Is the art market heading for a crash?

A Monet sold for £21m last week, setting yet another new record. But the true picture, some experts say, is of a less certain future

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Applause rang round Christie's auction room in New York on Tuesday when the hammer came down on Monet's 1873 Le Pont du chemin de fer à Argenteuil for $41.5m (£21m) – breaking the record for the artist set last year when his Nymphéas 1904 sold for £18.6m in London.

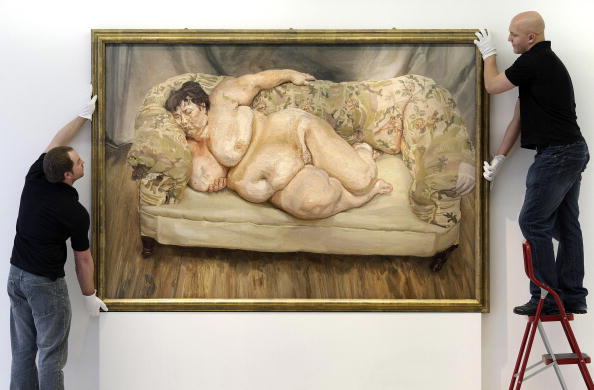

Between them Sotheby's and Christie's shifted around $500m-worth of art at spring sales in New York last week. It can expect more big business at the contemporary sales this week, the jewel being Lucian Freud's Benefits Supervisor Sleeping, valued at £17m, which would see Freud the most expensive living artist, a record already broken three times in less than a year.

All appears well in the art world, with the millionaire buyers seemingly insulated against the current economic uncertainty. The global market doubled in value between 2002 and 2006 to £28bn, according to a recent report by the European Art Market Foundation. Records also fell this week for Munch, Rodin and Léger.

But the headline figures are disguising signs that the market has already cracked, according to the art bankers Art Capital Group. Their analysis of Christie's sales reveals that 21 of the 58 lots failed to meet low estimates, and 14 failed to sell. Five of the 16 guaranteed lots failed to reach minimum estimate. Among the non-sellers, for example, was a Gauguin, estimated to sell at $15m.

Ian Peck, Art Capital's chief executive, says auction houses are acting more like private dealers in finding buyers for the big trophy works that only come up once in a lifetime to ensure they sell. And these figures disguise the real situation.

"The critical pieces that the auction houses have to sell, they will find somebody to buy – in essence they will pre-sell them," he said. "It's the middle market where we will see a lack of depth. Only a handful of the wealthiest collectors were bidding. The market is heading for a soft landing."

But a Christie's spokes-man said the market, including its middle sector, was holding up. "We are merely a platform that brings sellers to buyers," he said. "We work with collectors, and when a work comes up we have an idea who would be interested. With so many buyers from the Middle East and Asia, the market remains robust."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments