UK household living standards are falling at their fastest pace since 2011 as inflation surges

Real household disposable income per per head in the first quarter of 2017 was 2 per cent lower than in the same quarter a year earlier

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Household living standards seem to be falling at their fastest pace since 2011 as the surge in inflation since last June’s Brexit vote hits home, data released by the Office for National Statistics (ONS) confirmed today.

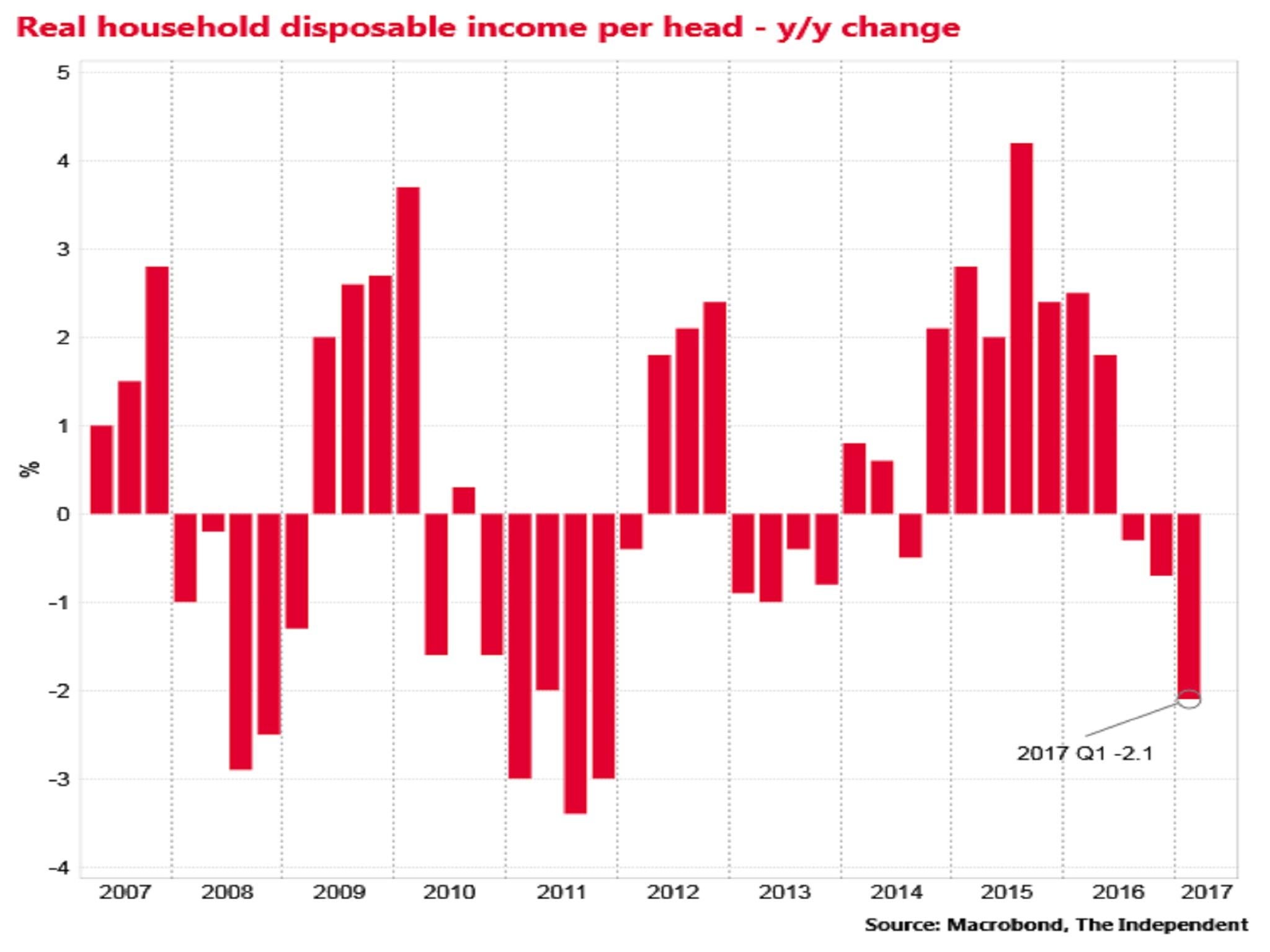

Real household disposable income per head in the first quarter of 2017 was 2 per cent lower than in the same quarter a year earlier.

It was the biggest annual decline on this measure since a 3 per cent fall in the final quarter of 2011, when the eurozone crisis was raging and consumer price inflation had spiked above 5 per cent.

There were also falls in the two previous quarters.

Biggest fall in six years

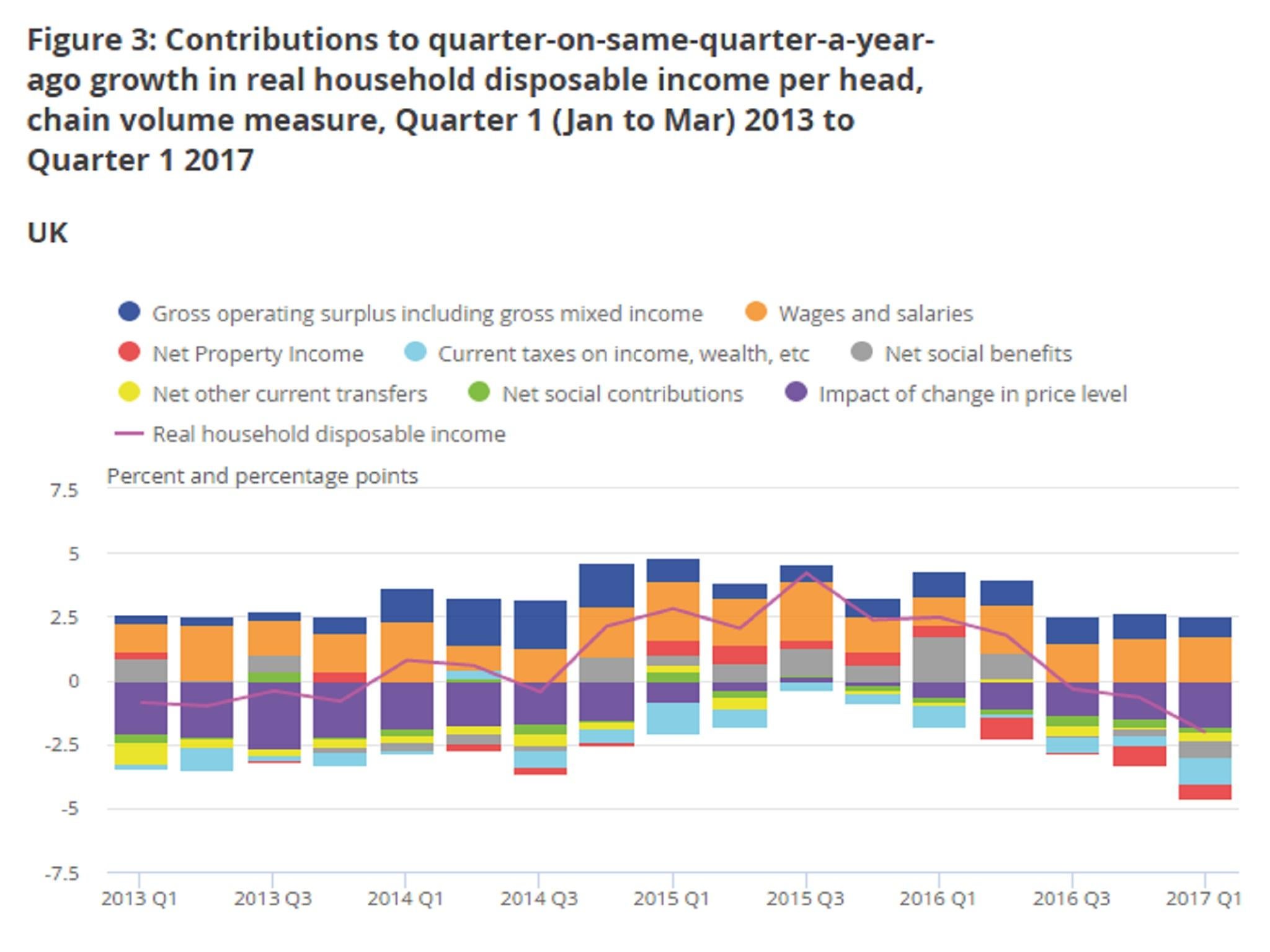

The biggest drag on this measure of living standards in the first quarter of this year was inflation, which shot up from 0.3 per cent in early 2016 to 2.9 per cent now, reflecting the almost 15 per cent decline in the value of the pound since the referendum.

Inflation is expected to breach 3 per cent soon.

There was also downward pressure on living standards in the first quarter from “net social benefits”, meaning cuts in welfare spending, and also higher taxes.

Inflation damage

This follows data last week from the ONS which showed that real disposable income available to the household sector as a whole declined for a third successive quarter in the first three months of 2017, the worst run since the 1970s.

Overall GDP growth slowed to 0.2 per cent in the first quarter and GDP per head did not grow at all.

A new report for the Joseph Rowntree Foundation on Thursday also provided evidence on the extent of the renewed living standards squeeze in the wake of the Brexit vote.

The report suggests that the spike in inflation alongside the Government’s planned cuts to welfare spending on the working poor will cancel out any positive impact from the new rise in the minimum wage.

“This year we have seen a return to inflation for the first time since the freeze in benefits and tax credits was introduced,” said the report’s author Donald Hirsch.

“It is clear from these results that this freeze is preventing better minimum wages from feeding through to improved family living standards.”

“A particularly important feature of this is that for every extra pound earned, about 75p is typically lost by low earning families in additional tax and reduced tax credits or Universal Credit. Unless the amount that you can earn before these credits are withdrawn rises along with prices and earnings, it will be very difficult to deliver the improved living standards for struggling families that have been promised.”

The Government has come under intense pressure in recent weeks to lift its 1 per cent cap on public sector pay and there are also growing demands for ministers to ease the planned welfare cuts, which were first formulated by George Osborne but retained by Philip Hammond and Theresa May, amid a popular mood of frustration with seven years of austerity.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments