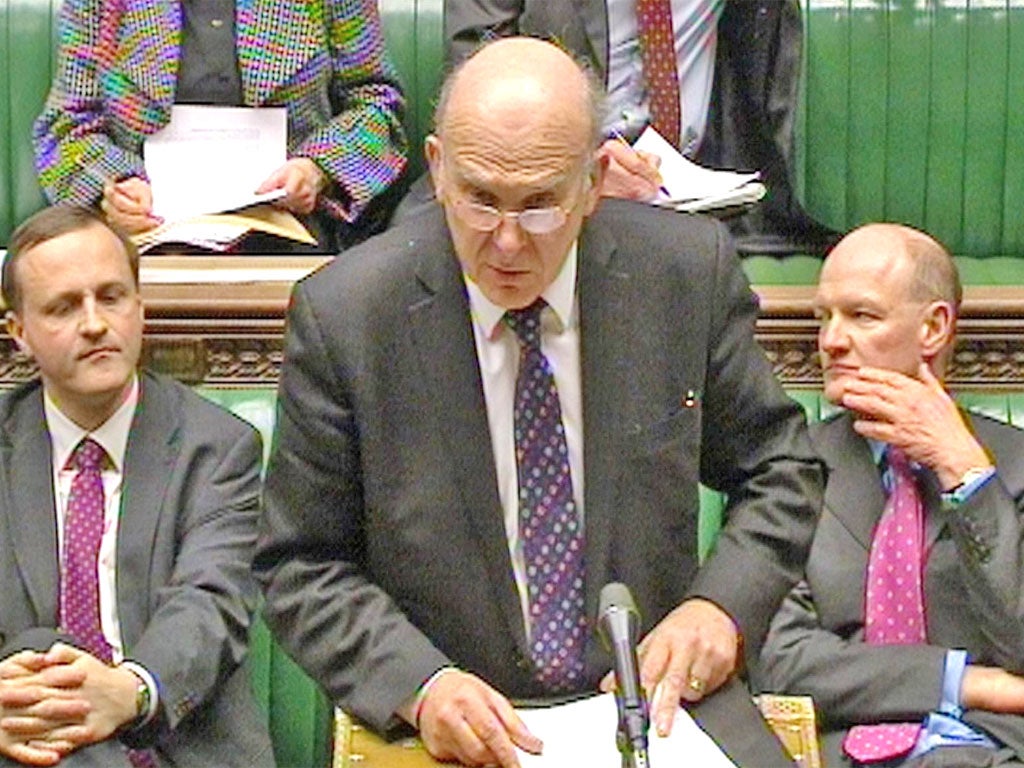

Cable vows to boost shareholders' power to curb pay

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Vince Cable pledged to replace "rewards for failure" with "rewards for success" as he outlined plans to boost the power of shareholders to curb excessive executive pay.

The Liberal Democrat Business Secretary argued he had got the balance right after Labour accused him of not going far enough and some Tory MPs warned he would stall growth.

Following objections from David Cameron and George Osborne, Mr Cable said he would not force companies to give employees a seat on remuneration committees and publish the pay ratio between their highest earner and the median wage in the firm. He admitted there was "no silver bullet" but insisted his reforms added up to a "major transformation" that would tackle the "disconnect between top pay and company performance". The Business Secretary had intended to announce his package in a speech today but was forced to make a rushed Commons statement yesterday after the Speaker, John Bercow, backed a Labour complaint that MPs should be told first. Mr Cable dodged questions about whether bosses at the state-owned Royal Bank of Scotland should receive bonuses despite a fall in its share price. The RBS board meets tomorrow to consider whether Stephen Hester, its chief executive, should receive a bonus of up to £1.5m and John Hourican, head of its investment unit, a reward of £4.4m under a package agreed in 2009.

Putting the ball into Mr Cameron's court, Mr Cable said the decision was "above my pay grade".

His boardroom reform plans include:

* shareholders' votes on pay packages to be binding rather than advisory;

* clearer remuneration reports on executive pay separating what happened in the past year and future policy;

* companies to publish a single pay figure for each executive;

* clawback clauses in executives' contracts at all large companies;

* shareholders to vote on pay-offs worth more than one-year's salary.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments