Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

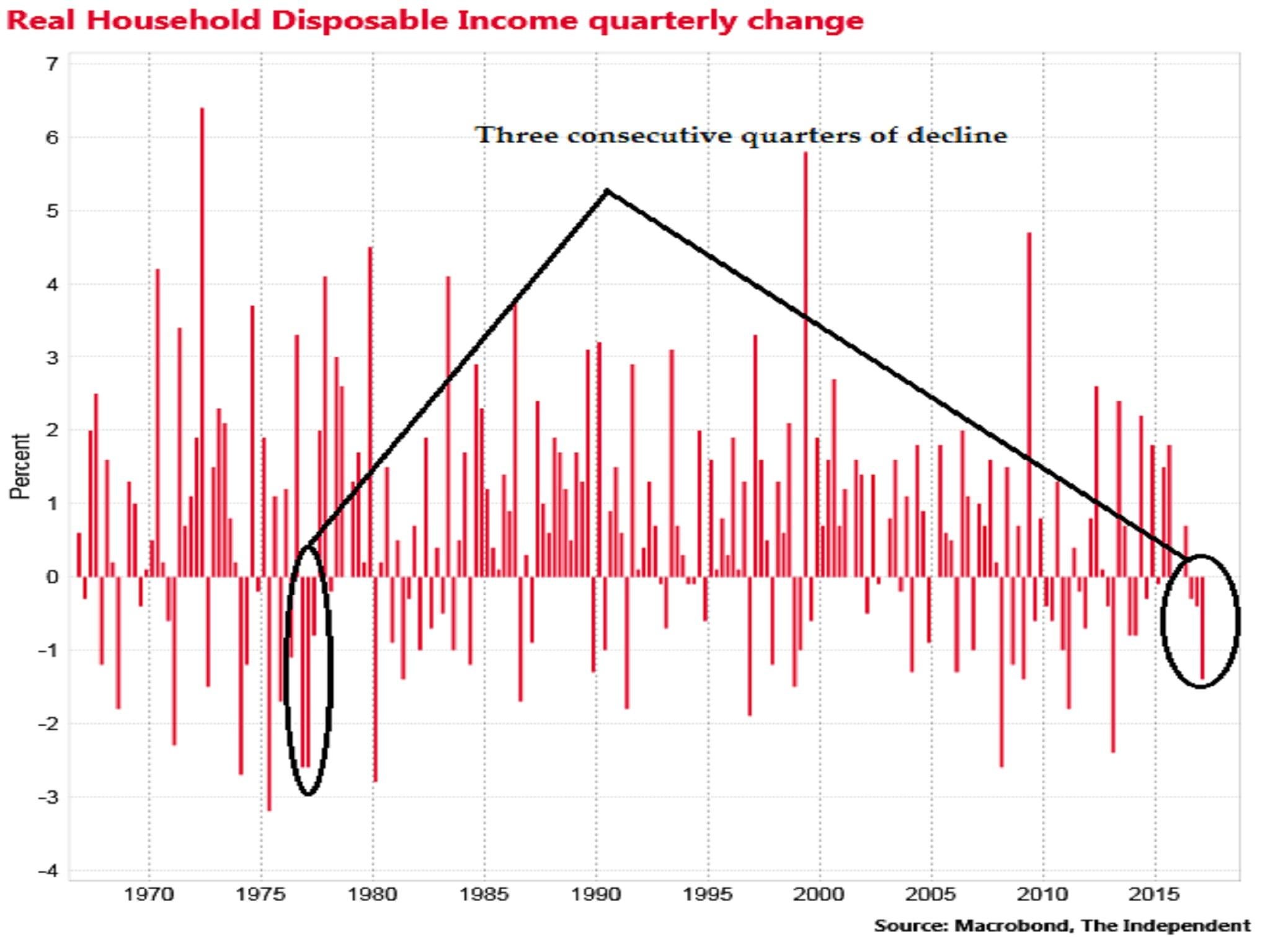

Your support makes all the difference.The aggregate real disposable income of UK households has fallen for three quarters in a row for the first time since the 1970s, according to the Office for National Statistics.

The ONS said that the inflation-adjusted compensation of the household sector fell 1.4 per cent in the first three months of 2017, reflecting spiking inflation and weak pay growth.

It was the biggest decline since the first quarter of 2013 and followed a 0.4 per cent fall in Q4 2016 and a 0.3 per cent slip in Q3 2016.

Three consecutive quarters of contraction is the worst run for the series since 1976-77.

