Hipgnosis reports widening losses as management spat rumbles on

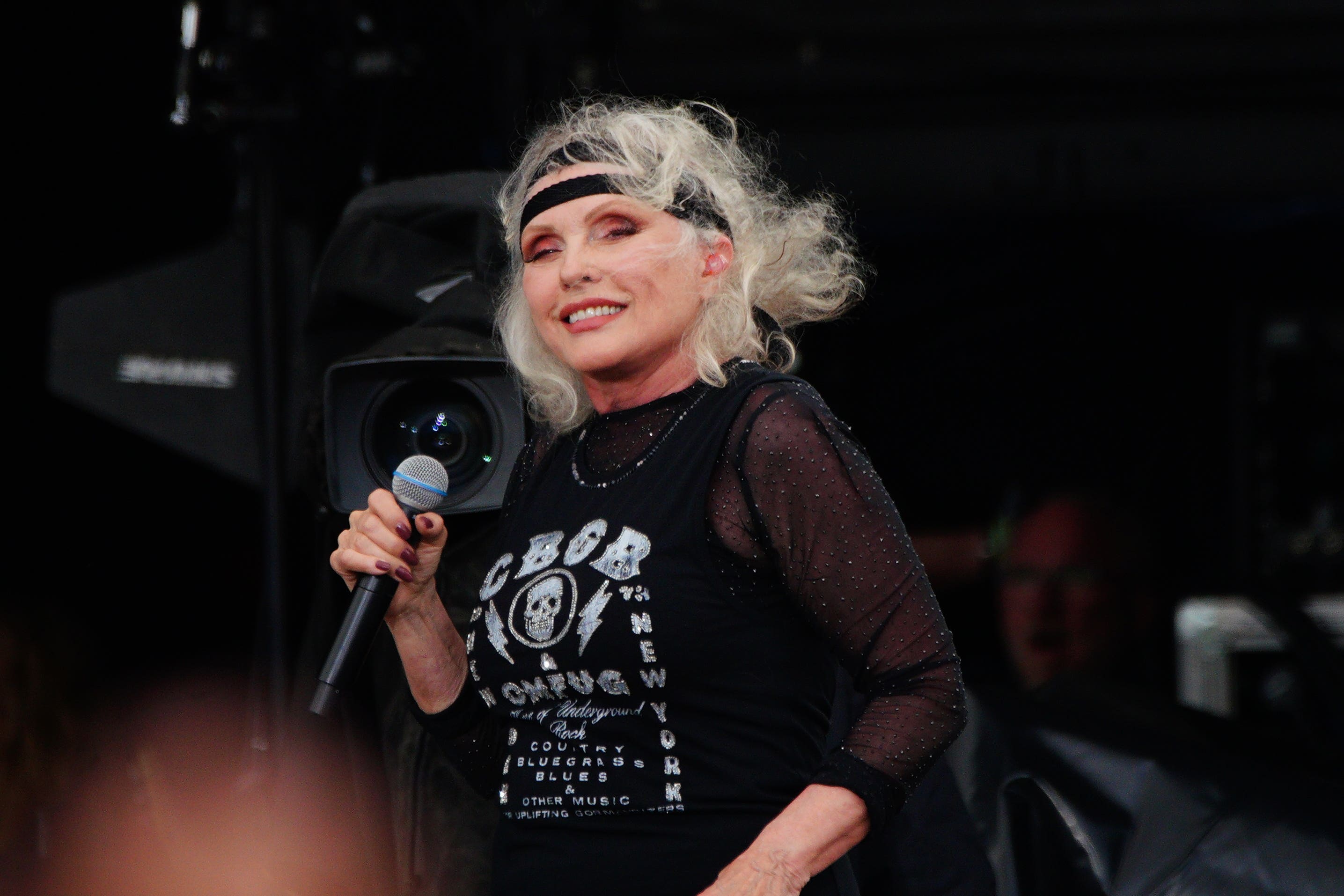

Hipgnosis Songs Funds, which owns the rights to tracks by artists including Blondie and Justin Bieber, has released its half-year results.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The troubles rocking music royalty fund Hipgnosis have deepened, as the firm hinted at a growing spat with its investment adviser, led by co-founder and former Beyonce manager Merck Mercuriadis.

Hipgnosis Songs Funds, which owns the rights to tracks by world-famous artists from Blondie to Justin Bieber, released its delayed half-year results on Thursday.

They show the fund’s pre-tax operating loss plunging to 63.7 million US dollars (£50.5 million) in the six months to September, widening the 17 million dollar (£13.5 million) loss reported this time last year.

Total revenues also fell by about 23 million US dollars (£18 million) over the same period, while net assets value declined by 9.2% between March and September.

The company said it had appointed an adviser to conduct due diligence into the quality of its assets.

I urge the investment adviser to provide the board with their opinion as to the fair value of the company assets, without caveats, such that we can provide greater certainty and transparency to our shareholders

It comes after it launched a strategic review in October which could lead to the replacement of Mercuriadis, as it considers shaking up the management team.

It is also targeting a potential sale of a chunk of its music catalogues.

Mercuriadis launched the music fund on the London Stock Exchange in 2018 with Nile Rodgers of Chic, who he previously managed. He now heads up Hipgnosis Song Management (HSM), an investment adviser formed of music industry experts.

Hipgnosis Songs Fund said it made “repeated requests” to HSM to give an opinion on the fair valuation of its music catalogues, over concerns they are not being valued highly enough.

Chairman Robert Naylor said on Thursday: “In the absence of further evidence or insight from the investment adviser, on which to base a judgment on the valuation of the company’s assets, the board has concerns as to whether the fair value is reasonable.

“On behalf of the board, I therefore urge the investment adviser to provide the board with their opinion as to the fair value of the company assets, without caveats, such that we can provide greater certainty and transparency to our shareholders.”

Mr Naylor said since joining the board there has been “ongoing failures in the financial reporting and control process”.

This led Hipgnosis to suspend dividend payments to shareholders for at least the rest of the year.

On Wednesday, investment adviser HSM said it had “fulfilled its duties to the company” and would “continue to work in a constructive manner” with the fund and its shareholders.