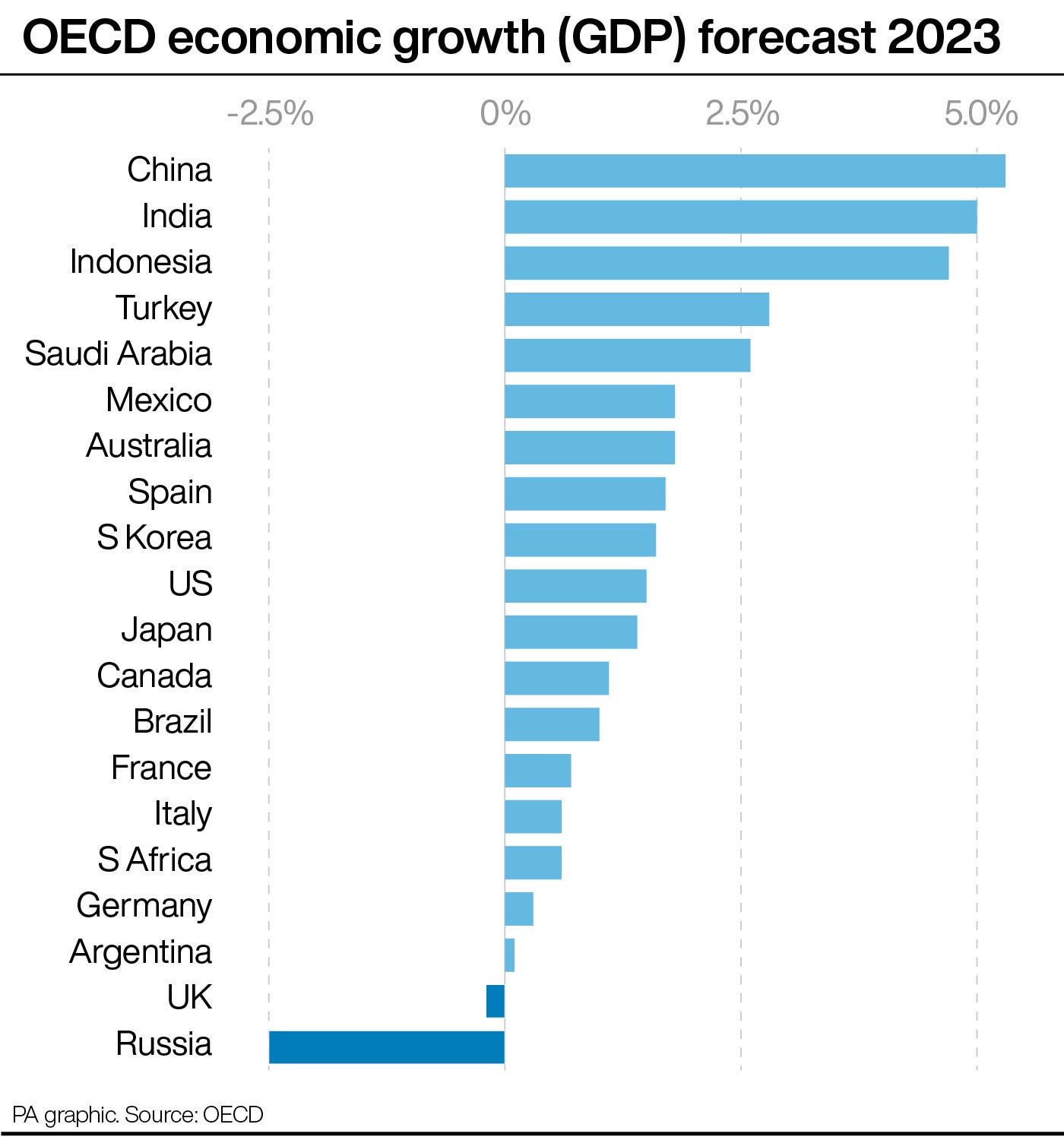

Blow for UK as experts predict economy will be the second-worst in G20

warned on Friday as it also urged central banks to keep interest rates high to tackle persistent inflation.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain’s economy is expected to perform the worst of any G20 nations apart from Russia both this year and next, the OECD warned on Friday as it also urged central banks to keep interest rates high to tackle persistent inflation.

It expects a 0.2 per cent fall in UK gross domestic product this year, followed by a rise of 0.9 per cent next year.

It means that the UK is the only country apart from Russia – which is subject to serious sanctions – to see its economy shrink this year. In 2024 the slight growth in the UK will be on par with South Africa and the United States.

The forecast takes the shine off the chancellor’s Budget optimism, in which he said Britain would avoid a technical recession.

Jeremy Hunt said: “The British economy has proven more resilient than many expected, outperforming many forecasts to be the fastest growing economy in the G7 last year, and is on track to avoid recession.

“Earlier this week I set out a plan to grow the economy by unleashing business investment and helping more people into work, alongside extending our significant energy bill support to help with rising prices, made possible by our windfall tax on energy profits.”

Despite not addressing the new figures, Mr Hunt won some support from OECD secretary general Mathias Cormann.

He said: “We believe the measures that the government is taking to address these issues are going to be very important to improve the economic outlook for the United Kingdom moving forward, but there are some particular challenges that are playing out at the moment.”

The OECD said that it expects global GDP to grow by 2.6 per cent this year and 2.9 per cent in 2024. The biggest gains will be made in China – up 5.3 per cent this year – and India – up 5 per cent.

We believe the measures that the Government is taking to address these issues are going to be very important to improve the economic outlook for the United Kingdom moving forward, but there are some particular challenges that are playing out at the moment

Mr Cormann said that he did not think that recent bank failures in the US and the struggles of Credit Suisse were spread much more widely.

“So far, we really do believe that the regulatory environment globally has improved very significantly since the global financial crisis.

“There is of course increased financial stability risk with the level of financial turbulence – markets are jittery. We do believe that the risks of this spreading more widely are quite contained at this stage.”

The OECD’s wider growth forecast is the first increase since Russia’s invasion of Ukraine, it but said global inflation remains too high.

Chief economist Alvaro Pereira said central banks should keep tackling inflation through interest rates, despite worries about the impact on the banking system.

“We still think that, knowing what we know today, the priority has to be fighting inflation,” he said in an interview. “This isn’t 2008. We don’t see systemic risk at this stage.”