Inflation set to leap to new 40-year high after eye-watering energy bill hike

Economists expect the latest official data to reveal Consumer Prices Index inflation jumped to 10.7% last month from 10.1% in September.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

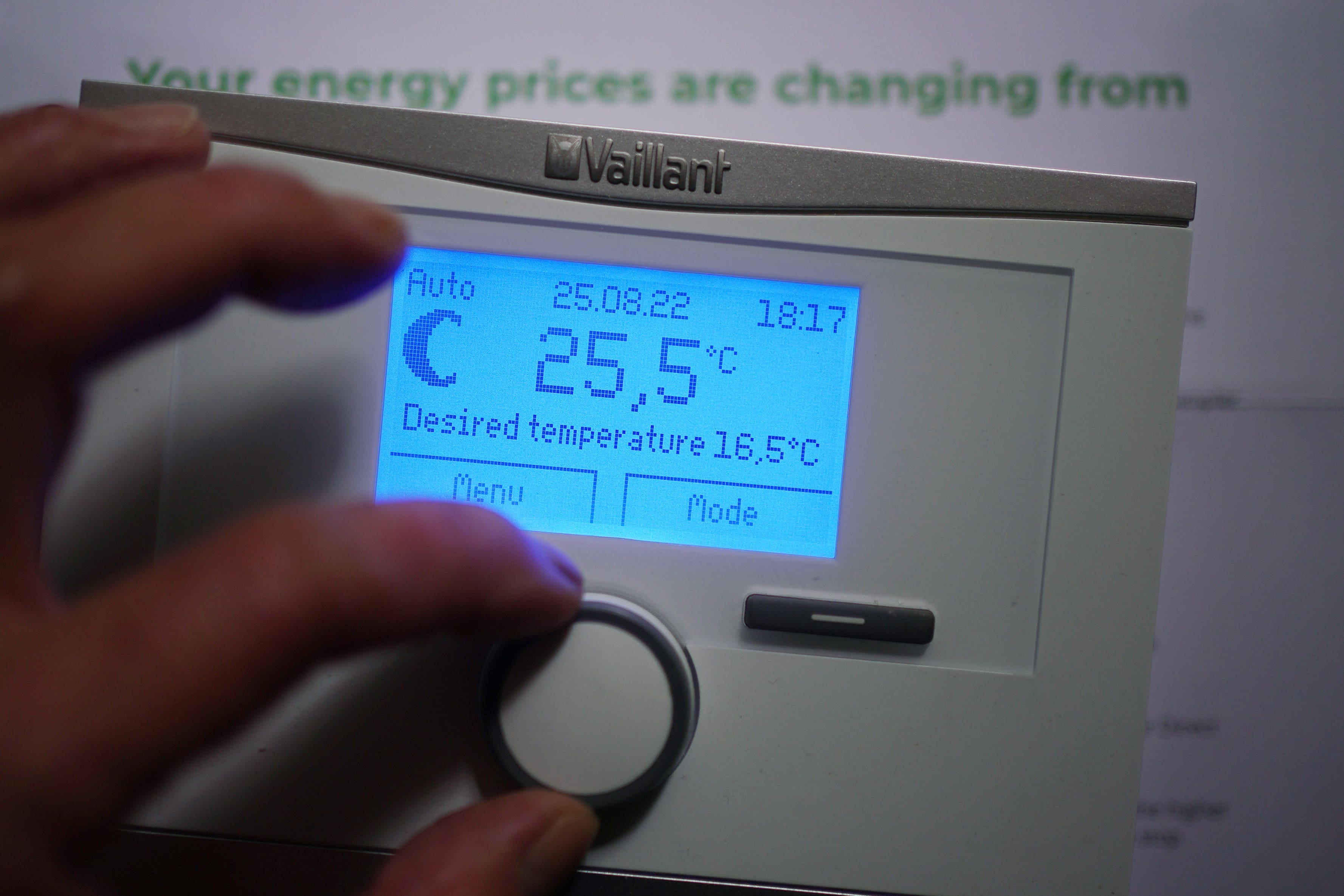

Your support makes all the difference.Painful gas and electricity bill rises in October are expected to send UK inflation surging to a fresh 40-year high in official figures on Wednesday, but experts predict this is likely to mark the peak in the cost-of-living crisis.

Most economists forecast that the latest data from the Office for National Statistics (ONS) will show Consumer Prices Index (CPI) inflation jumping to 10.7% last month from 10.1% in September.

It would mark the highest level of inflation since January 1982.

Although the headline rate of inflation is unlikely to be a pleasant read, comfort may be taken that on our forecasts it could represent the peak

The sharp rise comes after the hike in the energy price cap in October as a result of sky-high wholesale prices amid Russia’s war on Ukraine.

But the rise in bills has been cushioned after the Government stepped in to limit the increase in bills to around £2,500-a-year for households, with support also offered to businesses.

The Government promised in September that no household in the UK would pay more than 34p per unit of electricity and 10.3p for every unit of gas that they used.

For the average family, this would mean bills would reach around £2,500 per year, but households that used a lot of energy could pay more and people could reduce their bills by using less.

Before the price cap support, the Bank of England had warned that inflation could surge to 13.3% in October, with estimations at the time that Ofgem’s price cap would skyrocket to around £3,450 without any Government help.

We envisage that price growth will slow from here, dragged down as economic momentum slows. Helping this is that the sharp increases in energy price inflation are likely to be behind us

While inflation at 10.7% is still eye-wateringly high, economists said there was hope this may be as bad as it gets – though it is unknown at this stage what support will be available after next April.

The support was announced under former prime minister Liz Truss, and was initially meant to last for two years. This was later reduced by Chancellor Jeremy Hunt to six months, after which it will be reviewed.

Ellie Henderson at Investec Economics said: “Although the headline rate of inflation is unlikely to be a pleasant read, comfort may be taken that on our forecasts it could represent the peak.

“We envisage that price growth will slow from here, dragged down as economic momentum slows.

“Helping this is that the sharp increases in energy price inflation are likely to be behind us.”

She added: “Gas prices have eased significantly from their peak and secondly, even if we were to see a sizeable rise in the energy price cap in April next year when the cap is next going to be reset, given wholesale gas prices futures, this is unlikely to be a larger monthly percentage rise than that of April 2022, meaning the annual rate will ease a little due to favourable base effects.”

The pound’s recent rebound from record lows seen after the disastrous mini-budget will further help limit inflation pressures, making it less expensive to import goods and services from abroad, according to Investec.

October’s inflation hike is likely to reinforce expectations for another interest rate rise from the Bank of England when it meets next month, with many experts pencilling in a half point rise to 3.5%.

This would follow the three quarter point rise to 3% earlier this month – the biggest single increase since 1989 – as the Bank looks to rein in building inflation throughout the economy.

Jobs market data on Tuesday showed regular pay excluding bonuses jumped 5.7% in the third quarter – the fastest growth since 2000, excluding the pandemic, when the end of furlough skewed figures.

But pay growth was still far outstripped by inflation, with real regular wages falling 3.8% when taking account of CPI.