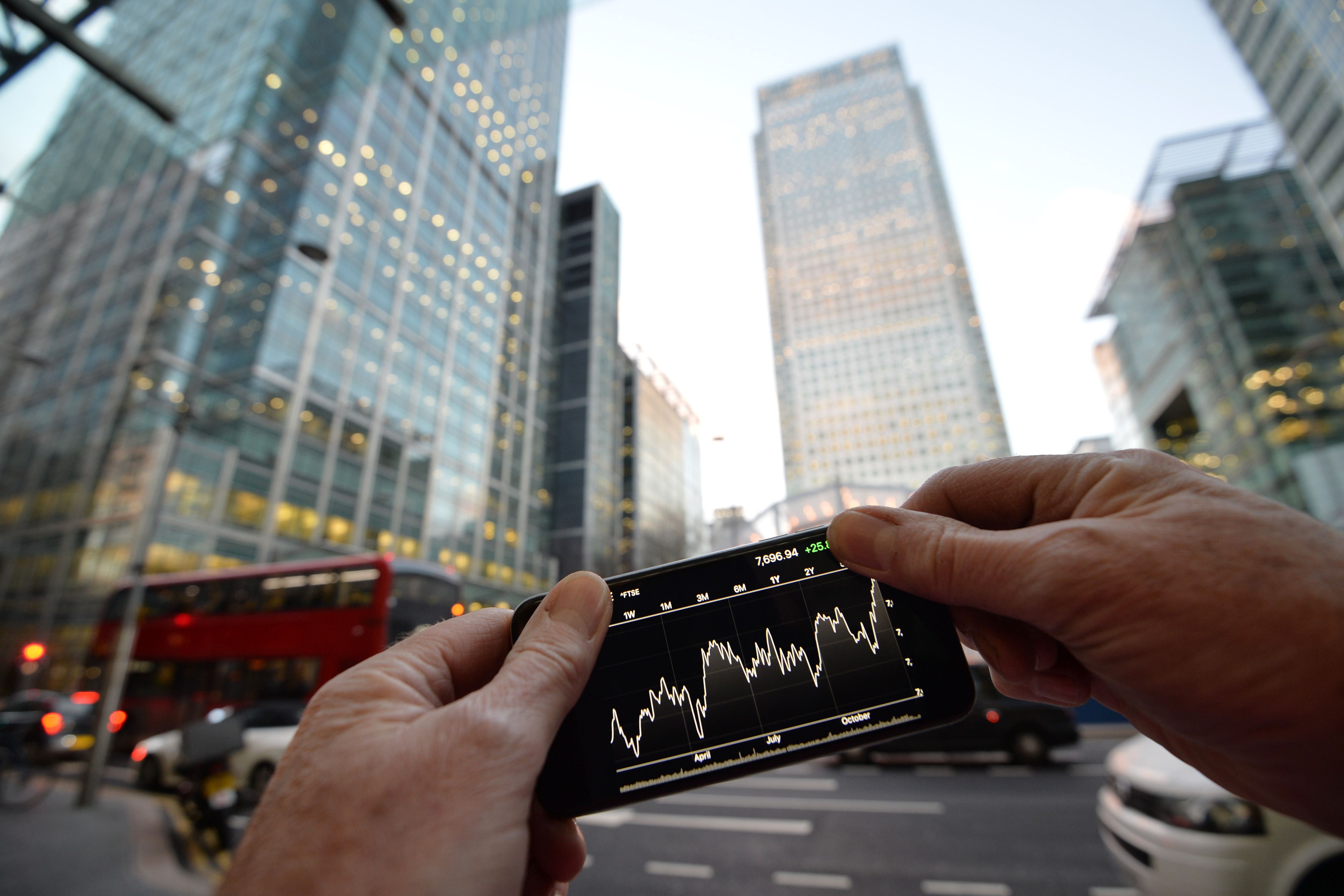

FTSE 100 rises as investors see UK interest rate cut in ‘touching distance’

The FTSE 100 closed 67.35 points higher on Thursday, or 0.82%, at 8,272.46.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK’s top share index has moved higher after the Bank of England held interest rates steady but revealed that the decision was a close call for some of its policymakers.

The FTSE 100 closed 67.35 points higher on Thursday, or 0.82%, at 8,272.46.

It was a mixed bag for stocks with miners among those leading the gains, while grocery group Ocado saw about 13% wiped off its share price during the day.

European investors appeared to be in positive spirits following the Bank’s latest meeting, where interest rates were kept at 5.25% for the seventh consecutive month, as analysts had been expecting.

But as is often the case, the devil was in the detail and it was noted that some members of the Monetary Policy Committee viewed the decision as “finely balanced”.

Investors are looking for a future when inflation is back under control and rates start to ease, and the magic moment looks to be in touching distance

Dan Coatsworth, investment analyst at AJ Bell, said: “Confidence is growing that the Bank could cut rates either in August or September and that would represent a major turning point in monetary policy and effectively draw a line underneath an era dictated by soaring inflation and rapid rate hikes.

“Investors are looking for a future when inflation is back under control and rates start to ease, and the magic moment looks to be in touching distance.”

It was a positive session for other top European stock markets, with Germany’s Dax rising 0.95% and France’s Cac 40 closing 1.34% higher.

Over in the US, the S&P 500 was up about 0.1% and Dow Jones up 0.2% by the time European markets closed.

It was a weaker session for the pound which edged lower against the US dollar and the euro following the Bank of England’s rate decision.

Sterling slipped about 0.4% to 1.264 US dollars, and was 0.1% lower at 1.1824 euros.

In company news, shares in Ocado tumbled on the news that Canadian supermarket giant Sobeys has paused the launch of its new warehouse in Vancouver.

The firms had a struck a partnership deal in early 2018 for Ocado to build warehouses, with the Vancouver site originally planned to launch in 2025.

The setback sent Ocado’s shares down by as much as 18% on Thursday afternoon.

It closed 12.1% lower.

Tate & Lyle’s share price also slipped on Thursday after the FTSE 250-listed firm told investors it had agreed to buy food and drink ingredients business CP Kelco in a roughly £1.4 billion deal.

The group said the deal would accelerate its growth and increase its earning margins over the coming years.

But it appeared to be not enough to convince investors and its share price closed 9.1% lower.

The biggest risers on the FTSE 100 were JD Sports, up 6.1p to 125.9p, Fresnillo, up 24p to 565p, Land Securities, up 27p to 636.5p, Antofagasta, up 89p to 2,146p, and WPP, up 22.2p to 758p.

The biggest fallers on the FTSE 100 were Ocado, down 42.5p to 310p, Hargreaves Lansdown, down 19p to 1,134p, United Utilities, down 16.6p to 993.4p, easyJet, down 4p to 451.1p, and Croda, down 14p to 4,100p.