Plunging pound precedes new PM but FTSE treads water

The FTSE 100 closed the day up 6.24 points, or 0.09%, at 7,287.43.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

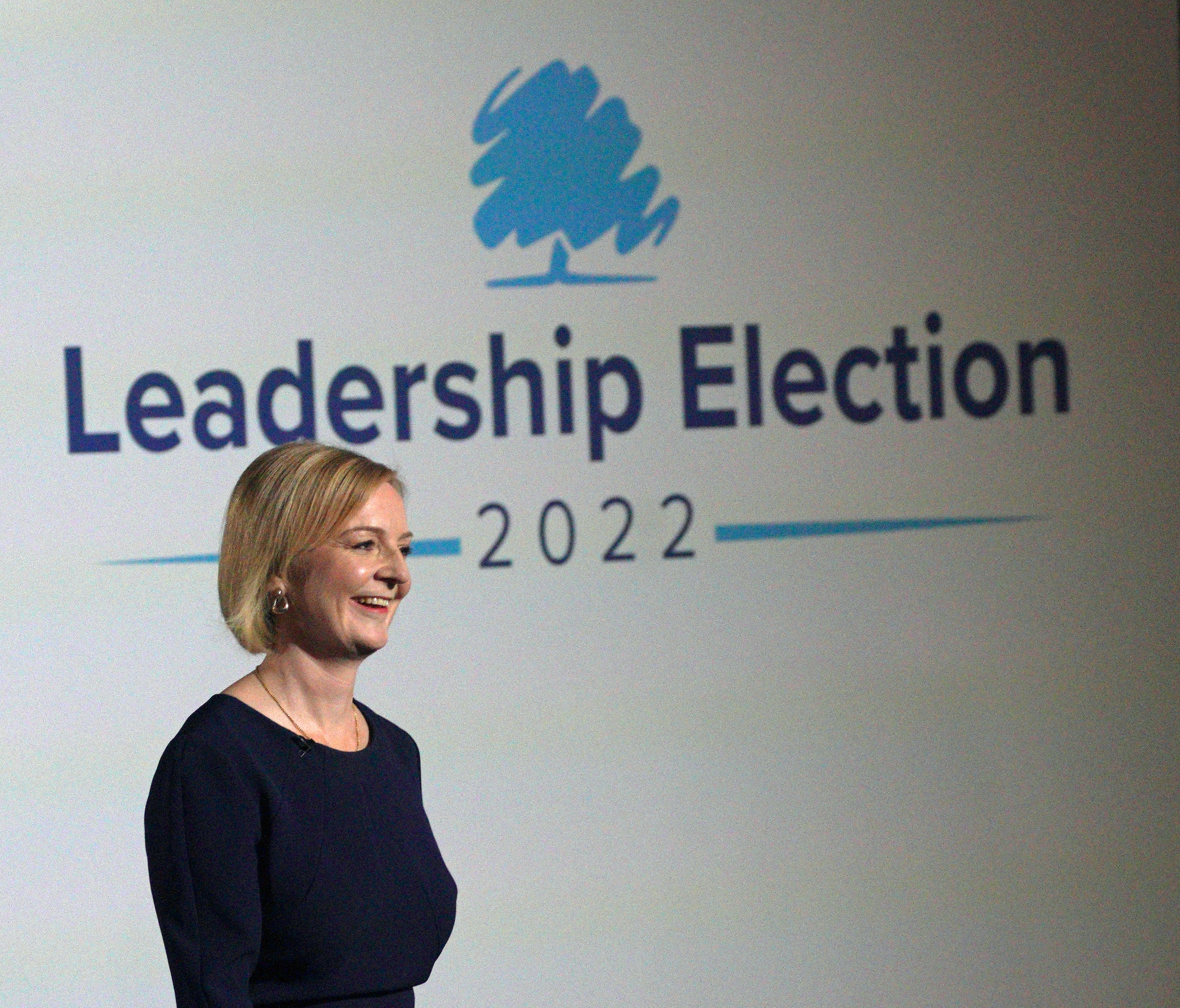

Your support makes all the difference.Liz Truss’s election as Prime Minister coincided with volatile European markets and the lowest pound against the dollar seen in decades, as the UK awaited its new leader.

But while London’s top index suffered losses during the day, it ended just about in the green on Monday, as gas and oil price rises pushed up stocks on the FTSE 100.

It closed the day up 6.24 points, or 0.09%, at 7,287.43.

However, it was the foreign exchange market that hit the headlines, with the pound dropping to the lowest point against the dollar in 37 years on Monday morning.

It briefly fell to a low where one pound could buy just 1.1443 dollars, below the 1.14506 it touched at the height of the pandemic on March 19 2020.

Analysts suggested that a weaker pound indicated concern among traders at Ms Truss’s leadership and her tax-cutting ambitions, which could send the country’s inflation even higher.

Once more, oil prices have come to the rescue of the FTSE 100, with the index looking to end this relatively uneventful session flat on the day

But by the time markets had closed, sterling had regained some ground from the earlier lows. It was up 0.08% against the dollar at 1.1515, and flat against the euro at 1.1599.

Chris Beauchamp, chief market analyst at online trading platform IG, said: “Once more, oil prices have come to the rescue of the FTSE 100, with the index looking to end this relatively uneventful session flat on the day.

“Opec’s talk of a modest cut to production has provided the spark for another bounce in oil prices.

“Should it continue to cut production if prices sink further, it risks intensifying the global recession that seems to be more likely with each passing day.”

European markets suffered greater declines on Monday in the wake of the news last week that Russian-owned gas and oil firm Gazprom would be shutting its Nord Stream 1 pipeline, the largest gas pipeline from Russia to Europe, indefinitely.

The announcement prompted further gloom over the energy crisis and warnings of winter blackouts.

Germany’s top index, the Dax, had fallen 2.18% at the end of the day, while the French Cac 40 was 1.26% lower.

Brent crude oil saw a substantial uplift and was 2.63% higher when European markets closed, hitting 95.47 dollars per barrel.

US markets were sheltered from movement on Monday as they closed for the Labour Day national holiday.

In company news, housebuilder Vistry Group agreed a takeover of rival Countryside Properties in a deal worth about £1.25 billion.

Vistry said that the merger will create a leader in the partnerships housing sector and expand the delivery of affordable housing across England.

Shares in Vistry ended the day 14p higher, at 755p.

Elsewhere in the housing sector, property franchise company Belvoir saw its half-year revenues jump by 12% as it benefited from an active lettings market.

The AIM-listed company reported a boost in buy-to-let purchases and higher rents that partially offset a slowdown in house sales caused by supply shortages.

Belvoir’s shares were down by 5p, at 220p.

In pharmaceuticals, a warning about the impact of economic uncertainty on the sector and a return to pre-pandemic spending from Dechra Pharmaceuticals sent its shares tumbling.

The veterinary pharmaceuticals business said trade had been bolstered during the pandemic by increased spending on pets, but that it is likely to fall back to normal levels.

Shares in Dechra dropped by about 10% during the day and were down 370p to 3,126p when markets closed.

The biggest risers on the FTSE 100 were Glencore, up 18.25p to 471.5p, BAE Systems, up 23p to 787.4p, JD Sports, up 2.85p to 122.8p, Ocado Group, up 15.6p to 719.6p, and Kingfisher, up 5.1p to 239.6p.

The biggest fallers on the FTSE 100 were Dehra Pharmaceuticals, down 370p to 3,126p, Smurfit Kappa, down 151p to 2,798p, CRH, down 121p to 3,075p, Abrdn, down 4.6p to 147.5p, and Smith, down 8.1p to 263p.