S4 Capital warns over revenues amid slump in tech marketing spend

The group said like-for-like revenues plunged 16.2% in the first half and are set to fall by more than expected over the full year.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

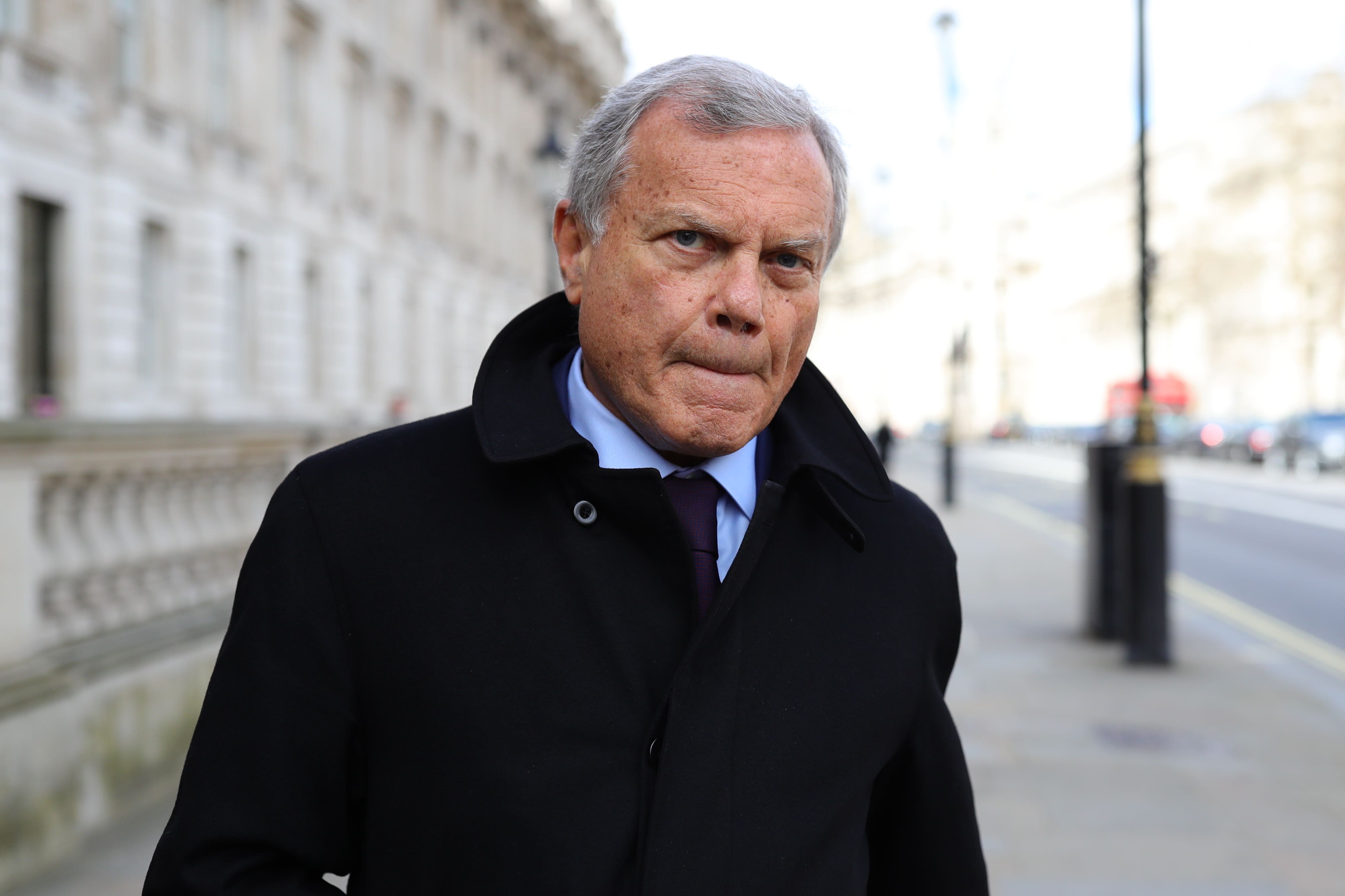

Your support makes all the difference.Sir Martin Sorrell’s marketing group S4 Capital has seen shares tumble after warning over full-year sales as tech firms slash their spending.

The group said revenues plunged 18.3% in the six months to June 30 and cautioned turnover is set to fall by more than expected over the year as a whole, sending shares down by as much as 16% at one stage.

Executive chairman Sir Martin said trading was being hit as tech companies cut back on their marketing budgets.

S4 Capital has slashed its workforce by nearly 1,000, or about 12%, to 7,553 year-on-year in the first half as it looks to cut costs.

Trading in the first half reflects the continuing impact of both challenging global macroeconomic conditions and high interest rates

Its actions to drive savings is helping limit the impact on profits, with the group reporting underlying earnings down 17.5% to £30.1 million for the first half and holding its outlook for the full-year.

On a statutory basis, it saw pre-tax losses narrow to £17.2 million from £23.2 million a year ago.

“We continue to expect a broadly similar overall level to the like-for-like operational Ebitda of 2023, as a result of cost reductions made last year and a continued focus on our cost base, where we have taken further action,” the firm said.

Sir Martin said: “Trading in the first half reflects the continuing impact of both challenging global macroeconomic conditions and high interest rates.

“This particularly impacted marketing spend by some technology clients and our technology services practice was affected by a reduction in one of our larger relationships.”

He added: “We maintain our profit target for the full year and, as in prior years, financial performance will be significantly second half weighted.”