Bitcoin price just hit new 2018 low but cryptocurrency analysts predict dramatic market reversal

'Personally I consider $250k-$500k/BTC plausible in the years ahead,' one noted analyst says

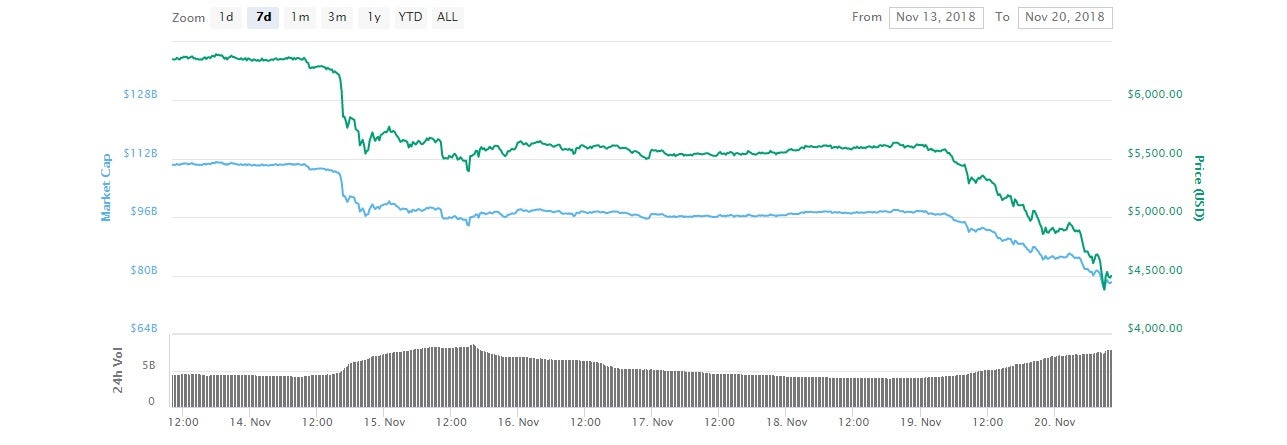

Bitcoin has fallen to its lowest price since October 2017, marking the latest losses in a year that has seen its value drop to just a quarter of what it was worth just one year ago.

Despite these losses, some cryptocurrency analysts are making the bold prediction that bitcoin could return close to record highs before 2019.

After falling below $4,300 late on Tuesday, the price of bitcoin experienced a slight bounce back and was trading at around $4,600 at the time of writing. This is a long way from the lofty predictions that some analysts forecast for bitcoin this year, with many having forecast a return to the $20,000 price it reached at the end of 2017.

But while some cryptocurrency analysts have revised their predictions, others have stood by their figures in anticipation of a major market turnaround in the coming weeks.

One of the most optimistic predictions comes from Adam Back, co-founder of the blockchain firm Blockstream, who said he anticipates gains that will take bitcoin's price to more than 100-times today's value.

"Personally I consider $250k-$500k/BTC plausible in the years ahead," Mr Back said on Twitter in response to fellow cryptocurrency enthusiast Bobby Lee, who himself speculated about whether the overall value of bitcoin could overtake the overall value of gold in the coming years.

The recent market slump also failed to dampen the bullish forecasts of Fundstrat co-founder Tom Lee, who said that he expected bitcoin to reach $15,000 before the end of 2018.

Mr Lee justified the current price of bitcoin by referring to the recent plunge in the price of tech stocks, like Amazon, Apple and Facebook. Increased institutional backing, he said, would help turn bitcoin's fortunes around.

"Global markets have seen liquidity dry up, and bitcoin is not necessarily a value asset – so as growth stocks, tech, and FAANG [Facebook, Amazon, Apple, Netflix and Google] come under pressure, it's going to hurt bitcoin. The downturn in FAANG is hurting those owning bitcoin," Mr Lee told CNBC.

"The next wave of adoption is institutional. There is a crossover happening. This is just an awkward transition... Once we have that, institutions will feel a lot more comfortable making bets [on bitcoin]."

Other analysts have taken a more retrospective look at bitcoin's recent turmoil, saying that such significant price movements are not surprising given the cryptocurrency's history.

"What we’re seeing now are the after-effects of the unprecedented rise of Bitcoin and other cryptoassets seen in 2017. This year is simply a retracement of that. The same is happening in broader markets as well where tech stocks, for example, are following a similar pattern. As with all markets, if prices reach levels that are higher than can be justified they need to pull back," Mati Greemspan, an analyst at the online trading platform eToro, said in an email to The Independent.

"These cycles can sometimes be accentuated in the crypto market due to the riskier nature of this nascent industry. In the same way previous cycles have not signalled the end for broader markets, these price movements don’t signal the end for cryptoassets. We’re still very much at the beginning of the crypto journey. At this stage, volatility is to be expected.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks