Debt interest and civil service pay deals pushed borrowing to £17.4bn last month

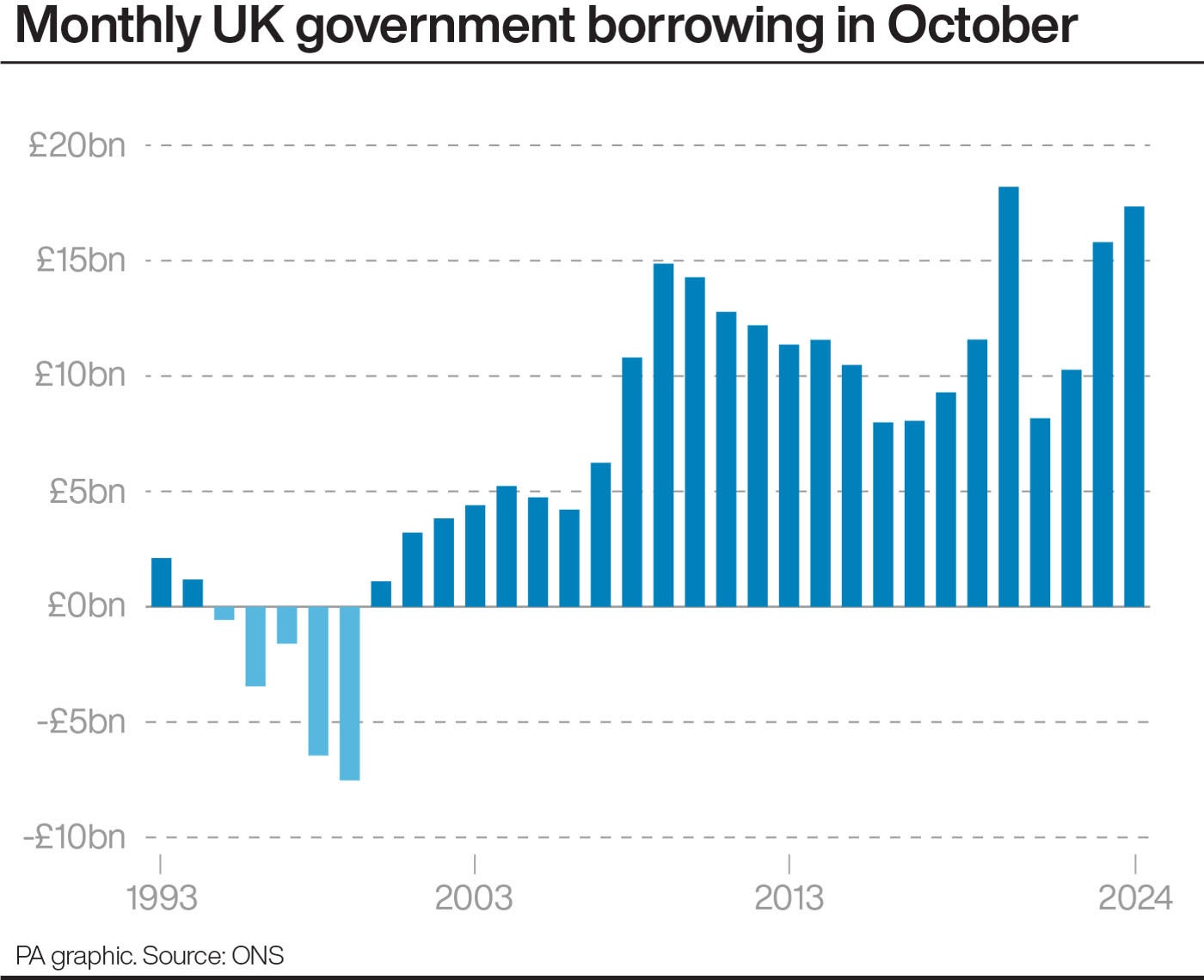

Borrowing rose to £17.4 billion last month marking the second highest October figure since monthly records began.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Soaring debt interest payments and Chancellor Rachel Reeves’ public pay deal have helped push borrowing to £17.4bn the second-highest October figure since records began in 1993.

The figure exceeded the expectations of economists of about £12.3bn for last month, after new borrowings of £16bn in September.

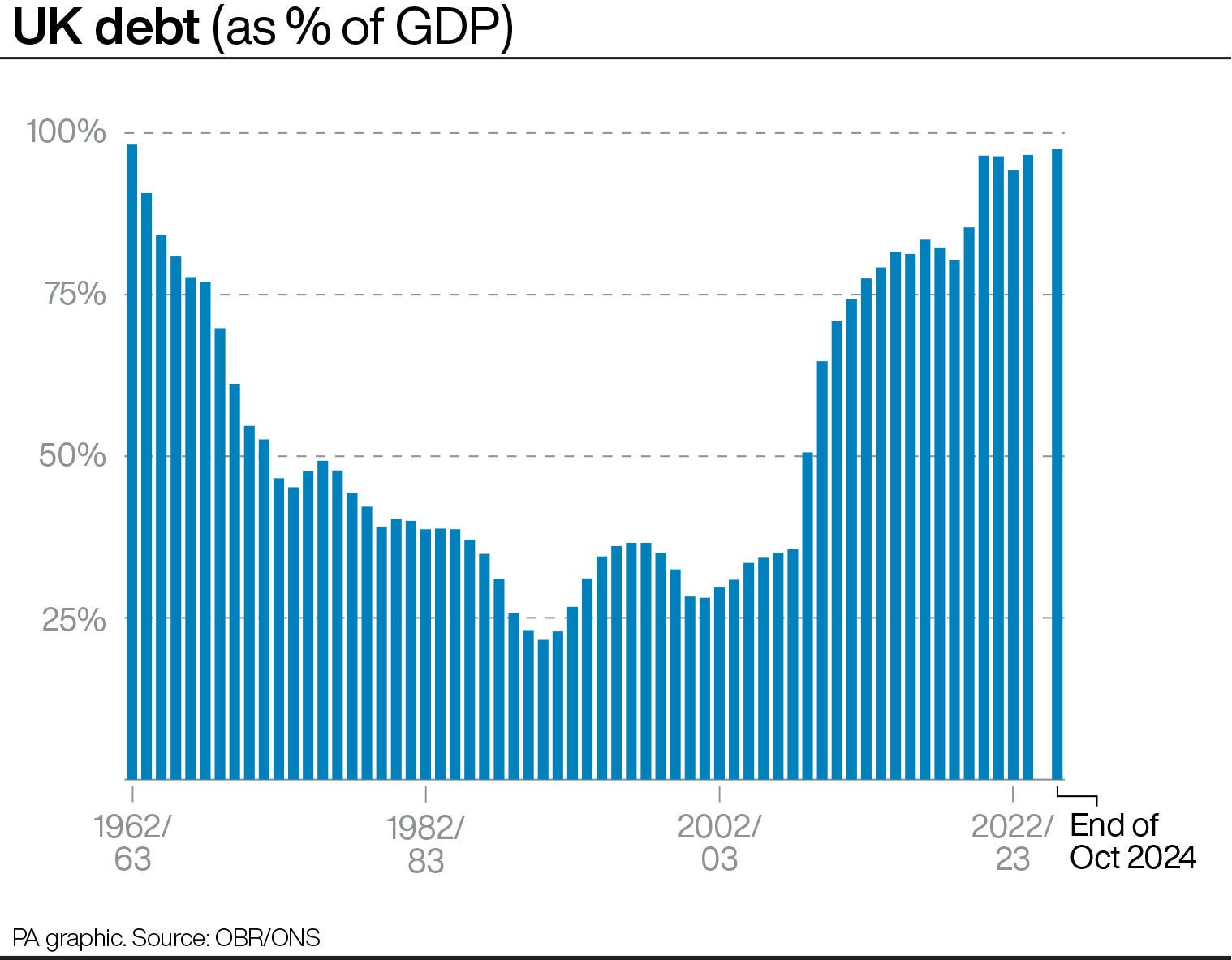

The added monthly drawdowns are helping the UK’s national debt to balloon. It now stands at about £2.8 trillion, or £2,800 billion. Ms Reeves is aiming to keep debt below the UK’s total economic output.

Before the Budget, she changed the rules around how much debt the UK could be in to allow for more building of infrastructure projects like schools, hospitals, roads and railways.

October was also the month that various above-inflation and backdated pay increases for NHS workers announced by Labour came into effect.

It came amid the first set of borrowing figures since the Government announced significant spending measures in last month’s autumn Budget.

Economists said that the latest figures highlight how the Chancellor has “little wiggle room” in the state finances.

The fresh figures showed that central government debt interest rose to £9.1 billion for the month – the highest October figure on record.

This was £0.5 billion higher than the same month last year.

ONS deputy director for public sector finances, Jessica Barnaby, said: “This month’s borrowing was the second highest October figure since monthly records began in January 1993.

“Despite the cut in the main rates of national insurance earlier in 2024, total receipts rose on last year.

“However, with spending on public services, benefits and debt interest costs all up on last year, expenditure rose faster than revenue overall.”

The ONS said central government departmental spending on goods and services increased by £2.5 billion to £36.9 billion in October on the back of “pay rises and inflation increased running costs”.

This includes the impact of above-inflation pay deals which were announced after the Labour Government took office, with NHS staff and teachers witnessing backdated pay increases from last month.

Overall central government spending was £88.5 billion in October 2024, £3.9 billion more than the same month a year earlier.

Meanwhile, central government receipts – the amount of money it receives, predominantly through taxes – rose by £2.9 billion to £81.2 billion for the month.

The rise was supported by increases in corporation tax and income tax payments.

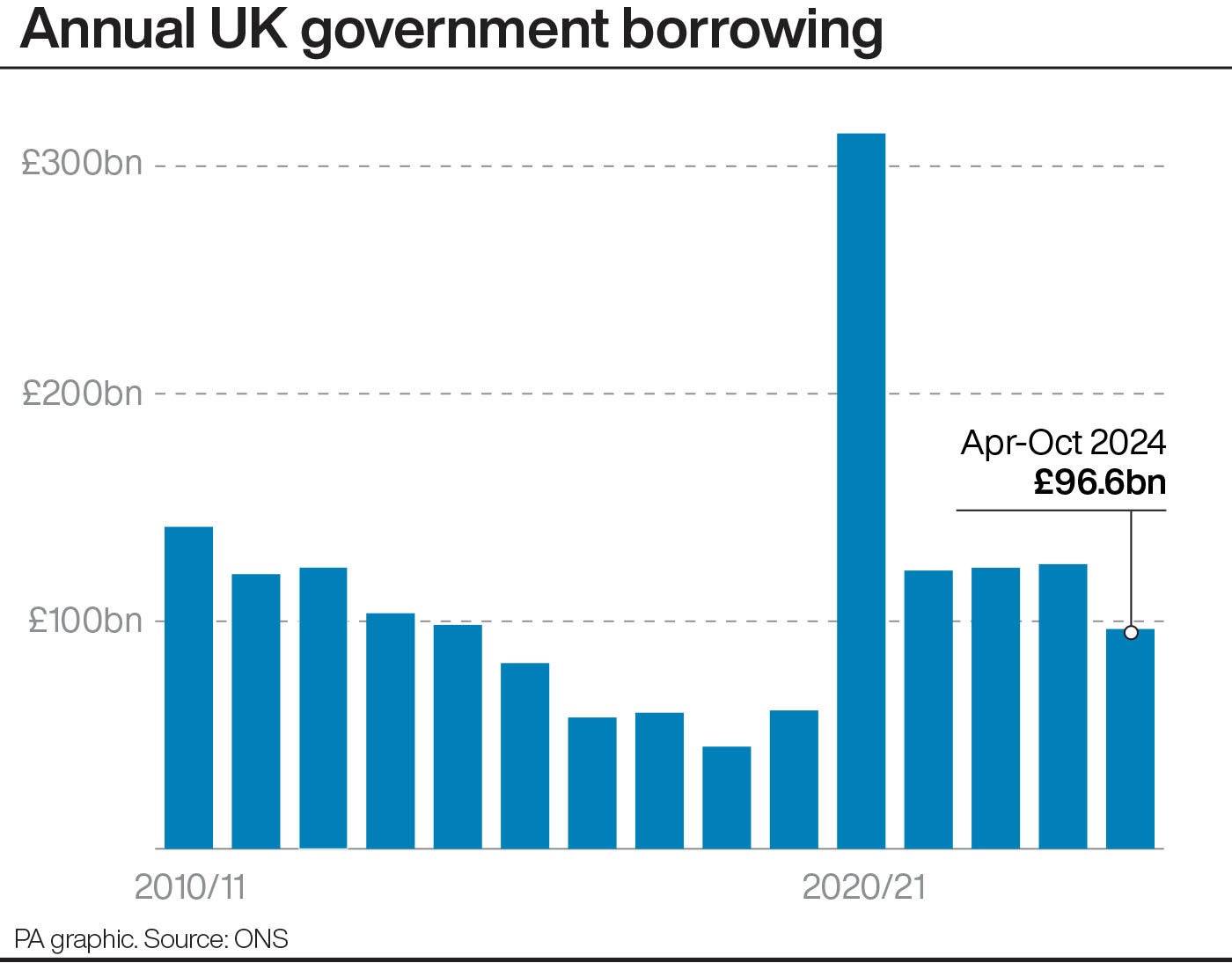

The ONS said public sector net borrowing as a whole stood at £96.6 billion for the financial year to October, as a result of the new figures.

It added that public debt, excluding state ownership in banks, was estimated at 97.5% of gross domestic product (GDP) at the end of October.

Chief Secretary to the Treasury Darren Jones said: “This Government will never play fast and loose with the public finances.

“Our new robust fiscal rules will deliver stability by getting debt down while prioritising investment to deliver growth.”

Alex Kerr, UK economist at Capital Economics, said: “Overall, October’s borrowing figures underline the little wiggle room the Chancellor has to significantly increase day-to-day spending.

“Despite raising day-to-day spending significantly this year and next, spending is set to rise by just 1.3% in real terms on average between 2026-27 and 2029-30.

“And given that the Chancellor only had £9.9 billion of fiscal headroom against her fiscal mandate left over after October’s Budget, this suggests that if she does want to increase day-to-day spending further, taxes will probably need to rise too.”

PA contributed to this report