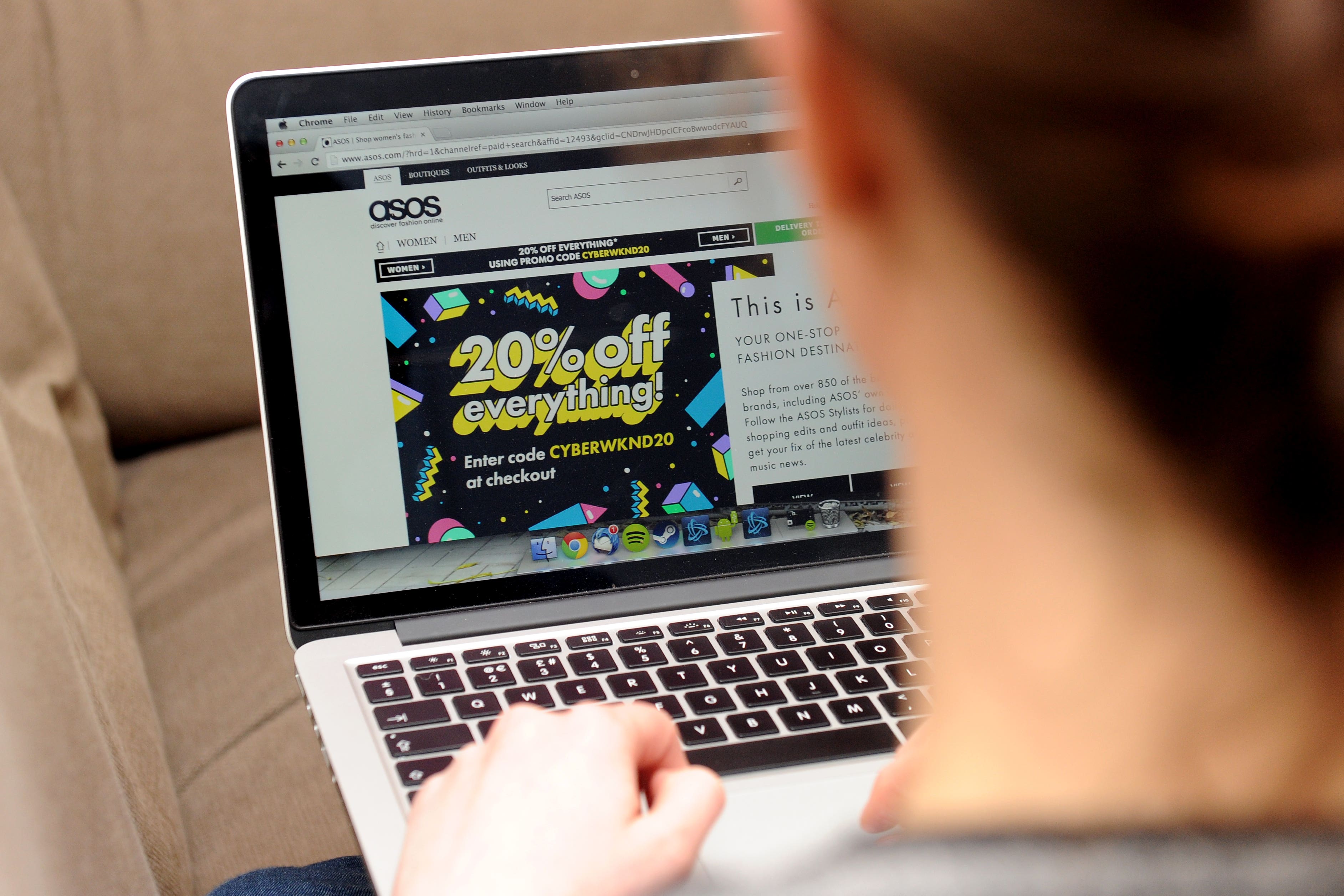

Asos to reveal sales slump amid turnaround efforts

On Wednesday April 17, the London-listed company is expected to post a roughly 18% fall in half-year sales.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Supply chain challenges and weak consumer sentiment are expected to contribute to a decline in sales at Asos.

Many UK fast fashion retailers have suffered a difficult year or two amid significant pressure on household budgets, as well as tough competition from global rivals such as Shein and Temu and online marketplaces.

Shares in Asos are around 50% lower than the same period last year as a result.

On Wednesday April 17, the London-listed company is expected to post another significant slump in sales amid efforts to transform its fortunes.

Analysts at Shore Capital have predicted it will confirm a roughly 18% decline in sales for the half-year to March 3, with predictions of a 13% fall to £3.08 billion for the current financial year as a whole.

Last month, Asos blamed the projected sales drop on overhaul efforts, having cut its stock in-take by about 30% year-on-year to “right size” stock levels.

The business has been on a mission to reduce its stock and costs and improve its profitability.

Investors will be hopeful that the company can show signs its turnaround plan is starting to bear fruit with a positive profit outlook.

Analysts have suggested the company is likely to see a slowdown in sales decline over the current half-year due to the turnaround plan.

However, Shore indicated this faces pressure from “wider trading backdrop of balancing a challenging position of supply concerns, still cautious consumer confidence, poor seasonal weather in the UK and dynamic competition”.

The brokerage said the growth of marketplace platforms such as Depop and Vinted is also attracting typical Asos customers, while it is also coming under pressure from the rapid growth of recent rivals such as Shein and Temu.

Nevertheless, shareholders might take positivity from recent positive trading updates from other UK fashion retailers such as Next, which highlighted robust consumer spending patterns.

Guy Lawson-Johns, equity analyst at Hargreaves Lansdown, said: “Investors will be looking for signs that better times are coming and that a return to growth in the final quarter of this year is still on the cards.

“Active customer numbers will also be in the spotlight.

“Ultimately, markets are looking for signs that the increased marketing spend and stock rationalisation are being well received by its target audience of fashion-loving 20-somethings.”