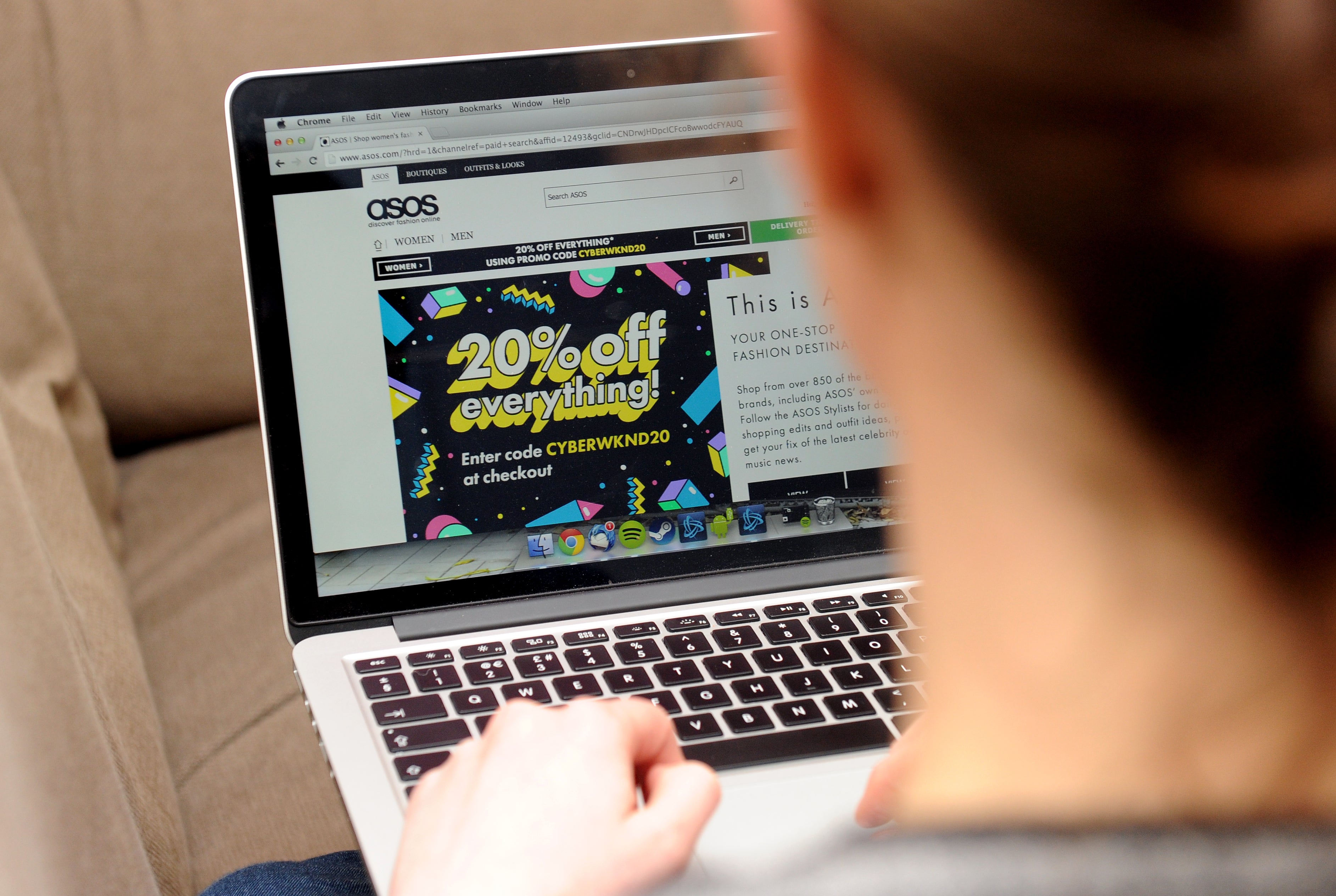

Asos set to reveal slowing sales and rising costs amid freight crisis

The online fashion retailer warned in July that growth had started to slow.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Asos is set to reveal a slowdown in sales growth and rising costs next week as the global freight crisis continues to dent its profit margins.

The online fashion giant’s sales soared through the pandemic as shoppers flocked to online retail and athleisurewear while locked down at home.

But the company warned the City in July that this growth had begun to slow down.

Trading weakened in the final weeks of the four months ending June, with bosses blaming bad weather and uncertainty around Covid-19 restrictions for dampened demand.

Analysts are expecting freight shortages, currency movements and less lucrative lockdown-focused products to have restricted the full year’s profits.

Sales are expected to grow 20% to £3.9 billion for the year to August, while analysts are anticipating a 35% rise in profits to £193 million.

Russ Mould and Danni Hewson, at AJ Bell said that loosening lockdown restrictions over the summer may have encouraged a more profitable period of consumer spending for Asos after a difficult four months to June when the country was in lockdown.

They said: “Sales of occasion wear may have offered some margin support as people started to go out again as pubs, clubs and restaurants began to open more fully.”

Sophie Lund-Yates, equity analyst at Hargreaves Lansdown said that the market “wasn’t impressed” by Asos’ third-quarter results but was more optimistic ahead of the update on the full year’s trading next week.

She said: “We suspect, but can’t be certain, that things will have picked up in some key markets. More social events on calendars means more outfits to be bought.”

She added: “Profitability’s been held back by a higher proportion of less lucrative ‘lockdown’ items, coupled with higher distribution costs, and rising return rates, could mean operating margins are heading in the wrong direction.”

The company said in July that supply disruption would not impact its customers.

Nick Beighton, chief executive of Asos, told reporters in July: “We have not changed any of our pricing, quite the contrary, we’ve invested heavily in it and will continue to do so.”

Profits at Asos’ online rival Boohoo slid on the back of soaring shipping costs when it reported its first six months’ trading last week, causing shares to fall 15%.

Boohoo’s statement unnerved Asos shareholders, causing its stock to drop 7%.