Two-thirds of UK voters support tax rises for action on climate change

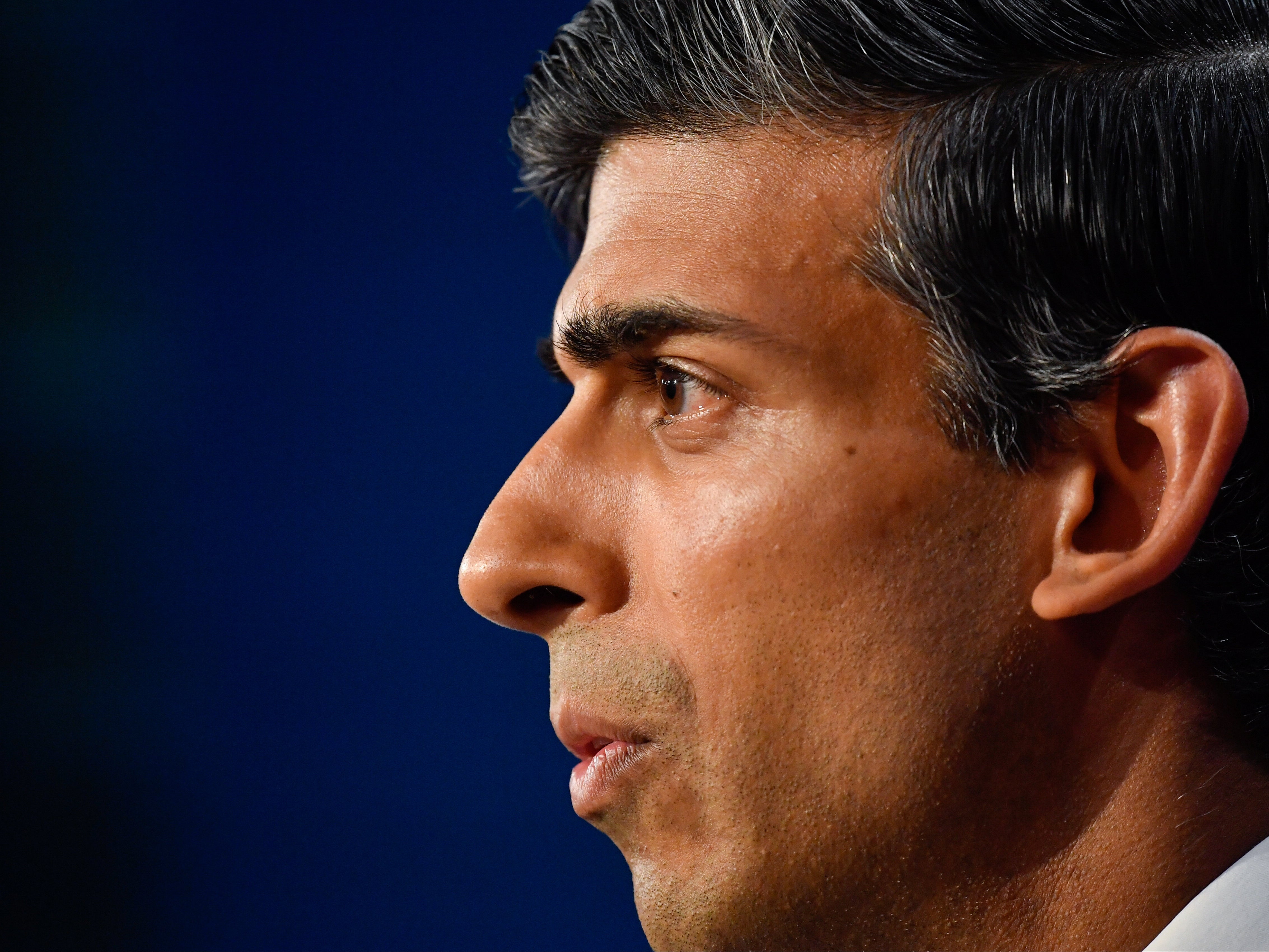

Exclusive: Poll shows widespread support for green spreading ahead of Rishi Sunak’s Budget

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Two in three voters in the UK support tax rises to pay for measures to mitigate the climate crisis, exclusive new polling for The Independent has found.

Chancellor Rishi Sunak is under pressure to avoid tax hikes from Conservative MPs sceptical of the government’s net zero plans as he prepares to deliver his Budget on Wednesday.

But the idea of raising taxes to deal with the climate emergency has widespread support from the British public, a survey by Savanta ComRes has revealed.

Some 67 per cent of voters said tax rises at the Budget would be “acceptable” if revenue was spent on action to reduce the impact of climate change. Only 22 per cent said they found the idea “unacceptable”.

It comes as Liberal Democrat leader Sir Ed Davey called for a windfall tax on gas producers to help pay for the transition to a green economy and provide more support for families struggling with fuel bills.

“Fossil fuel companies are raking it in hand over fist through this gas crisis. The least they can do is pay a little more in tax to help struggling families get through the winter,” Sir Ed told The Independent – estimating a windfall tax could raise up to £10bn.

He added: “This windfall tax would raise vital funding to insulate people’s homes, slash energy bills and protect skilled jobs. If Rishi Sunak is serious about tackling both the climate emergency and the cost of living crisis, he would introduce this one-off tax.”

Boris Johnson claimed Britain could meet its target of net zero emissions by 2050 “without so much as a hair shirt in sight” as he revealed the government’s net zero strategy earlier this week.

But a separate Treasury report warned that the country faces new taxes or cuts to public spending to pay for the transition to net zero.

Income from fuel duty and vehicle excise duty will all but disappear as the UK goes green, Mr Sunak’s department conceded – blowing a £37bn black hole in its budget unless “new sources” of revenue are found.

Kate Blagojevic, head of climate at Greenpeace UK, said the Savanta ComRes poll for The Independent showed that the government “now has a clear public mandate to fix our tax system in order the help cut emissions”.

She added: “Our current tax system isn’t fit for delivering action on the climate emergency. It gives very mixed signals on green growth, innovation and, in the case of energy levies, keeps us hooked on climate-wrecking gas ... Voters clearly understand this and want change.”

Greenpeace has calculated that an extra £73bn of public investment is needed over the next three years in the push for energy-efficient homes and clean transport. But the campaign group said the extra investment would help create up to 1.8 million jobs.

Ahead of the next week’s Budget, the campaign group called for Mr Sunak to impose green levies on gas and scrap VAT on green goods such as heat pumps and solar panels.

Currently, green levies are imposed on electricity bills but not gas, which is a more polluting form of energy. The government is thought to be considering moving the surcharges from electricity to gas.

Chris Hopkins, associate director at Savanta ComRes, said voters may support spending on action to tackle climate change in principle, but still need to know how exactly the extra money will be raised.

“The public will often tell us they are favour of tax rises to pay for noble causes, but when it comes to paying more tax themselves, support usually wanes,” he said. “The big question for the government, and the opposition calling for it, is what should be taxed more to pay for this?”

Labour has said it would spend an extra £28bn each year on helping Britain tackle the climate crisis, saying the money would come from government borrowing.

Conservative MP David Davis said fellow backbench Tories are “sick of tax hikes and green spending”. He claimed: “The government’s hell for leather pursuit of net zero carbon emissions by 2050 threatens a huge drop in living standards for our children and grandchildren.”

Meanwhile, the Savanta ComRes survey also found high levels of support for tax rises to boost spending on the NHS and social care, raising the minimum wage and investment to “level up” disadvantaged parts of the country.

Some 76 per cent of voters are willing to see taxes increase if means more money for the health and social care sector. Some 75 per cent will accept tax hikes for action on low pay, while 65 per cent back higher taxes if money goes to disadvantaged areas.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments