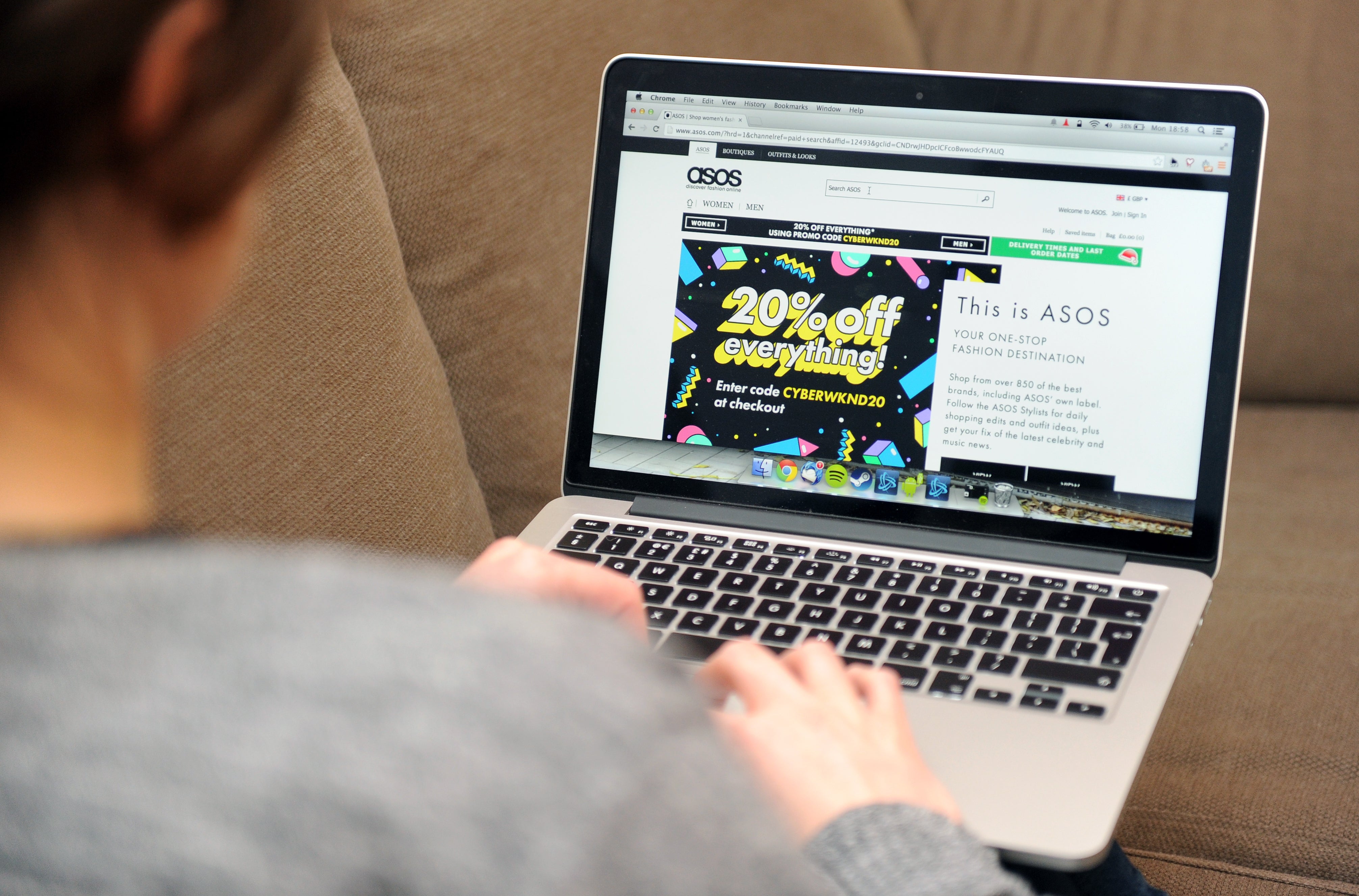

Supply issues to last into new year, Asos says as boss steps down

Nick Beighton is stepping aside after six years in charge of the online fashion retailer.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Asos has said it expects pressures from its supply chains to continue at least until February, and announced the immediate departure of its chief executive.

The online fashion retailer said Nick Beighton is stepping down from the role he has held for six years, before the company has found a successor.

Ian Dyson, the group’s new chairman, said Mr Beighton didn’t feel his “heart was in it” for another significant period in the role.

“Nick felt that he had to commit to another six years or so for our next strategy and that wasn’t something he could commit to,” he said.

He will be available until the end of the year if the board needs his advice, but day-to-day running of the business will be handed to current finance boss Mat Dunn.

Mr Dyson, a veteran of Marks & Spencer and Punch Taverns will take over as chairman from Adam Crozier who is stepping down to join BT Group.

The new leadership will have to contend with problems across global supply chains, which the company believes will last throughout the first half of its financial year, which ends in late February.

The problems have hit millions of businesses around the world. For Asos they have meant that supplies of some of the brands it sells online have dried up, and shipping costs have risen.

Mr Dunn told the PA news agency the company expects particular “supply constraints” in the peak Christmas trading period.

“There are a litany of supply challenges but the main issue for us is how we get items from around the globe to customers when there is disruption to shipping and air freight,” he said.

“We are working with the space available and everyone has the same issue – it isn’t just fashion, we are against everyone trying to get their products delivered.”

He added that Asos also expects the price of its products to increase in line with broader inflation across the retail market, as it deals with soaring costs.

The company said its pre-tax profit will be a lot lower in the 2022 financial year than in its most recent year, which ended in August.

On an adjusted basis, pre-tax profit is expected to fall from £193.6 million to somewhere between £110 million and £140 million.

Asos said there are several reasons for this. Last year’s figure included what it called a “Covid-19 benefit” of £67.3 million because fewer clothes were being returned by customers.

Leisurewear, which proved popular during the pandemic, is less likely to be returned than more formal clothes.

Returns are already normalising, so this benefit is expected to disappear, Asos said.

In fact, it said, the 1.4 million new customers it attracted in the last year and others throughout the pandemic are more likely to send clothes back.

Today we are setting out details of our ambitious plan to significantly increase Asos’s sales and profitability, becoming a £7 billion business within three to four years

Meanwhile, it is also facing headwinds from the cost of freight, Brexit duties, delivery costs and increasing salaries.

Without adjustments, pre-tax profit had risen 25% to £177.1 million in the 12 months to the end of August. Revenue grew by a fifth to £3.9 billion.

The number of active customers increased 13% to 26.4 million.

Mr Dunn said: “While our performance in the next 12 months is likely to be constrained by demand volatility and global supply chain and cost pressures, we are confident in our ability to capture the sizeable opportunities ahead.

“In the last two years, we have transformed Asos with investment in infrastructure and the customer offer; we have generated strong revenue growth and free cash flow and improved structural profitability.

“But we know there is more to do and today we are setting out details of our ambitious plan to significantly increase Asos’s sales and profitability, becoming a £7 billion business within three to four years.”

Shares were 14.5% lower at 2,379p after early trading.