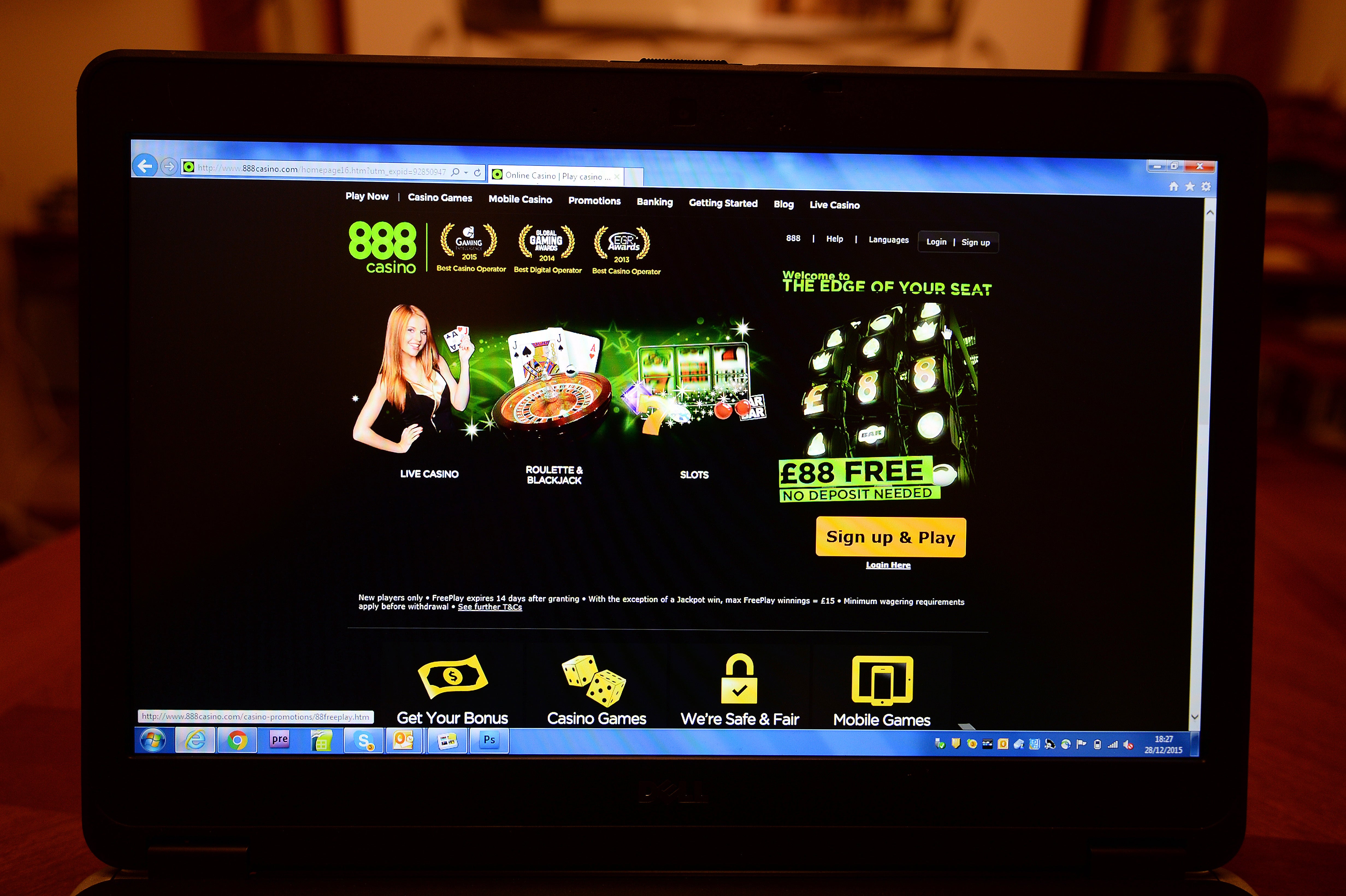

888 to beat revenue and earnings targets after UK betting boom

Shares in the company lifted after it reported more than 50% UK revenue growth for the six months to the end of June.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Betting firm 888 Holdings has lifted its revenue and earnings expectations for the year as it saw UK sales soar higher.

Shares in the company lifted after it reported more than 50% UK revenue growth for the six months to the end of June.

It revealed that total revenues grew by 39% to 528.4 million US dollars (£383.7 million) for the period, while pre-tax profits increased by 14% for the period.

The gambling firm said UK revenues benefited from favourable foreign exchange movements, while also growing its market share.

The company said revenue growth for July and August slowed down as it felt the impact of the reopening of retail and leisure venues across international markets.

It added that the company board is confident that revenues and adjusted earnings for 2021 will come in “slightly ahead of its prior expectations”.

Itai Pazner, chief executive officer of 888, said: “The strong momentum from 2020 continued into the first half of 2021, with growth driven primarily by regulated markets, where we believe ongoing market share gains continue to reflect our product-leadership strategy, highly effective data-driven marketing, and our excellent content.

“The board remains confident that, with 888’s advanced technology, products and diversification across markets, the group remains well positioned to deliver further strategic progress during 2021 and beyond.”

Julie Palmer, partner at Begbies Traynor said: “These results show 888 Holdings is a safe bet with investors, and the numbers so far are stacking up against 2020’s bumper lockdown results, as when the leisure sector was placed under lockdown restrictions, punters turned to online poker rooms and virtual casinos instead.

“With restrictions being all but lifted, the odds may not be in favour of online gambling companies compared to last year’s winning streak.

“However, with the fact that major sporting events are being staged once again, 888 Holdings’ continual development of products to attract new revenue streams and a looming wager on expanding into the US market, the company may well be playing its cards just right for future growth.”

Shares in the company were 0.8% higher at 410.8p in early trading.