Bank of England interest rates announcement: everything you need to know

Expectations on financial markets show about a 65 percent chance of the Bank of England’s policymakers opting to reduce rates today

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England could be encouraged to cut interest rates for the first time in more than four years amid growing evidence that inflation has been tamed, experts have said.

Expectations on financial markets show about a 65 percent chance of the Bank’s policymakers opting to reduce rates on Thursday.

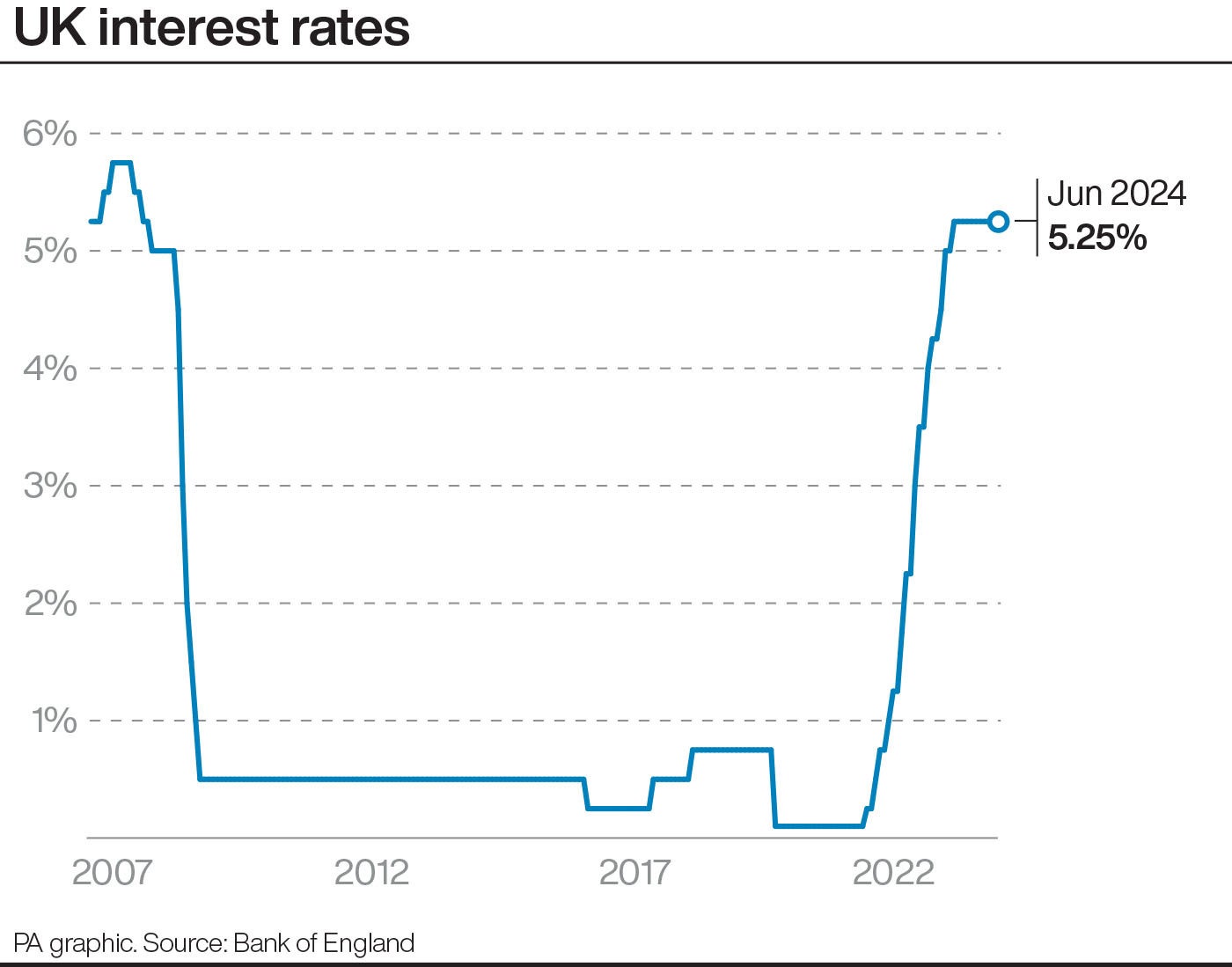

The UK’s base rate has been held at 5.25 percent since August last year, the highest level since 2008.

Some experts think it could be cut to five percent, which would be the first time UK rates have been reduced since the onset of the Covid-19 pandemic in March 2020.

It comes after new economic data suggested the UK’s cost-of-living crisis has eased in recent months thanks to inflation coming off the boil.

Consumer Prices Index (CPI) inflation hit two percent in May and June, which is the central bank’s target level, indicating that price rises have been brought under control.

Economists stressed that other key indicators of inflationary pressure – mainly services inflation and wage rises – have remained a concern for policymakers.

James Smith, developed market economist for ING, said it will be a “close call” but he expects a majority of policymakers to vote in favour of a 0.25 percentage point rate cut on Thursday.

What are interest rates?

An interest rate dictates how high the cost of borrowing is, or how much can be added on to savings. It sets the amount you are charged for borrowing money, or the reward you can get for keeping money in savings.

The ‘Bank Rate’ is the key interest rate in the UK, and it is set by the Bank of England. It has been fixed at 5.25 percent since August last year, the highest level in 16 years. The Bank Rate did not rise above one percent from 2009 to 2021.

When interest rates rise, borrowing generally becomes more expensive. This could affect you if are looking to secure a mortgage to buy a house or buy something on credit, such as a new car.

If repayments are not set at a fixed rate, they will increase as interest rates rise. Many homeowners have struggled in recent years as limited-time fixed rate deals have come to an end, meaning they have had to pay much higher rates due to the current record interest rate.

The Bank says interest rates are set high to curb high inflation, which causes high prices. Inflation has reached record levels over the past few years, but has now levelled off to the Bank’s two percent target for the last two months.