What is Cardano? The ‘green’ crypto that defied Musk’s bitcoin crash – and hopes to surpass Facebook and Netflix

Ada price has risen more than 1,000 per cent in 2021, pitching itself as the ‘most environmentally sustainable’ cryptocurrency

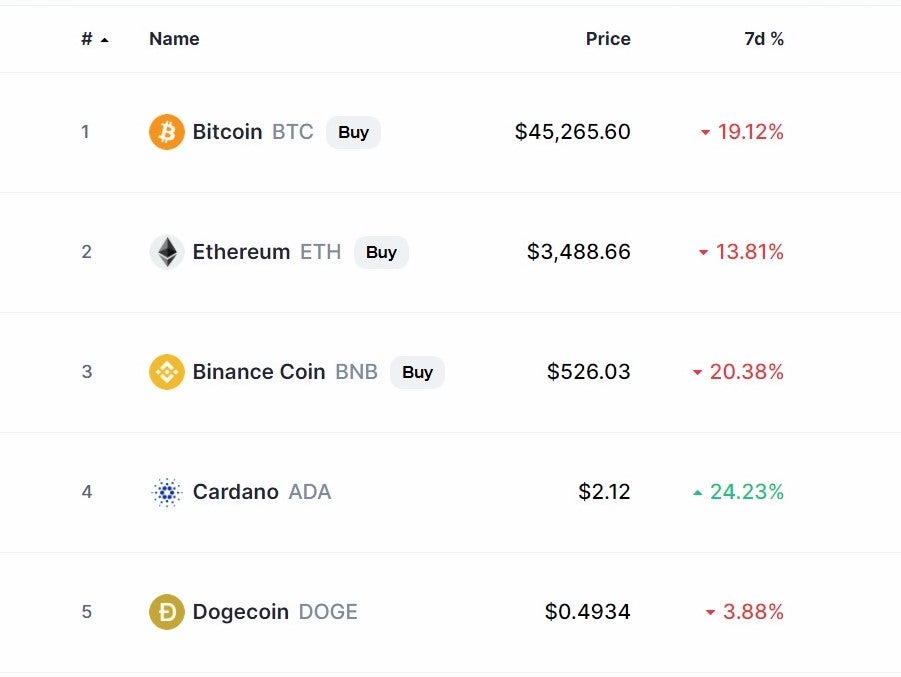

Within an hour of Elon Musk announcing that Tesla would no longer accept bitcoin payments last week, more than a quarter of a trillion dollars was wiped from the global cryptocurrency market.

The billionaire entrepreneur and part-time crypto enthusiast cited concerns about bitcoin’s environmental impact, which had the knock-on effect of crashing the price of nearly all of its rivals – with one notable exception.

The Ada cryptocurrency, based on the Cardano platform, not only avoided a price fall, it actually rose by 20 per cent in the immediate aftermath of Musk’s tweet, before climbing to a new all-time high over the weekend above $2.

>> Follow all the latest updates with The Independent’s live coverage of the crypto market <<

One reason for this is its underlying technology, which relies on a proof-of-stake, not proof-of-work. This means it does not depend on electricity-guzzling computers in order to process transactions and generate new units of Ada.

Cardano describes itself as “the most environmentally sustainable” cryptocurrency, thanks to its innovative proof-of-stake blockchain protocol that values the percentage of coins a miner holds rather than the processing power they possess.

Earlier this year, Cardano founder Charles Hoskinson estimated that its network uses less energy than 0.01 per cent of bitcoin’s network. Theoretically, the proof-of-stake system could achieve more than four million-times the energy efficiency of a proof-of-work system, like bitcoin’s.

It is not the only cryptocurrency to use proof-of-stake or to take its environmental impact into consideration, but it is easily the biggest.

Beyond its climate credentials, Cardano also recently became a fully-decentralised community-run network, meaning its parent company no longer has control over its blockchain. Market analysts claim this development makes it an attractive proposition for investors.

“This milestone will help Cardano better position itself to challenge major rivals in the cryptoverse,” said Nigel Green, CEO of financial advisory firm deVere Group.

“Cardano is likely to be a challenger to ethereum as not only can it be used as currency, but its blockchain can also be used to build smart contracts, protocols and decentralised applications. Plus its is significantly more scalable than ethereum.”

A 2019 forum post speculated what the future price of Ada could be in the future. At the time, a single Ada was worth $0.04 and Cardano’s overall market capitalisation was roughly $1 billion, yet the developers foresaw the exponential value growth that was to come – and went even further.

Rather than simply compare it to other cryptocurrencies, Cardano’s potential was stacked up against global tech giants like Amazon, Facebook and Netflix, and the huge valuations that come with them.

“Cardano aims to become a global financial computer,” the post stated. “Is that more than what Netflix can offer? Netflix is a streaming service... We think Cardano can have a bigger impact. Could Cardano be better than Facebook? Facebook is just a social network. Cardano is here for all people who could use decentralised currency and build decentralised services.

“What could the price of Ada be in a few years? If you agree with our comparison of Cardano with technological companies then it is quite easy... It could be huge. Cardano could have a similar capitalisation as big technological giants.”

In the year and a half since this was written, Cardano has risen to become the world’s fourth most-valuable cryptocurrency with a market cap above $70 billion. While this may still be a long way off the $200 billion valuation of Netflix, it puts it on a par with Chinese tech behemoth Baidu – and more than the combined worth of Dropbox, McAfee antivirus, Slack and LG Electronics.

The same year as the post was written, Cardano was ranked as the ‘busiest’ cryptocurrency ahead of ethereum, according to a report by market insight firm Santiment, making it the most actively developed crypto project of 2019 of more than 1,000 that were considered.

Bitcoin did not even make the top 20. It is this utility and technological potential that sets Cardano apart from its more famous rival. On top of the online ledger that keeps track of transactions, Cardano has a second computation layer that enables everything from smart contracts and decentralised apps, to buying land and voting.

“Is bitcoin a competitor? We do not think so. Bitcoin is something else,” the 2019 post stated. “Bitcoin keeps the narrative to be digital gold.”

This idea that bitcoin is best suited to being a digital store of value has been adopted by institutional investors over the last year, who have cited its finite supply – only 21 million coins will ever exist – and its already-established reputation for offering a solid return on investment.

Even Tesla has stuck by bitcoin in this regard, choosing to not sell its $1.5 billion holdings. “When fiat currency has negative real interest, only a fool wouldn’t look elsewhere,” he explained in a tweet justifying Tesla’s investment. “Having some bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P500 company.”

Musk has already shown his preference for other cryptocurrencies as an alternative to fiat currencies by accepting dogecoin payments at one of his other companies, SpaceX. The question now will be whether the potential promised by the less well-known Cardano can be both popularised and realised on a similar scale.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks