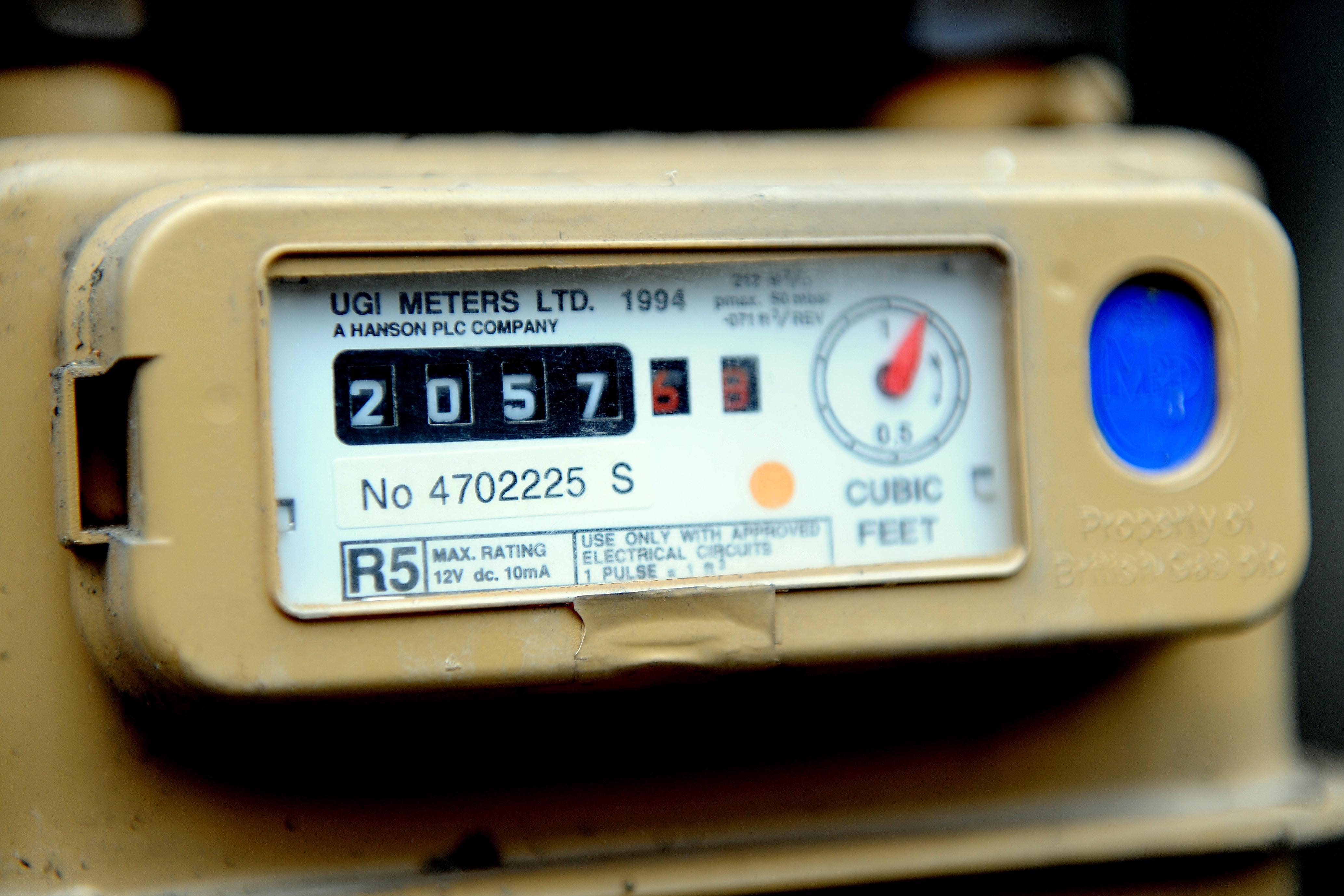

Insolvencies rise as companies worry about energy bills

The number of companies going insolvent in England and Wales hit 5,629 in the second quarter of 2022.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Nearly a quarter of small businesses say that energy prices are their main concerns as insolvencies spiked to their highest level since the wake of the financial crisis.

The number of companies going insolvent in England and Wales has been rising since last year, and hit 5,629 in the second quarter of 2022.

When adjusting for the season, this pushed insolvencies to their highest level since the third quarter of 2009, amid the global financial crisis.

The rise has come after businesses were protected from insolvencies during the pandemic due to Government rule changes.

These rules were only temporary and were later reversed, paving the way for many collapses in the wake of the crisis.

Now businesses are facing a whole new set of challenges as their costs rise and under-pressure shoppers cut back their spending.

“Several factors are likely to have played a role in the recent rise in insolvencies, such as persistently high energy prices, difficulties in meeting debt obligations, rising costs of raw materials, and supply chain disruptions,” the Office for National Statistics (ONS) said on Friday.

A survey by the statisticians found that 23% of businesses said that energy prices are their main concern in early October. This compared to 15% in February when bills had already been rising.

The survey also found that businesses with between 10 and 49 employees were the most worried about energy. Around 27% said that this was their primary concern.

“The price of energy is likely to remain a key concern for businesses, especially during winter months when energy usage for many businesses increases,” the ONS said.

Two weeks ago the Government announced a new programme to help businesses with their energy costs.

Under it, businesses will get some of their runaway energy costs covered by the Government.

Although it did not draw a direct link between bills and insolvencies, the ONS showed that the accommodation and food service sector saw unusually high levels of both.

Nearly 41% of respondents from the sector said that energy was their biggest worry, and 611 insolvencies were recorded in the second quarter – the highest since records began in 2012.