Big Question: Should Britain now consider joining the European single currency?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Why are we asking this now?

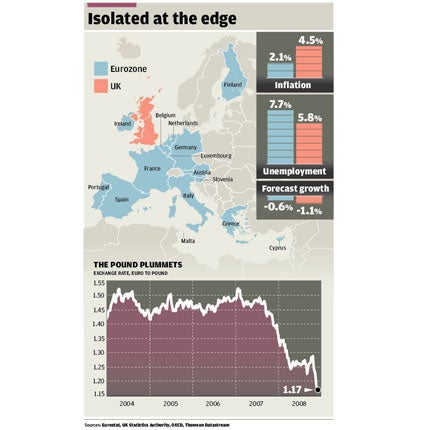

Some influential people in the higher echelons of government have been talking about it to the European Commission, apparently. The pound is now plummeting – again – and there are some fairly obvious signs that we do not seem to be able to run our economy very well. If our banking system needs to be nationalised completely, that might even bankrupt the nation. So the euro suddenly looks like a good idea, if it helps us get through this crisis.

Aren't the European economies in big trouble too?

Yes, but not as much as we are, and their financial problems are probably significantly smaller. The IMF places UK growth next year lower than Germany, France, Italy or any other major industrialised economy. The eurozone states have two things going for them, broadly speaking. First, their banks are in slightly better order than ours, arguably. If European banks do turn out to be as badly run as ours, and some have been, their banks are smaller in relation to the size of their economy than the British ones, and thus the task of stabilising them is much cheaper and much easier.

Just how much trouble has the banking crisis caused Britain?

The cost of rescuing the UK's banking system completely would leave the national debt at levels higher than were seen during the Second World War: it would effectively bankrupt Britain. Even as things stand, the levels of public debt now being planned will place a considerable burden on taxpayers for decades to come, with depressing effects on growth and living standards. That may be inevitable, and the price we must pay for our 16-year-long boom, but lower (relative) growth in the UK compared to Europe will once again become a fact of economic life, as it was for much of the 1960s and 1970s, creating investable envy. At that time our comparative weakness propelled us, often unwillingly, towards membership of the European Community which was seen as the answer to our economic problems. The same logic may push us into the single currency.

So joining the euro might help our economy?

The resources available to the British Government are dwindling by the week compared to the challenges we face. Because many European nations, notably Germany, have run their public finances more prudently than the UK they now have more room for manoeuvre for bank rescues and general reflation than we do. It would be crude to say that by joining the euro we could get the Germans to pay for our financial mistakes, but not so very far away from the truth – though Berlin might not relish that invitation.

Aren't there better reasons for joining the euro?

Of course. All the old reasons remain. It would make trade and travel far easier, reduce transactions costs and the need to "hedge" currencies. Inward investment to the UK might well get a boost as we join the world's largest single currency zone; "exchange rate risk" is one thing that industrialists and financiers can do without right now, and joining the euro abolishes it overnight. Cross-border competition would increase as prices would be far easier to compare. In the very long term our economy would also converge with the eurozone, so the undoubted costs of adjusting to the euro will eventually pass, while the benefits will be permanent. Put simply, we'd be better off in the eurozone in good times and bad.

Can we manage outside the euro?Probably, as we have before now. Britain has seen many economic crises before, and no one ever suggested that abolishing the pound would solve anything. The fundamentals of this recession remain, and it might be more honest, and less politically comprising if we continued to simply borrow our way out of trouble, even if that might eventually mean crawling to the IMF, or indeed our dour European partners for assistance. Even Iceland hasn't had to join the euro.

What could go wrong?

There are potential downsides to joining the euro. The most powerful is the economic point that we might end up with the wrong level of interest rates for the state of the British economy. While it may be that the current level of European rates, or one a bit lower, would be perfectly fine for us now, that might not always hold in the future. That assumes, of course, that the UK has had a place at the European Central Bank (ECB) table to put that case successfully. The "one size fits all" philosophy of the ECB is not going to change, and Europe's largest economy, Germany, inevitably has a preponderant influence on what that level of rates will be. There again, the Bank of England sets rates that might be better suited to Guildford than Glasgow, or vice versa, and no one suggests that they should start their own currencies. In reality, the main constraint is that the structural difference between the UK and the eurozone economies remains surprisingly large after 35 years of British membership of the EU and 15 years of the single market. There would be inevitable discomfort; how much is the real question.

Will the euro survive this diplomatic difficulty?

Almost certainly. However, there are some new tensions building up. The recent chaos as governments tried to help savers in their own countries, with no regard to the rest of the EU, was an object lesson in the dangers of member states going it alone, and made Europe look silly. More recent initiatives, such as the EU Commission's plan for coordinated fiscal stimulus packages, have been more coherent. But those boosts to public spending and tax cuts have created a new problem: the "Maastricht Criteria" were designed to stop individual nations running huge budget deficits and undermining the currency. For most of the past decade the rules were obeyed. Now, however, some nations are so desperate to rescue their economies, they are simply ignoring them.

What if the euro reached £1 in value?

It would certainly be much more convenient to convert at "parity". Sterling would be competitively priced, so exporters could take advantage of that. A euro is worth about 85p now, so it may not be long.

Could the euro nations say "non" to Britain again?

Yes. Just like General de Gaulle way back in 1963. One very big problem could be the UK's budget deficit. We've already been told off about this by the EU Commission, because we were running a budget deficit above the Maastricht Treaty's 3 per cent limit even in the good times. The fact that the deficit will hit 8 per cent of GDP, or more, over the next few years makes it still more difficult for the UK to join the eurozone on the existing rules. Indeed, many EU governments might be secretly grateful for an excuse to turn down the profligate British and their busted banks.

Is the euro the best solution for Britain's ailing economy?

Yes

*Our economy will soon be totally bankrupt; we need help from our European partners.

*We will be more prosperous because of the extra investment, trade and jobs the euro will bring.

*The pound may be the most high-profile victim of the credit crunch and recession; the euro is strong.

No

*It gives foreign governments too much power over our economy. The EU has far too little transparency.

*They wouldn't let us join anyway because we borrow too much.

*Once we're in at some point we'll end up with the wrong interest rates again, but unlike the ERM fiasco – there will be no escape.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments