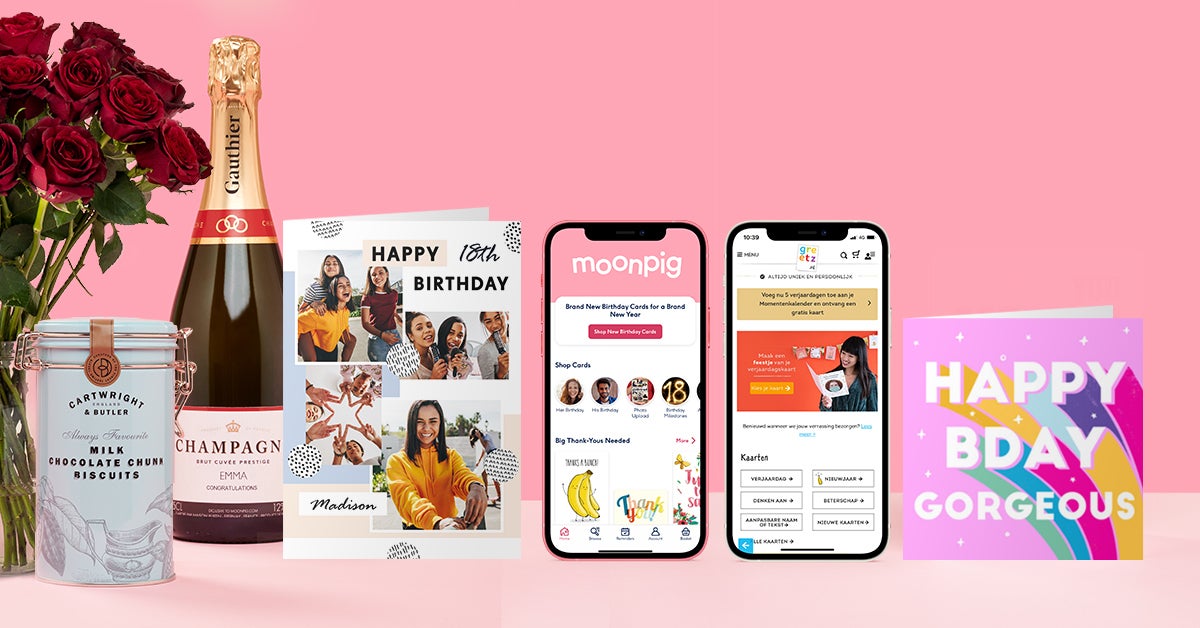

Moonpig hails strong gift demand despite cost-of-living pressures

The planned acquisition of Buyagift is expected to be finalised by the end of July and could increase Moonpig’s revenue to about £350 million.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Moonpig has shrugged off fears of a consumer spending slump due to the cost of living as it puts faith in a new gift push to boost sales.

The company said the “resilient” gifting market is helping to protect it against weaker consumer sentiment due to rocketing inflation.

But the message came as Moonpig revealed a sales fall for the past year.

Chief executive Nickyl Raithatha told the PA news agency the planned acquisition of experience provider Buyagift would support the firm in coming years with a bigger offering for customers.

The acquisition of Buyagift is expected to be finalised by the end of July and is predicted to increase Moonpig’s revenue to about £350 million.

Mr Raithatha said this could see Moonpig triple products in its gifting range.

He said: “We currently have around 2,500 gifts in our gifting range. And we can double and triple that very, very quickly with Buyagift because you can sort of add digital inventory online.”

News of the planned acquisition comes as profit and revenue figures for the business were lower than the previous financial year, as it reported a 30.9% slump in underlying pre-tax profits to £51.5 million for the year to April 30 – its first full year as a stock market-listed company.

Revenue also dropped sharply by 17.3% to £304.3 million.

The 2021 financial year was a particularly successful one for the company, with an underlying pre-tax profit of £74.6 million and revenue of £368.2 million due to the closure of physical card stores.

Gifting is actually inherently more resilient than self purchase. Someone is much more likely to not buy that extra pair of shoes or T-shirt for themselves than they are to not buy their mum's birthday card or flowers for someone's birthday

However, Mr Raithatha said 2021 was “kind of a blip” because of the pandemic.

He said the business was focused on holding on to as much of that “temporary elevation as possible”, and gifting could help the company record higher figures over the next financial year due to its “power to put a smile on a person’s face and forge connections”.

“For the price of a coffee, you can put a huge smile on your mum’s face and we think actually £3.50 for a Moonpig card, which you can personalise, is likely to stick,” he said.

“Gifting is actually inherently more resilient than self purchase. Someone is much more likely to not buy that extra pair of shoes or T-shirt for themselves than they are to not buy their mum’s birthday card or flowers for someone’s birthday.”

He added that the loyalty of customers has been “driving the business”, with the average order value of Moonpig’s customers rising by 6% from the previous year.

“We have delivered almost 60 million cards and gifts to our customers in the past year. And really importantly, almost 90% of our revenues came from existing customers. So really the loyalty of our customer base is what is driving the business,” he said.

He added that the business has passed an average 9% pay increase to all staff over the past year and it continues to innovate, with 43,000 card designs for customers to choose from.