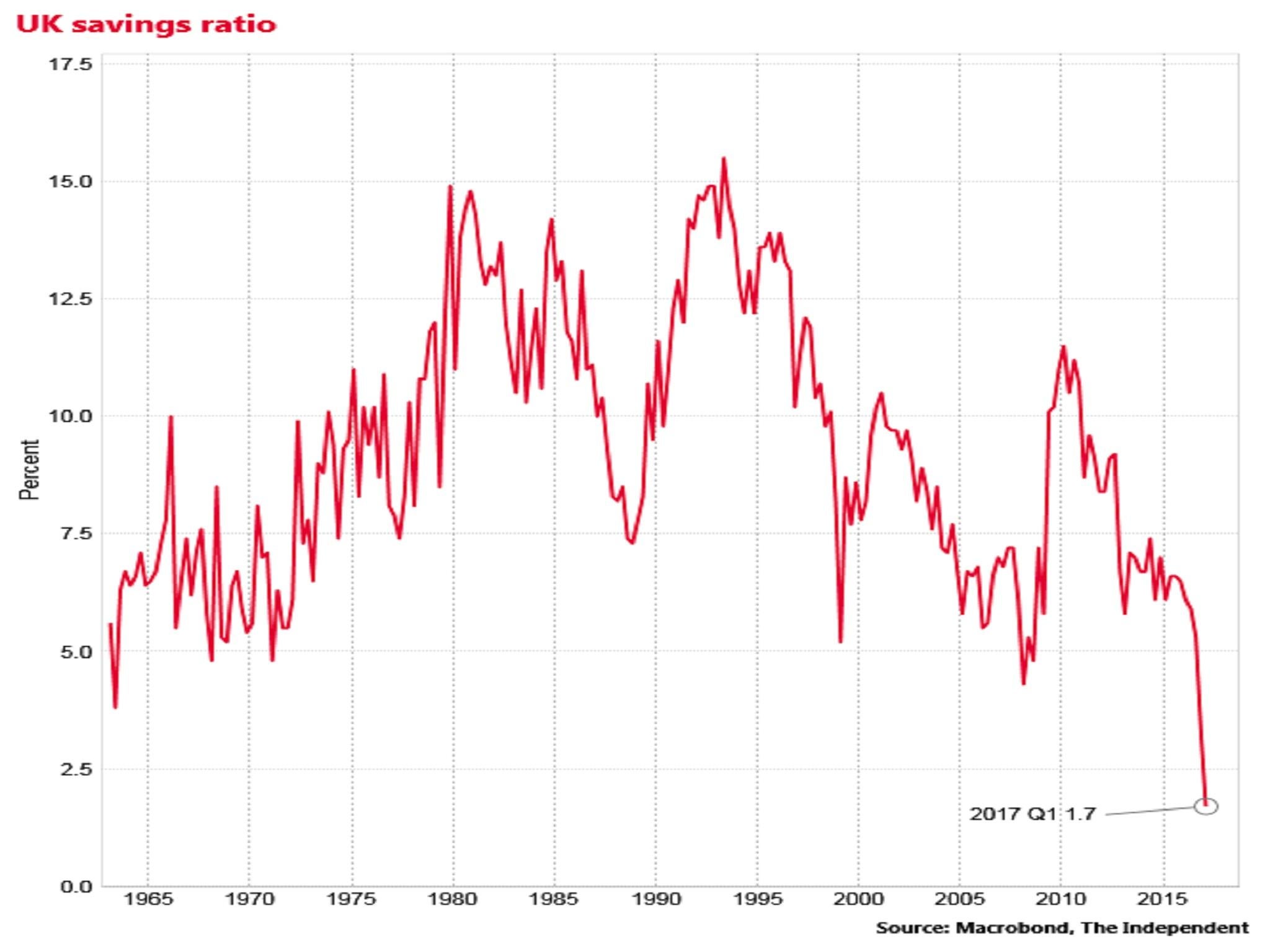

The ONS also said that the aggregate household savings rate collapsed to just 1.7 per cent, down from 3.3 per cent in the final quarter of 2016, and the lowest on record, although it said one-off tax payment factors might have distorted the latest reading.

Nevertheless, weak pay growth means that households have had to resort to running down their savings and borrowing to support consumption, which has almost single-handedly powered the overall economy since last June’s Brexit vote.

“This is not sustainable and fuels the belief that weakened consumer spending is likely to hold back the economy over the coming months,” said Howard Archer of the EY Item Club.

“With consumer confidence declining and banks reporting that they intend to restrict the supply of secured credit, the saving rate is more likely to rise than fall ahead,” said Samuel Tombs of Pantheon.

Worst since the 1970s

The GfK consumer confidence index is now roughly back to where it was in the immediate wake of the Brexit vote, while inflation is expected to rise above 3 per cent in the coming months.

The GDP growth rate for the first quarter was unrevised from previous estimates at just 0.2 per cent, down from 0.7 per cent in Q4 2016.

Analysts said that the growth rate in the second quarter of this year would likely pick up, but not significantly, and that the outlook further out would likely be weaker if consumers rein their spending in.

Services, which account for around 80 per cent of total output, grew by 0.2 per cent in April, the ONS separately reported.

The latest ONS figures complicate life for the Bank of England’s Monetary Policy Committee, which had expected the savings ratio to increase slightly in the first quarter, and which is split on the question of whether interest rates should rise to curb inflation.

“We think that a rate hike in August is [still] a significant risk. The data over the coming month could still tip the balance,” said Alan Clarke of Scotiabank.

All time low

After factoring in population growth, there was zero growth in GDP per capita in the quarter.

Business investment grew by 0.6 per cent , following a 0.9 per cent contraction in the final quarter of 2016.

Despite the steep slump in the pound over the last year, the current account deficit widened by £4.8bn on the final quarter of 2016 to £16.9bn, equivalent to 3.4 per cent of GDP.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments