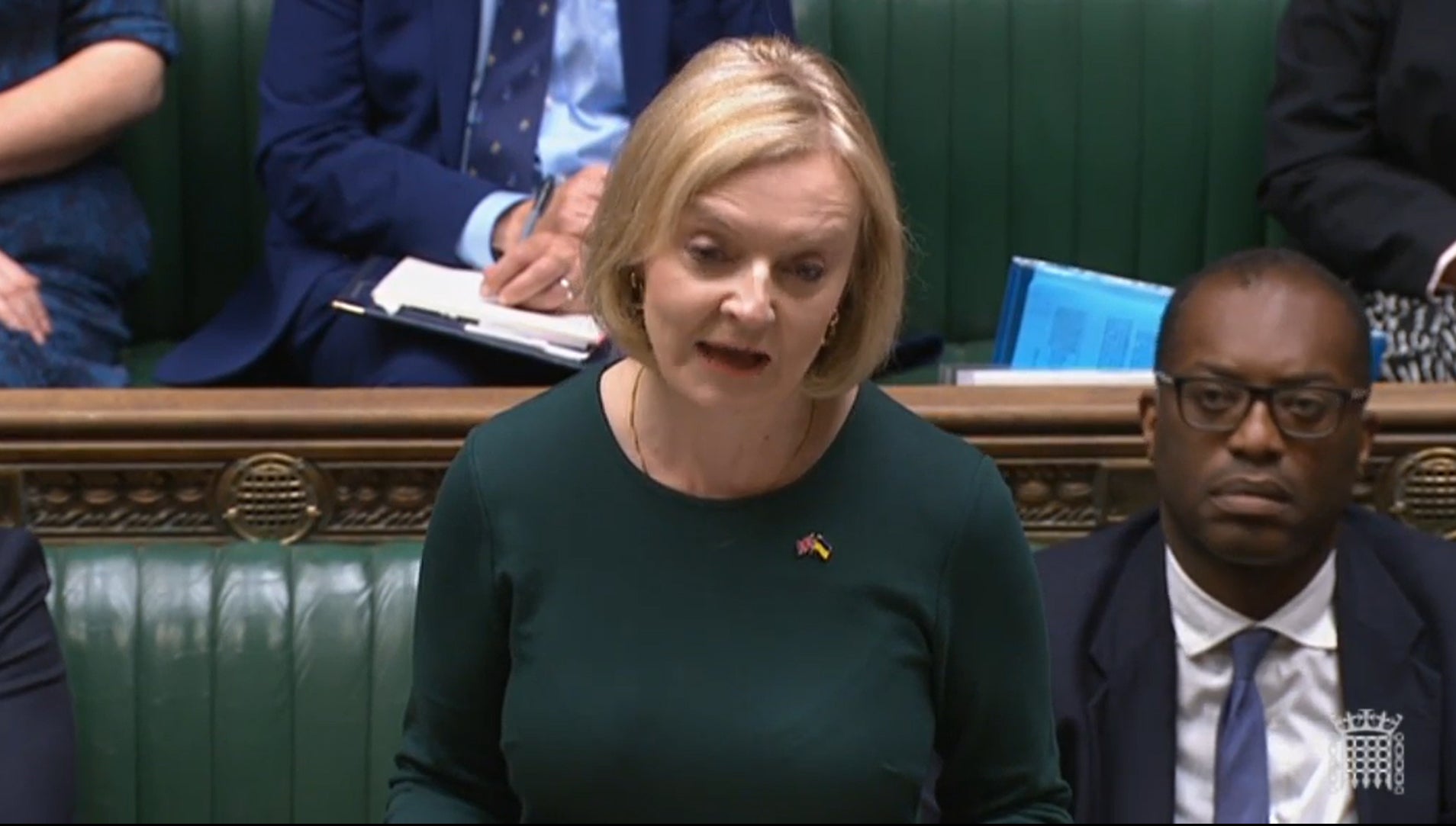

London markets make gains as PM unveils huge energy support package

The FTSE 100 closed the day 24.23 points higher, or 0.33%, at 7,262.06.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.London’s top markets were all in the green on Thursday after the Prime Minister committed to spending billions of pounds on freezing energy bills for households across the UK.

All indices on the London Stock Exchange had made gains when markets closed as the Government delivered some good news in the form of the costly support package.

The FTSE 100 closed the day 24.23 points higher, or 0.33%, at 7,262.06.

It has been slow going, but stocks look like they are in a mood to continue yesterday’s rebound

The upbeat mood was somewhat dampened by the European Central Bank’s (ECB) decision to hike interest rates by 75 basis points, its largest ever increase, in efforts to curb inflation that is pushing Europe towards a recession.

Chris Beauchamp, chief market analyst at online trading platform IG, said: “It has been slow going, but stocks look like they are in a mood to continue yesterday’s rebound.

“The mood hasn’t been helped by the ECB, which has put investors on notice that the new policy of sharp interest rate hikes is here to stay for a while, but overall the mood seems to be much more positive than might have been expected in a week that has seen Russia cut Europe off from gas supplies.”

The pound was also boosted against the US dollar when Liz Truss addressed the House of Commons, having crashed a day earlier amid reports that the Government was set to increase borrowing to fund its energy support pledges.

However, sterling had slipped again at the end of the day and was down 0.22% against the US dollar, to 1.1465, and 0.12% against the euro, at 1.1528, when European markets closed.

Elsewhere in Europe, the German Dax was fractionally lower amid further threats from Russian President Putin to cut off European gas supplies during the week. It was down by 0.09% when markets closed, while the French Cac 40 had gone up by 0.33%.

In the US, both its top indices were in the green after Fed chairman Jerome Powell reiterated its determination to lower inflation, which has reached a four-decade high of 8.5%. The S&P 500 was around 0.1% higher and Dow Jones was up by 0.03% when European markets closed.

The price of Brent crude oil had risen on Thursday after dropping more than 3% a day earlier. It was 1.17% higher, at 89.03 dollars a barrel at the end of the day.

In company news, Royal Mail denied claims from its main union that the delivery company is in “secret talks” that could end in its sale to a private equity company.

The company said it had held “no such talks”. Shares in the business dropped 1.8%.

In other potential takeover news, Darktrace shares fell by more than 30% after the business revealed that a different private equity suitor was pulling out of talks to buy it.

“An agreement could not be reached on the terms of a firm offer,” that could have reached around £2.7 billion, the cybersecurity company said.

Meanwhile the Restaurant Group, the company behind Wagamama and Frankie & Benny’s, said that sales slowed during the heatwave at the two restaurant chains.

However the firm swung from a £20 million pre-tax loss in the six first months of last year to a profit of £10 million in the same period this time around. Sales nearly doubled in the same period.

Shares rose 2.8%.

The biggest risers on the FTSE 100 were Antofagasta, up 46p to 1,151p, Pershing Square Holdings, up 80p to 2,840p, Standard Chartered, up 16p to 592.8p, Experian, up 71p to 2,692p, and Ocado Group, up 17.4p to 751.2p.

The biggest fallers on the FTSE 100 were Melrose Industries, down 12.85p to 124.8p, Associated British Foods, down 110p to 1,345p, B&M European Value Retail, down 18.2p to 344.1p, Tesco, down 11.9p to 237.4p, and Sainsbury, down 9.4p to 197.6p.