Amigo Loans shares plummet after court dismisses rescue plan

The High Court rejected a deal which would see it hand out lower than expected compensation packages to customers who were mis-sold loans.

The future of subprime lender Amigo has been thrown into doubt after its rescue plea was rejected by the High Court.

Shares in the troubled guarantor lender were slashed in half on Tuesday morning after the court decision fuelled concerns that the business could be forced into administration.

Amigo had previously said that the rescue plan, which would see it hand out lower than expected compensation packages to customers, was integral to its survival.

Mr Justice Miles stated that he was “not satisfied that the court should sanction the scheme”.

It came after two weeks of significant losses in the company’s share price after the Financing Conduct Authority (FCA) also criticised the scheme.

Amigo said that 95% of customers who had been mis-sold loans, and were due compensation, had approved the plan.

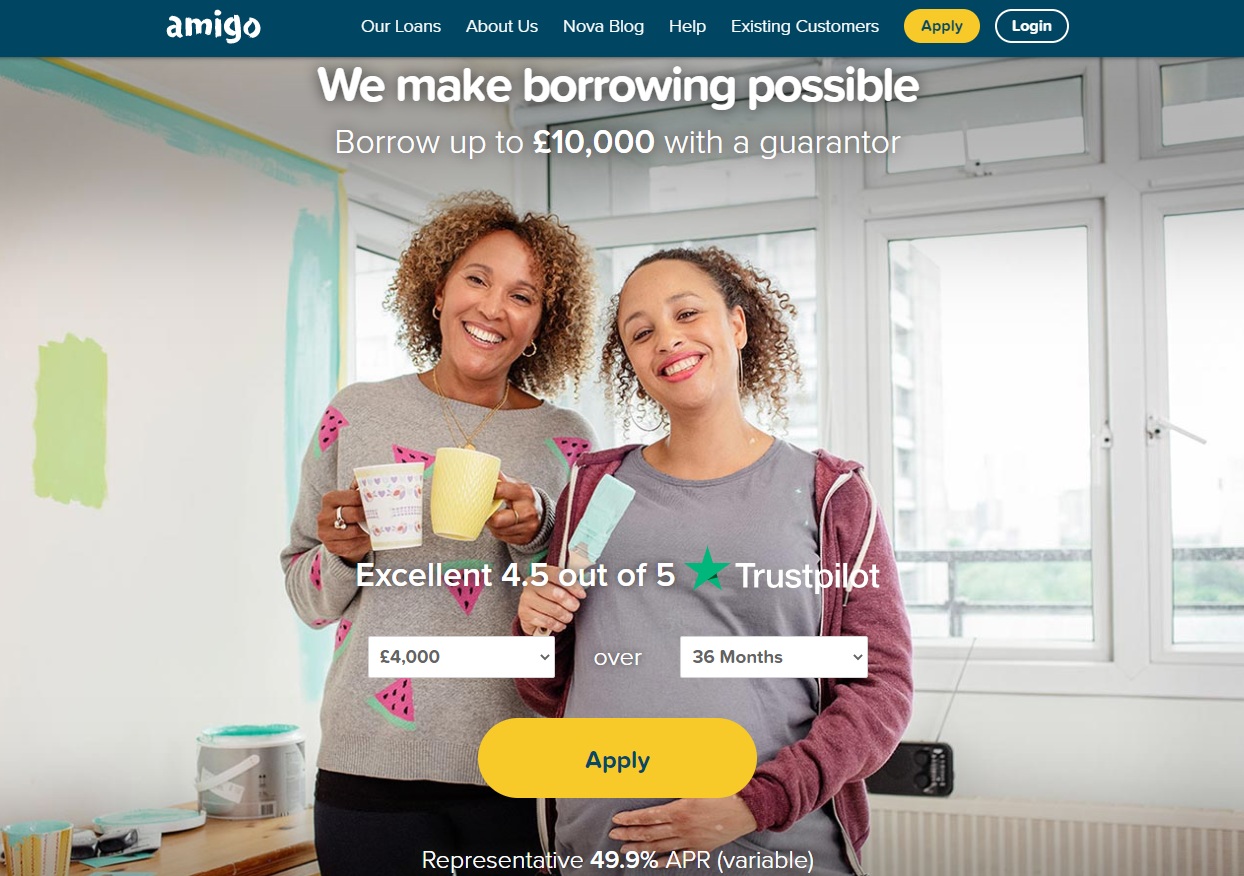

The lender, which typically charges 49.9% interest, offers loans to borrowers with poor credit histories on the basis that they have a friend or family member act as a guarantor.

It has come under fire over fears that many of its former customers are expected to receive around 10% of the claims, according to the judge, although customers could still receive more.

Gary Jennison, chief executive officer of the business, said: “Amigo is incredibly disappointed that the scheme has not been approved despite the 74,877 customers who voted in support [of it], representing over 95% of those who voted.

“We are currently reviewing all our options and will provide an update at the earliest opportunity.”

Shares were 51.8% lower at 8.98p after early trading.